by Tim Rowan, Editor Emeritus

"Life and Death"

Medicaid Cuts are Looming

We don’t need to cut benefits, and it really infuriates me to hear people here talking about that because it stresses people out. This is life and death for them. –Senator Bernie Moreno (R-OH)

Budget Reconciliation Threatens Medicaid

After last weeks HHS purge, all of Care at Home is on edge as the U.S. House and Senate negotiate differences in each body’s budget reconciliation bill. The same jitters are found among Medicaid-eligible citizens, especially those who hear more rumors than actual progress reports from Washington. All we know for sure this week are two things: Speaker Johnson has pushed his deadline for a vote on the bill, asking for $880 billion in cuts, from Memorial Day to Independence Day; and the parallel Senate budget bill, at this date, is quite different. Watching the reconciliation talks should be nerve-wracking but entertaining.

The House Version

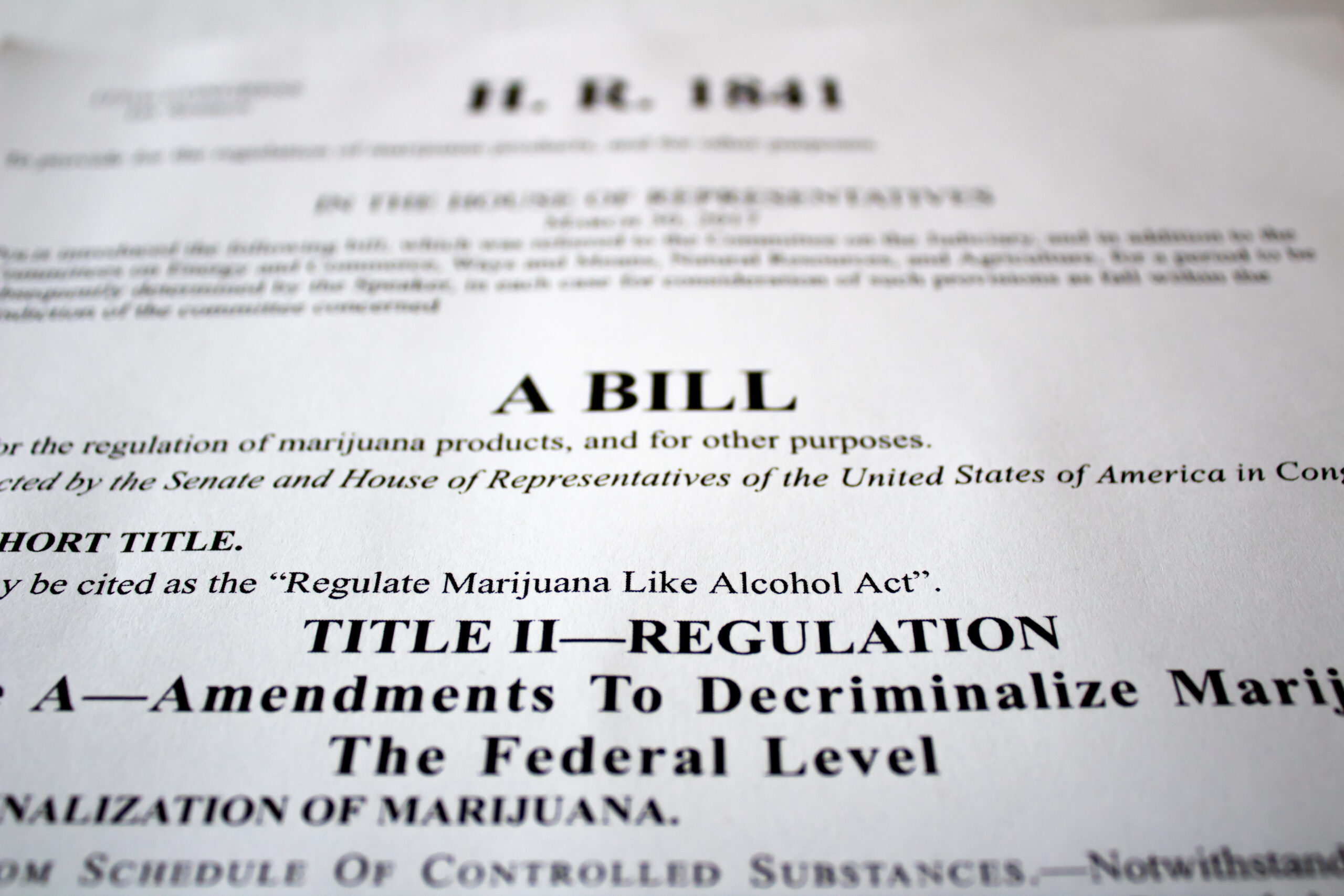

As of May 1, it is too early to assign a dollar amount to the FY 2026 Medicaid budget. H.B. 1968, named “Full-Year Continuing Appropriations Act of 2025,” delegates specific cut decisions to committees. It first directs the House Energy and Commerce Committee, which oversees Medicaid and part of Medicare, to reduce the federal deficit by $880 billion over ten years. The Agriculture Committee, which oversees SNAP, is ordered to cut $230 billion over the same time period.

Medicaid Cuts: Per Capita Caps

The Energy and Commerce Committee is the oldest standing legislative committee in the House. It has broad jurisdiction over our nation’s energy, health care, telecommunications, and consumer product safety policies. In the 119th Congress, it is chaired by Brett Guthrie (R-KY), a West Point graduate with a degree in Public and Private Management from Yale.

Guthrie has advocated changes to Medicaid since his days as a Kentucky state legislator. He pushed for the $880 billion in cuts that found life in H.B. 1968. Guthrie’s solution to growing Medicaid costs is “per capita caps” which would give states a fixed maximum amount of money for each person on Medicaid. According to an analysis by Axios, published after interviewing Guthrie:

- “The federal government now covers a percentage of states’ Medicaid costs, so the amount reimbursed goes up or down depending on how much a state spends on the program.

- Per capita caps would likely result in less money for states, forcing them to make up the difference by raising taxes or cutting spending elsewhere.”

In His Own Words

Guthrie told Axios he saw how the Medicaid program affected state budgets firsthand while serving in the Kentucky Statehouse. “I dealt with it,” he told Axios. “That is why I care about this…It just overwhelmed state budgets. What I’ve learned is, as we keep subsidizing health care, the price keeps going up. So, my idea with per capita allotments has always been that it will control costs.”

People might “fall off” Medicaid. “I’ve talked to a lot of providers, other groups, and they’re concerned. I’m not saying they’re not, but I think we can do it in a way that people get service.”

(202) 225-3501; (202) 225-3501

SNAP Cuts

Glenn Thompson (R-PA) chairs the Agricultural Committee, which will be asked to make cuts to SNAP. Prior to being elected to Pennsylvania’s Fifteenth District, Thompson spent 28 years as a therapist, rehabilitation services manager, and a licensed nursing home administrator.

(202) 225-5121; (814) 353-0215

Strange Bedfellows in the Senate

Along with every Democrat, at least two conservative Republicans have expressed uncertainty about putting budget savings on the backs of Medicaid beneficiaries. Senators Bernie Moreno of Ohio and Josh Hawley of Missouri both warned in interviews with newsmagazine Semafor that proposals to cut the federal government’s share of the costs in states that have expanded Medicaid, and to otherwise cap Medicaid expansion spending, could lead to coverage losses. Moreno bluntly told Semafor that both ideas amount to “cutting benefits.”

“There’s not 50 votes for any kind of cuts in benefits. That’s just a fact,” Moreno said.

Just A Skosh of A Difference to Negotiate

A detailed analysis by the Geiger Gibson Program in Community Health at the Milken Institute School of Public Health at George Washington University compares the House and Senate versions side by side. Their analysis points out that the Senate outline for its bill calls for at least $1 billion in Medicaid spending reductions over the 10-year budget window. As already noted, the House wants its committees to find at least $880 billion over the same window.

“The Senate bill also authorizes the Budget Committee to adjust the targets for the purpose of “protecting the Medicaid program,” which may include “strengthening and improving” Medicaid (undefined) in a deficit-neutral fashion. The Senate measure thus effectively prioritizes protections for Medicaid over other potential policy aims to be achieved through the reconciliation process. The House bill, by contrast, calls for scaling back tax relief if the spending reduction targets are not met, thereby placing additional pressure on the $880 billion floor.

The House and Senate now must reconcile two extremely different measures before the reconciliation process actually proceeds, the university report concludes. “Although it is unclear whether the House will proceed with a legislation to achieve reconciliation in advance of a final agreement.”

$779 billion is a lot of reconciling...

One final independent analysis may draw this discussion to a close that speaks directly to our industry’s concerns. The Commonwealth Fund, in a March 25 “Issue Briefing,” looked at the long-term consequences of deep Medicaid cuts. In its executive summary, the briefing says:

Key Findings and Conclusions

Combined losses from proposed Medicaid and SNAP cuts would reach $1.1 trillion over a decade, including a $95 billion loss of federal funding in 2026 alone. State gross domestic products (GDPs) would be $113 billion lower, exceeding federal budget savings. About 1.03 million jobs would be lost nationwide in health care, food-related industries, and other sectors. State and local governments would lose $8.8 billion in state and local tax revenues. Not extending the enhanced health insurance premium tax credits that are scheduled to expire after December 2025 would lead to an additional 286,000 jobs lost in 2026, for a combined total of more than 1.3 million jobs lost in the United States.

Stay tuned. We at the Rowan Report are committed to keeping a close eye on developments in this bi-partisan battle.

# # #

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com