Whistleblower Case Impedes Lawsuits

by Kristin Rowan, Editor

Whistleblower Action

A United States District Court in Tampa, Florida ruled against a whistleblower action under the False Claims Act (FCA) against her former employer. In 2019, a family care physician filed a whistleblower, or qui tam, action against her employer for increasing the risk adjustment scores of Medicare Advantage patients in order to receive higher payments.

Whistleblower Protection

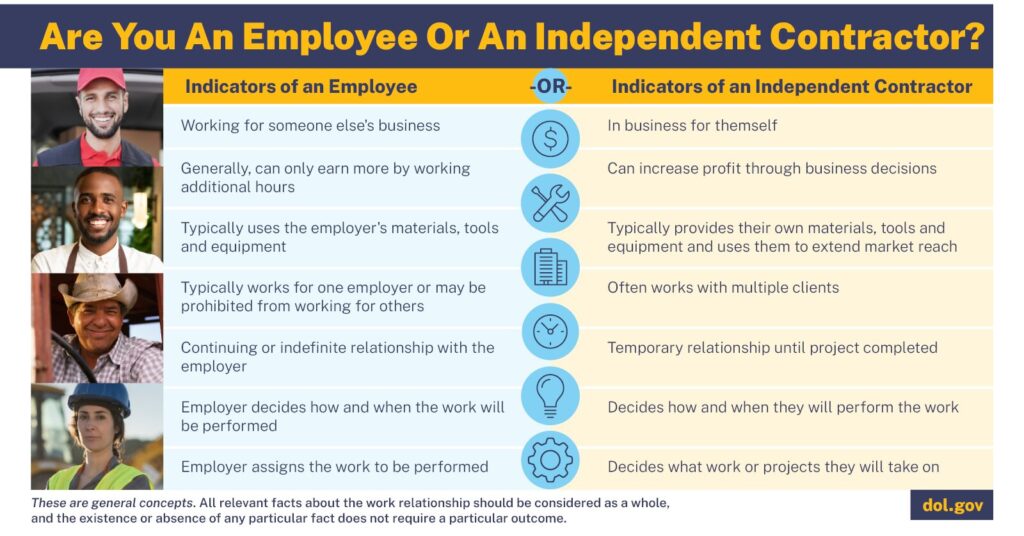

When an employee or person with information about a company’s wrongdoing, they can file a lawsuit against that company. Whistleblowers are protected under OSHA, EEOC, and several federal and state regulations against retaliation from their employer. A whistleblower, the person who brings evidence of wrongdoing to the court, is called a “relator.”

Before the Ruling

The False Claims Act is the first and one of the strongest whistleblower laws in the U.S. Under the FCA whistleblower rules, any private citizen can sue any individual, company, or other entity that is defrauding the government and recover damages and penalties on the government’s behalf. Whistleblowers also receive compensation when these suits are settled between 15% and 30% of the total proceeds. As the FCA has expanded since its passing in 1863, the law made it possible for anyone to serve as a whistleblower.

The Ruling

In the case noted above, the court ruled that FCA whistleblowers act as officers of the United States when they sue on behalf of the federal government. The decision reasoned that whistleblowers are appointing themselves as officers of the federal government by bringing these lawsuits.

Article II, Section 2, Clause 2 of the Constitution states that the President can appoint officers and officials to the government and that they require Senate approval for some of these. Cabinet appointments, judicial appointments, and other high ranking positions are often the subject of news stories during Senate hearings to confirm these appointments.

The court ruled that an FCA whistleblower becomes an officer of the federal government through self-appointment, violating the Appointment Clause of the Constitution. The court further ruled that the False Claims Act in itself is a violation of the Constitution, effectively nullifying the FCA, at least in Florida for now.

Widespread Implications

Any company who has lost a False Claims Act suit may now be able to challenge those rulings, using this case as precedent. However, there are some hoops they would need to jump in order to do so, depending on how this case is interpreted. Ironically, this case states that whistleblowers cannot be officers of the government without appointment, but if that’s true, then all False Claims Act decisions become easier to challenge.

If this decision stands and is adopted as precedent across the U.S., it could completely nullify the False Claims Act. It may even be considered for a Supreme Court ruling. In 2023, the U.S. government recouped $2.6 billion from FCA suits, nearly $2.3 billion of which were claims brought by whistleblowers.

Care at Home Implications

Medicare and Medicare Advantage are rife with fraudulent claims, “coding intensity“, upcoding, and predatory marketing. In 2024, CMS announced changes to the risk adjustment model in the Risk Adjustment Validation Final Rule after seeing higher-than-expected risk scores. The changes could help CMS recoup up to $4.7 billion in the next ten years.

MedPAC estimates that Medicare Advantage plans received as much at $88 billion in excess payments in 2024. The lowest share of overpayment reimbursement through the Fraudulent Claims Act would give whistleblowers a combined $13.2 billion. Eliminating the FCA may discourage employees and contractors from reporting fraudulent claims and overbilling through Medicare and Medicare Advantage.

Final Thoughts

A safeguard for people trying to do the right thing, a means to save the federal government billions of dollars that can be spent elsewhere, and ultimately better care for patients are all at risk if the FCA is struck down. A law that has been in place for more than 150 years should carry more weight than the ruling of one district court who applies a new definition to a long-standing term.

Whistleblowers and the federal government have generally been considered co-defendants in these suits. Two parties with separate interests in the same suit, acting independently, not a joint case like a class action suit would be. I anticipate an appeal on this decision and hopefully a panel of judges who better understand the necessity of the False Claims Act and the Whistleblower provisions.

# # #

Kristin Rowan has been working at The Rowan Report since 2008. She is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news .She also has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2025 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com