UnitedHealth Bribes Nurses

MedicaidUnited Health Bribery Update

In the weeks since the below article revealed allegations against UnitedHealth, members of Congress are calling for action. At least one US Senator and two Representatives are engaged in the allegations. Senator Wyden (D-OR) announced that his office is launching its own investigation. Senator Hawley (R-MO), who is on the investigations subcommittee said it was “alarming to hear these serious allegations. I look forward to securing justice for patients, policyholders, and whistleblowers alike who’ve been harmed by insurance companies.” Other Senators expressed similar sentiments.

“If these allegations are true, UnitedHealth must be held responsible for their gross abuse of patients. Patients should always come before profits.”

Three U.S. Representatives, coming from both sides of the aisle, are calling on the DoJ to investigate. A letter to the DoJ reads:

“The Guardian’s findings reveal the need for a wide-ranging investigation by the Department of Justice into years, if not decades, of potential waste, fraud, and abuse at UnitedHealth.”

Here is another take on the breaking news story, published by whistlebloweraid.org

The Guardian has uncovered some truly disturbing information about UnitedHealth Group. As the investigation and reporting belongs to them, I have reprinted the first part of the article here. Read the full article here.

by George Joseph, The Guardian

Wed May 21, 2025

Revealed: UnitedHealth secretly paid nursing homes to reduce hospital transfers

A Guardian investigation finds insurer quietly paid facilities that helped it gain Medicare enrollees and reduce hospitalizations. Whistleblowers allege harm to residents

UnitedHealth Group, the nation’s largest healthcare conglomerate, has secretly paid nursing homes thousands in bonuses to help slash hospital transfers for ailing residents – part of a series of cost-cutting tactics that has saved the company millions, but at times risked residents’ health, a Guardian investigation has found.

Those secret bonuses have been paid out as part of a UnitedHealth program that stations the company’s own medical teams in nursing homes and pushes them to cut care expenses for residents covered by the insurance giant.

In several cases identified by the Guardian, nursing home residents who needed immediate hospital care under the program failed to receive it, after interventions from UnitedHealth staffers. At least one lived with permanent brain damage following his delayed transfer, according to a confidential nursing home incident log, recordings and photo evidence.

“No one is truly investigating when a patient suffers harm. Absolutely no one,” said one current UnitedHealth nurse practitioner who recently filed a congressional complaint about the nursing home program. “These incidents are hidden, downplayed and minimized. The sense is: ‘Well, they’re medically frail, and no one lives for ever.’”

Confidential Investigation

The Guardian’s investigation is based on thousands of confidential corporate and patient records obtained through sources, public records requests and court files, interviews with more than 20 current and former UnitedHealth and nursing home employees, and two whistleblower declarations submitted to Congress this month through the non-profit legal group Whistleblower Aid.

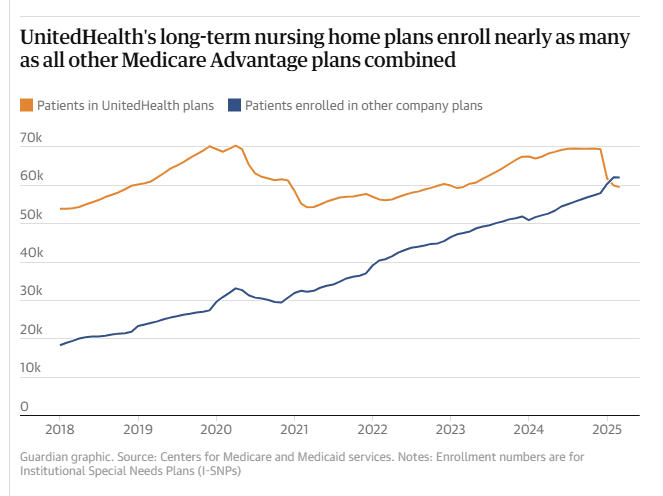

The documents and sources provide a never-before-seen window into the company’s successful effort to insert itself into the day-to-day operations of nearly 2,000 nursing homes in small towns and urban commercial strips across the nation – an approach which has helped UnitedHealth secure a vast stream of federal dollars from Medicare Advantage plans that cover more than 55,000 long-term nursing home residents.

UnitedHealth Responds

UnitedHealth said the suggestion that its employees have prevented hospital transfers “is verifiably false”. It said its bonus payments to nursing homes help prevent unnecessary hospitalizations that are costly and dangerous to patients and that its partnerships with nursing homes improve health outcomes.

Long-Term Profit

Under Medicare Advantage, insurers collect lump sums from the federal government to cover seniors’ care. But the less insurers spend on care, the more they have for potential profit – an opportunity that UnitedHealth higher-ups have systematically sought to exploit when it comes to long-term nursing home residents.

To reduce residents’ hospital visits, UnitedHealth has offered nursing homes an array of financial sweeteners that sounded more like they came from stockbrokers than medical professionals.

Seven Years of Bribery and Threats

Over the past seven years, the company has shelled out “Premium Dividend” and “Shared Savings” payments that boosted nursing homes’ bottom lines. Through its “Quality and Shared Risk” program, UnitedHealth offered an even bigger cut to nursing homes that drove down medical spending, but threatened to claw back money from those that didn’t, according to former employees and internal corporate documents.

“You gain profitability by denying care, and when profitability suffers for the shareholders, that’s when people get crazy and do things that are not appropriate.”

# # #

© 2025 This article is reprinted from The Guardian. The full article can be accessed here. For more information or for permission to reprint, please contact The Guardian directly.