by Kristin Rowan | Feb 21, 2024 | Admin, Clinical

By Kristin Rowan, Editor

The workforce shortage across the country both in and out of home care is creating increasing demand on workers and added stress on organizations. Added to this is the increasing number of older adults living past retirement age. As more and more “boomers” reach that age, more of them are considering aging in place rather than moving to a facility. High turnover rates among care providers also contributes to the workforce shortage for care at home agencies.

One agency has a plan to increase its workforce by 50% by the end of the year. Right at Home, based in Omaha, Nebraska, has more than 700 franchise locations and employs more than 45,000 caregivers. They intend to add 26,000 additional caregivers to address the growing needs of our aging population.

Recruitment and retention issues are not specific to care at home, but the compounding factors of a larger aging population and higher turnover rates make it a pressing issue. It may seem like a lofty goal to increase an already large workforce by another 50% when many businesses are struggling to hire at all. Right at Home has implemented several strategies to reach this goal:

- Preferred partnerships with job boards

- Collaborations with local and national job platforms working directly with franchise owners

- Technology solutions

- Increased efficiencies in the office gives staff more time and energy for hiring and onboarding

- Electronic onboarding resources and automated communication within applicant tracking systems to simplify hiring process

- Engagement platforms to reward and recognize caregivers to lower turnover rates

- Cultivating an appealing culture

- Becoming the employer of choice in each demographic area

- Breaking down the caregiver experience into micro elements for a better experience for caregivers

Creating partnerships with job boards and using automated processes for hiring are the simplest of these tasks to implement right away. Larger job boards like Indeed and Monster may not be willing to collaborate, but local colleges may be an easier route. They typically have job boards with smaller pools of applicants who are already partitioned into fields of study. No matter the size of your agency, there are technology solutions to reduce the time spent with onboarding and applicant tracking that are cost effective and increase efficiency. If you’re looking for one, we’ve reviewed several over the years.

Cultivating an appealing culture may be more difficult. An appealing culture is subjective and vague. Right at Home mentions breaking down the caregiver experience into micro elements. Even if you know what those micro elements are, improving the experience is the goal but not a plan. In a recent conversation with home care agency owner Bob Roth, he mentioned the difficulties of establishing leadership and creating culture in a dispersed workforce. This topic bears additional scrutiny and we will have some upcoming articles on creating culture in the next few weeks.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Feb 21, 2024 | Clinical, Regulatory

By Kristin Rowan, Editor

Federal Waiver Program

In 2020, CMS launched a hospital care at home program to help increase patient capacity during the height of the Covid-19 pandemic. The study included 300 hospitals and thousands of patients receiving care in their home using a hospital at home waiver. Outcomes of the study showed that patients had greater ability to stand up and move around at home than would have had in a hospital and that in-home caregivers were better able to educate patients on home to care for themselves once they were able to see the social determinants of care in the home. CMS also reports only 7.2% of patients were required to be transferred to a hospital.

Hospital Study

Mass General Brigham conducted its own study alongside CMS and analyzing outcomes of diverse patients, including socially vulnerable and medically complex patients. The findings of their national analysis showed that within 30 days of discharge, 2.6% of patients used a SNF, 3.2% died, and 15.6% were readmitted. Findings were consistent among all groups, including those who generally have worse outcomes: patients of Black and Latine race and ethnicity, dual-eligible patients, and patients with disabilities.

Health System Study

In April of 2020, Kaiser Permanente conducted an 18-month study on the scalability of “Advanced Care at Home” (ACAH). The patients all required hospital-level care and were first admitted to the program through the emergency department. Some were admitted to the hospital, and some were instead admitted to the Kaiser ACAH program, where a team of nurses, physicians, nurse practitioners, and a pharmacist developed a care plan.

This study increased its daily census from 7.2 per day to 12.7 per day at the end of study. The average episode of care decreased from 7.43 days to 5.46 days and readmission rates dropped from 11.52 percent to 9.24 percent. These patients were less likely to experience delirium than patients admitted to traditional hospital settings. The researchers noted the limitation of the study as being too small to develop precise comparisons.

Limitations of Acute Hospital Care at Home

Currently, the only patients eligible for AHCaH are those who have been evaluated in a hospital or emergency department. Kaiser has extended this to patients seen in their own urgent care offices in areas where they don’t own a hospital. Kaiser has served a few thousand patients through this program, but they estimate there are more than 1.1 million eligible patients. Rural patients who don’t live near a hospital or emergency department have the same trouble accessing AHCaH that they do accessing hospital and physician care now.

The CMS waiver for AHCaH has been extended through December 2024. Beyond that, it is unclear how hospital care at home will be reimbursed. Some providers have offered hospital care at home to risk-based patients in a VBC model. Not all eligible patients will qualify for the waiver or VBC reimbursement. Without specific provisions from CMS to reimburse hospital care at home for all Medicare and Medicaid patients and coverage from private insurance, the hospital at home program will remain limited.

The current model for AHCaH includes technology support for the patient using a tablet, smartphone, or other device. This requires that the patient have a broadband internet connection in the home, which eliminates eligibility for rural patients who are already underserved.

Final Thoughts

There is a lot of support for Hospital Care at Home among providers, health systems, and consumer insurance companies. Support for home health, hospice, palliative care, and supportive home care has not been as strong. As these larger players start to see the cost and outcome benefits of care in the home, a few things may happen.

First, hospitals, payers, and physician groups may start to recognize the value of care at home and be more open to creating referral partnerships with care at home agencies. Home care is a small percentage of total care reimbursed by Medicare and Medicaid and we could see that increase.

Conversely, these providers may realize that care at home is lucrative and will extend their own AHCaH models to include post-acute and hospice care, cutting out home care agencies altogether. Care teams are constructed around a Hospital Care at Home patient. Including a post-acute nurse who is familiar with the patient history would provide additional continuity of care.

Either way, I see the support for the Hospital Care at Home program as beneficial to home health. Branches of health care that were previously averse to extending patient care into the home are now supporting it. Increased adoption of telehealth and other technology platforms increase the possibilities for integrating with home health and hospice providers. Interoperability between Hospital Care at Home and Post-Acute Care at Home may finally become a reality.

We will continue to report on the AHCaH waiver as the deadline to renew comes closer.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

Sources:

CMS (2024) Acute Hospital Care at Home Data Release Fact Sheet. Retrieved from: https://www.cms.gov/newsroom/fact-sheets/acute-hospital-care-home-data-release-fact-sheet#:~:text=In%20response%20to%20challenges%20faced,inpatient%2Dlevel%20care%20at%20home.

Mass General Brigham (2024) Study of National Data Demonstrates the Value of Acute Hospital Care at Home. Retrieved from: https://www.massgeneralbrigham.org/en/about/newsroom/press-releases/study-of-national-data-demonstrates-the-value-of-acute-hospital-care-at-home#:~:text=In%20addition%2C%20within%2030%20days,and%20have%20fewer%20adverse%20events.%E2%80%9D

mHealth Intelligence (2023) Kaiser Permanente Study Shows Scalability of Hospital-at-Home model

by Kristin Rowan | Feb 21, 2024 | Clinical, Editorial

By Kristin Rowan, Editor

The news this week has been filled with stories about former president Jimmy Carter, 99, who entered hospice care last year. His wife, Rosalynn Carter was in hospice care for only a few days before she passed away in November. Advocates and hospice providers are hoping that Carter’s length of care in hospice will help increase awareness of what hospice care really is.

Hospice care is a misunderstood service. Many people equate hospice care with dying. While it is true that patients are only eligible for hospice care if they have a life-ending illness with no hope of cure, hospice care involves a lot more than easing a patient through the end-of-life transition. Physical symptoms are eased with medicine and the patient’s emotional well-being is supported as well. Just as importantly, the family’s emotional needs are met through hospice care.

The Carter family’s high profile has shed some much needed light on hospice care in general. The vast difference in length of care between the former first lady (three days) and the former president (one year and counting) has also highlighted the degree to which hospice care can be administered.

The hope for many, in light of the public coverage of Carter’s hospice care, is a change in long-term care coverage to cover the gap between hospital care and hospice care. Medicare does not have a long-term care benefit, so patients either go without this needed care or pay for it out of pocket. Detractors argue that new taxes would have to be levied in order to fund this type of care, making the change politically difficult.

I would argue that long-term care benefits could be used to pay for step-down care instead of hospice care and would not need a separate budget. After all, isn’t that what palliative care aims to do? Home health care aids in recover and hospice care maintains quality of life during end-of-life care. Palliative care is the bridge that spans the two, when a patient is not going to recover, but isn’t ready or eligible for hospice care. Adding Medicare and Medicaid coverage for palliative would lower the overall cost of hospice care and add much-needed service for the patients that fall between the gap.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Elizabeth E. Hogue, Esq. | Feb 14, 2024 | Admin

by Elizabeth E. Hogue, Esq.

Two former Amedisys employees claim that they were fired in retaliation for alerting management to possible violations of the federal False Claims Act. They then filed a whistleblower, or qui tam, lawsuit [Pilat v. Amedisys, Inc., No. 23-566 (2d Cir. Jan. 17, 2024)]. In their whistleblower suit, the employees claim that they complained internally to supervisors about suspected fraudulent practices and refused to engage in such practices.

The employees, for example, recommended against recertifying patients, but supervisors overruled the recommendations and recertified patients again. One of the employees then refused instructions from his supervisors to recertify the patient yet again. The employee said that the patient was completely independent and it would be “unethical” to do so.

The employees also expressed concern to supervisors about the inability of nurses and therapists to keep up with a large volume of patients. One employee said he had to schedule visits for three times as many patients as was safe. The employees explained that many patients were seen for only a few minutes rather than an appropriate amount of time. The employees said that one nurse was assigned to make eighty-six visits during one week and another was assigned to make seventy-eight visits. Amedisys billed for the visits anyway.

In addition, former employees identified multiple specific instances in which clinicians were instructed to document false information about patients. The false documentation was then used to support treatments for which patients did not qualify or to recommend unnecessary treatments. Supervisors, for example, instructed employees to fraudulently document that a fifty-year-old man whom an employee was treating was not independent and needed assistance to climb stairs. The patient did not need such assistance.

The employees further claimed that a female patient in her late fifties with early onset Parkinson’s disease received services during an episode of care. The severity of her condition was overstated in order to continue treatment.

Perhaps the most vivid example provided by the employees involved a female patient who was approximately seventy years old who had a neurological disorder that limited her mobility. The patient’s condition did not prevent her from leaving home or from driving. Supervisors repeatedly overruled employees’ recommendations to reduce visits even though she was completely independent and it would be “unethical” to provide more intensive treatment. The employees were also told not to document a leg injury that the patient suffered in a car accident because documentation of the accident would make it clear that she was not actually homebound and that she did not meet eligibility requirements of the Medicare Program.

Providers must take seriously employees’ concerns regarding possible fraudulent and abusive practices. Most whistleblowers take their concerns to their employers first. It is only when employers ignore their concerns or, even worse, retaliate against employees for raising issues in the first place, that employees turn to outside enforcers for assistance in pursuing their concerns. Whether or not the allegations of employees are valid, providers must take them seriously. Thorough investigations are required in order to demonstrate to employees that there is no problem or that the problem has been corrected.

Although this case involves home health services, the message applies to all types of providers. The message from this case and numerous other lawsuits is clear: Don’t shoot the proverbial messenger who brings information about possible fraud and abuse violations. There is a very heavy price to be paid.

©2024 Elizabeth E. Hogue, Esq. All rights reserved.

No portion of this material may be reproduced in any form without the advance written permission of the author.

by Kristin Rowan | Feb 14, 2024 | Product Review, Vendor Watch

By Kristin Rowan, Editor

For those of us who didn’t grow up with a smartphone in our pockets and every tool imaginable available on the internet, mobile apps are still a bit of a mystery and a marvel. There are 25 categories of mobile apps, including gaming, finance, education, business, dating, travel, and health. Development, testing, and execution of an app that actually works is difficult, time consuming, and expensive, so it may seem out of reach for most small businesses. Last week, we spoke with the creators of an app that not only coordinates care for your patients and families, but makes it seem like you have your own agency app.

The Story

Dr. TJ Patel, PT DPT, grew up in India, where he studied physical therapy. After landing his dream job, he started to notice a lot of patients returning to the hospital because they got an infection or just didn’t know how to care for themselves. There was no one providing care after discharge; there was no concept of home based care. Patel soon learned that if he was passionate about home-based care he needed to move to a country that had the infrastructure already built because it didn’t exist there.

Dr. Patel moved to the U.S. and received his masters in kinesiology and doctorate in physical therapy. He was working in home health within a week and did 27,000 home visits in his fifteen year tenure. During this time, Patel noticed that in healthcare, “the right hand does not talk to the left hand.” Communication was a huge pain point and Patel set out remedy that.

By combining care management, care delivery, and what the patient wants into one centralized location, it creates connectivity to all care providers for a patient. Thus, Care Coordinations was designed.

The Concept

Care Coordinations is a tech solution for an impactful experience for patients, caregivers, and families. It opens the lines of communication between the parties customized for each patient.

Patient Channels include all caregivers associated with the patient. Users both inside and outside the organization can be added to the channel. Each patient channel is a secure, private channel for all internal and external care providers. The patient channel can include smaller groups within the channel.

Care Circles include the primary agency caregiver, patients, and family members. The app allows for unlimited two-way communication that protects the personal information of the caregiver. This removes the need for the caregiver to use a personal cell phone or give the patient access to personal information like social media profiles. The two-way communication inside the app is HIPAA compliant, unlike standard text messaging.

Group Channels are non-patient specific for other members of your agency to feel connected, especially in a remote working environment. Department specific group channels for marketing, sales, or HR can also be created. Management functions allow for one-way communication to all employees, anonymous employee surveys, and read-only access to all other channels.

CAHPS Survey

The patient and family experience is captured in the CAHPS survey and impacts agency reimbursement rates. Care Coordinations includes a mock CAHPS survey for patients and families that goes out before the CAHPS survey. The agency can make any needed adjustments to the patient and family experience prior to the actual CAHPS survey, improving scores and reimbursement rates.

Additional Features

Care Coordinations integrates directly with EMRs to upload an episode of care.

Robust read-receipts allow you to see if caregivers have seen a notification inside a communication channel.

Phone and video call capability inside the app adds additional secure communication.

Remote patient monitoring is built in with integrations with more than 500 devices to monitor blood pressure, pulse ox, weight, blood sugar, and temperature.

Direct communication to the agency allows the patient or family to notify the agency in the event a caregiver does not show up for an appointment.

Similar to the user experience with Uber and Lyft, the map feature alerts the patient that the caregiver is in route and estimates time of arrival with a pictogram of a car.

Optional 24/7 functionality to allow the patient to contact the agency after hours. Your call center can input details of the call into the app for real-time updates and assist with reaching other family members in case of an emergency when calling 911 is not necessary.

Post-visit surveys are customizable and can help struggling caregivers to improve and recognize high-performing employees.

The Good, The Bad, and The…Just kidding, there’s nothing ugly

Overall, we found the Care Coordinations app to be useful and well-designed. The app is charged on a per patient basis, making it more cost effective to include multiple care providers in one patient channel for increased connectivity. The available integrations, ability to upload files and videos, HIPAA compliant communication, and familiar messaging structure all point to ease of adoption.

As we’ve noted before, many home health nurses are technology adverse and will fight against the adoption of anything new. Care Coordinations stresses the legality of HIPAA compliant communication and not using your personal cell phone as selling points for nurses. Still, we know this isn’t always enough to convince a steadfast (read stubborn) care provider. Caregiver benefits and a gamified system to track timeliness, survey results, and other metrics may add some incentives for those harder-to-convince nurses.

The Uber-like experience for the patient and family to see where the caregiver is and when they will arrive is a great feature. On the flip-side, there is no tracking of the caregiver on the agency side. With increased reports of workplace violence in home-based care, a feature that allows the caregiver to alert the agency of any change in schedule, without constant tracking of caregiver movements, would allow the caregiver and agency some peace of mind.

I found Care Coordinations to be robust and detailed. Current EMR integrations include Axxess, Kantime, and HomeCare HomeBase, all through Worldview. Direct integrations are in the works. As Care Coordinations adds features and integrations, we are bound to hear more from and about them.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Feb 14, 2024 | CMS, Regulatory

By Kristin Rowan, Editor

Republican and Democratic leaders joined forces to introduce the Credit for Caring Act (S. 3702, H.R. 7165) in support of family caregivers across the country. Family caregivers are those who are caring for a family member but are not nurses or employees of any home care agency. They are not eligible for Medicare or Medicaid payments, nor is there an employer paying them for the endless hours of support they provide. Family caregivers are often under a lot of emotional and financial stress. Some have full-time jobs in addition to the care provide. Others are caring for more than one family member, sometimes in different homes.

The Credit for Caring Act, a bipartisan effort to recognize the personal cost to family caregivers with a $5,000 federal tax credit for eligible working family caregivers. As is generally the case with government intercession, the “eligible” part will exclude many family caregivers. From Congress.gov:

“This bill allows an eligible caregiver a tax credit of up to $5,000 for 30% of the cost of long-term care expenses that exceed $2,000 in a taxable year. The bill defines eligible caregiver as an individual who has earned income for the taxable year in excess of $7,500 and pays or incurs expenses for providing care to a spouse or other dependent relative with long-term care needs.”

The bill also includes the caveat that eligible caregivers must incur qualified expenses, limited to goods, services, and supports. The language excludes the time and energy a family caregiver expends, essentially limiting the tax credit to repayment of money paid out of pocket for care that should have been covered by Medicare, Medicaid, or private health insurance, but isn’t. The cost of a direct care giver is included in eligible expenses, but doesn’t consider the family caregiver to be one.

As I break down the math in my head, I come up with this:

A tax credit of $5,000 is received if the caregiver has spent $16,600 in the previous year (5,000/.3). This leaves a total out of pocket amount of $11,100. Supportive home care services average $30/hour. $16,660 is equivalent to 555 hours of non-medical home care. That’s roughly 10 hours per week or 1-1/2 hours per day. This doesn’t include the costs for DME, doctor visits, lost wages from time off work, medication, or any of the other eligible expenses included in the bill.

This is getting us one step closer to paying for supportive in-home care and palliative care services, but I don’t think it goes far enough. An under-served, under-paid population who makes $7,500 per year cannot afford $16,000 in out-of-pocket expenses in order to qualify for the maximum tax credit. Once this bill is (hopefully) passed, we should move on to including additional services in the Medicare/Medicaid reimbursement model. The Rowan Report joins NAHC in its support of the Credit for Caring Act and urges you to reach out to your representatives to urge them to support the passing of the bill.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

Read the article and statement from NAHC here

Read the full text of the bills: H.R. 3321 and S. 3702

Find your Senator here

Find your Representative here

by Kristin Rowan | Feb 14, 2024 | Admin, M&A

By Kristin Rowan, Editor

Home care is no stranger to mergers and acquisitions. It seems there is news almost daily about companies joining forces or selling parts of their company to new entities. Notably, we reported just last week that Cigna has dropped its entire Medicare Advantage book of business. This week, we have two M&A stories to share with you.

Acquisition

Texas-based agency Angels of Care, previously of Varsity Healthcare Partners, has been bought by Nautic Partners, a private equity company. Angels of Care provides pediatric home health, including private duty and skilled nursing services, along with physical and speech therapy, and respite care. Angels of Care operates in seven states, up from two states prior to their partnership Varsity Healthcare Partners, and employs more than 2,000 nurses, physical therapists, and other service providers.

Nautic Partners, based in Providence, RI, is already a backer of VitalCaring Group, a similar agency with locations across the southern United States, Integrated Home Care Services, providers of DME, home care, and infusion services in Puerto Rico, almost 30 additional healthcare companies. Nautic is a middle-market firm founded in 1986. They specialize in healthcare, industrials, and services.

Partnership

CVS’ Aetna has partnered with Monogram Health to offer in-home care services to Medicare Advantage members with chronic kidney disease. Nurses from Monogram will provide in-home and virtual appointments to eligible members. The two companies will also reportedly work to get timely referrals for kidney transplant evaluations.

Monogram Health is a tech start-up for in-home kidney disease management. Their latest growth funding round garnered $375 million in new funding from health care companies and financial backers, including CVS. Monogram has raised a total of $557 million. Monogram operates by creating value-based care deals with health insurance plans and risk-bearing providers to manage chronic and end-stage renal diseases.

If this model sounds familiar to you, it might be because we wrote last week about Gentiva, which is partnering with risk-based providers to offer palliative care services with risk-sharing benefits on both sides. I expect this is not the last time we will hear/write about risk-sharing partnerships to pay for services that aren’t covered by health care plans.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Feb 7, 2024 | Admin, Marketing, Regulatory

by Kristin Rowan, Editor

Medicare Advantage has multiple measures of success for payment bumps and bonuses. Rehospitalization rates has long been the most important measure of how well a care at home agency is performing, but there are additional measures that can help or hurt your agency. One that is gaining a lot of traction with MA and can impact your agency’s ability to survive is the overall patient experience. Measuring the patient experience can be subjective, but a great marketing tool to use is the Net Promoter Score (NPS). NPS is a calculation of patient responses regarding their likelihood to recommend you to others. A NPS score of “0” means that, overall, your clients are not going to speak positively or negatively about you; there just isn’t anything outstanding enough to bother saying anything. Anything above zero is better than nothing, but 30 and above is ideal.

During January’s HomeCare 100 Winter Conference, Tim Craig moderated the panel, “The MA Member Experience and Why it Matters” with a panel of experts. He posed this question to the audience:

“How well do home care providers perform when it comes to delivering on patient experience?”

Rating care provider performance on a scale of 1-5, the responses during the panel were somewhat surprising

- 47% of those who responded rated the delivery on patient experience 3

- 43% said 4

- 6% responded 2

- A mere 4% responded 5

- There were no responses of 1

If we turn these answers into a Net Promoter Score, we get -6. If caregivers, administrators, and providers don’t believe we’re doing a good job, how can we expect our clients, patients, and families to be happy with the care they receive?

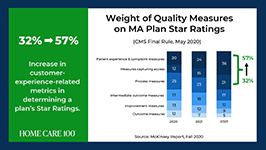

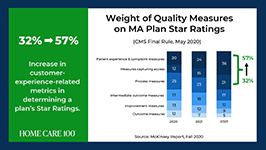

Statistics

- Patient experience and complaint measures count higher toward star rating than they have before

- CAHPS Scores have changed weight from 1.5 to 4 since 2021

- Star Ratings Determine Bonus Eligibility and Amount – starts at 4 stars and above

- Number of plans that have a 4.0 or higher star rating dropped from 64% to 43%

- Disenrollment is on the rise from 10% in 2017 to 17% in 2021

Net Promoter Score

Glen Moller, CEO of Upward Health, whose net promoter score is a whopping 86, said:

“The Member Experience has always been important. What has changed is the way we manage it, given the implication of the CAHPS rating, you can’t be a 4 star without high CAHPS scores.” Moller improved his patient experience with internal surveys to get actionable intel and asking open-ended questions. Look at change and innovation and how that could be disruptive to members. Member experience is at the center of all the other measures. No matter what benefits you’re offering, embed member experience measures at every step of the process.

Because your star rating directly impacts your ability to receive bonuses and because experience-related metrics are increasingly weighted in determining star ratings, you should be looking at the member experience more closely in all of your process. You should also be measuring the member experience and looking at ways to improve it.

Ways to measure ME

• HHCAHPS

• Quality of Patient Care Ratings

• Word of Mouth

• Net Promoter Score

• Glassdoor

• YelpCalculating a Net Promoter Score can be challenging, especially when trying to get older or infirmed patients to answer a survey. For the most accurate NPS, send a single question survey to all of your current and past customers asking them to rate, on a scale of 1 to 10, “How likely are you to recommend us to a friend or family member.” If you aren’t able to do this, you can still calculate a rough NPS using your other measures. You can use your Google and Yelp reviews with a simple formula: % of promoters – % of detractors = NPS. Three stars and below are detractors; four and five stars are promoters.The NPS score is more about comparative to the usual experience rather then the actual experience. A high score from a customer doesn’t necessarily meant it’s “great”, only that it’s much better than what they’re used to or what they expected.

The NPS is not the only measure of customer experience. To get the whole picture, use all the data you have to find out what interventions should be done and implement them. Whether the change is in training your staff, updating your scheduling process, using AI to help communicate directly with patients and families, or simply streamlining your website for a better user experience, you can improve your chances for higher ratings and bigger bonuses in a few easy steps.

I won’t often insert a shameless plug into an article, but if increasing patient satisfaction and member experience can help your agency survive the CMS pay cuts, and you need help with getting a NPS, understanding how to measure your patient experience, or getting online reviews, please contact me for more information. My marketing agency is happy to help get you started.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Elizabeth E. Hogue, Esq. | Feb 7, 2024 | Admin, Regulatory

by Elizabeth E. Hogue, Esq.

A caregiver in Wyoming who is charged with causing the death of her mother has been jailed based on allegations that she committed aggravated assault and battery; deliberate abuse of a vulnerable adult; and intentionally and maliciously killing another human being, commonly known as 2nd degree murder. The defendant, Edwina Leman, cared for her mother, Mary Davis, beginning in June of 2022. At the time of the events described below, Davis was a hospice patient.

On December 28, 2023, Leman’s son heard her yelling at her mother. At some point, he heard an audible “thump” and Davis began to scream. The son then entered the bathroom and found Leman pulling roughly on her mother’s leg, even though Davis was screaming that it hurt. According to Leman’s son, Leman then told her mother “not to be dramatic” and called her “Marygina,” a derogatory name the caregiver had previously called Davis on multiple occasions.

Leman claimed that she was removing her mother’s clothing “more forcibly than necessary when she fell.” She also said that Davis became very frail and fragile during the time the patient lived with her. Leman admitted that she had a temper and had “thumped or swatted” her mother on the head at various times in the past.

Leman’s husband and son said that they saw the caregiver engage in a pattern of physical and verbal abuse toward Davis. The caregiver screamed at her mother and sometimes called her names. Leman’s husband said he saw his wife hit the patient on the head and push her while she was walking with her walker. Leman said that she also pushed Davis when she was not using her walker, which caused her to fall to the ground. The coroner’s report said that Davis died of complications of a displaced fracture of her femur.

A sad story indeed! We read it and weep!

This case is a reminder for all types of providers who render services to patients in their homes to be alert to any signs of abuse or neglect, and to take action to protect patients who are subject to abuse or neglect. Action by providers should include reports to adult protective services. Providers may respond to this recommendation by saying that adult protective services rarely takes action based on their reports. Providers must remember, however, that reports to adult protective services are required in many states. In addition, it is important to establish a record of abuse and neglect even if authorities do not take action. Better to err, if necessary, on the side of protecting patients.

# # #

©2024 Elizabeth E. Hogue, Esq. All rights reserved. No portion of this material may be reproduced in any form without the advance written permission of the author.

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com Reprinted by permission. One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Feb 7, 2024 | Uncategorized

By Kristin Rowan, Editor

Last month, we published an article in partnership with Bob Roth of Cypress HomeCare Solutions in Scottsdale, AZ about paying for long-term care at home. Since then, I have come across some interesting information as we continue to tackle the issue of paying for care that is not reimbursed by the current Medicare/Medicaid system.

Medicare and Medicare Advantage have set pay rates for home health and hospice care. Home Health Value-Based Purchasing (HHVBP), implemented by CMS, was designed to incentivize agencies by paying more for quality care rather than a higher number of services provided. This is similar to giving advances and pay raises based on performance rather than longevity in a job, which I’m all for. However, the HHVBP overlooked palliative care altogether and neither the fee-for-service model nor the HHVBP model includes supportive (read private duty) care at home. Since these services are not reimbursed, there is no incentive to provide them nor way to get paid for them if the patient cannot pay out-of-pocket.

This causes two problems:

1. Home Health and Hospice Agencies are reluctant to provide unreimbursed care, with good reason, so the overall patient experience is less than ideal, rehospitalization rates increase, star-ratings and scores decrease, bonuses go away, and the agencies make less money than before.

2. Patients can’t get the care they need and want. Palliative care patients may receive Hospice care too early, or they may not receive care at all because they fall between home health and hospice. Patients who need supportive care at home can’t afford it so they either go without, causing increased complications or they rely on friends and family members who burn out under the stress of being a full-time caregiver.

Innovative care strategies can overcome the obstacles faced by agencies and patients alike. There may not yet be a perfect solution, but there are some innovative ideas out there and something has to disrupt the current pay model.

Palliative Care Partners

Medicare Advantage organizations and primary physician groups receive a “cost of care” analysis for the duration of the patient care. The organization takes on the risk of that patient costing more than what the MA plan will pay, but can make more money if patient care costs less than anticipated. Palliative care at home costs less. David Causby, President and CEO of Gentiva, a Hospice organization that operates in 35 states across the U.S. and has an average daily census of 26,000, has implemented a plan of care in cooperation with these organizations in what he calls Advanced Illness Management (AIM) Model for Risk-Based Partnerships. Designed for palliative care, Gentiva creates a plan of care that includes visit frequency and care needs and employs nurse practitioners, care managers, after hours RNs and social workers. The hospital pays Gentiva on a PMPM model with shared savings. The hospital still gets paid the full amount from MA but uses fewer resources, has lower costs, and sees reduced rehospitalizations, saving more than what they pay out. According to Gentiva, this partnership “provides value to contracted organizations by decreasing the overall end-of-life spend on this high-risk patient population.”

Supportive Care at Home Innovations

Supportive Care at Home (Private Duty Home Care, Private Pay, Non-medical home care) is not covered by Medicare, Medicare Advantage, or most health insurance plans. Limited Medicaid grants, VA plans, and long-term health insurance pay for some supportive care at home. Without one of these plans, patients and family members pay out-of-pocket for supportive care at home, averaging $22-$27 per hour with a 4-hour minimum. In some states it can cost up to $50 per hour. At $80 per day, that’s around $20,000 per year.

One software company we recently spoke with is upending the home care model with fee-for-service model that charges by the minute, rather than by the hour, making care more affordable for more people. You can see our product review of Caring on Demand here. By reducing the cost for customers and reducing the time for caregivers, agencies can onboard more customers without hiring more caregivers. The system is being used in facilities where these services are not provided, which allows a caregiver to visit several people in one stop. The agency and the caregiver can see the same income in the same time, spread out across multiple private payers.

Combining Innovation for a Win-Win-Win

I heard about Caring on Demand and spoke with its founder in August of 2023. I spoke with one Home Care agency owner who recently started working with Caring on Demand. “Times have changed,” the agency owner said. With fewer caregivers joining the workforce, increased levels of burnout since 2020, and CMS changes that overlook palliative and non-medical care, maybe there’s another way…

- Partnerships with organizations and physician groups that have Medicare, MA, and traditional health insurance patients, non-medical home care agencies, and palliative care providers.

- Localized groups of patients in limited areas like retirement villages, planned communities, neighborhoods, or small towns.

- Cost sharing and care coordination that includes in-home palliative care visits, supportive care, communication with primary care providers and specialists

- Preventative intercessions to avoid unnecessary ER visits and hospitalizations

- Shorter visits per caregiver with multiple visits to a community each day

- Cost sharing among patients splitting a 4-hour minimum visit among 4-8 patients

- Shared savings from reduced hospital stays, shorter durations of hospice care, and nursing visits that are supplemented by supportive care

Gentiva has experienced some success already in using shared savings as a payment model. Can costs be decreased even more by adding supportive home care to this plan? Is there enough shared savings for three payees instead of two? I don’t have the answers to these questions, but I do believe providers of supportive care and palliative care have been in the background, overlooked by CMS and MedPAC for long enough. If they aren’t going to recognize the positive impact and cost savings of home care and palliative care and include them in the reimbursement model, we may have to do it for them.

We’d love to hear your feedback on this and other innovative ways to combat the crisis of paying for care at home.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

• HHCAHPS

• HHCAHPS