DOJ Settles with UnitedHealth and Amedisys

by Kristin Rowan, Editor

DOJ Settles with UnitedHealth and Amedisys

Judge to Weigh In

DOJ settles with UnitedHealth and Amedisys after almost nine months of negotiations. The Department of Justice (DOJ) initially blocked the proposed merger between UnitedHealth and Amedisys, citing concerns over eliminating competition in home health and hospice services in some areas of the U.S. After the most recent settlement hearing, the merger seems to be back on track.

Public Comment Period and Judicial Review

Now that the DOJ hurdle has been passed, there is a public comment period. Following the public comment period, the U.S. District Court for the District of Maryland will enter final judgement. From the Justice Department website:

As required by the Tunney Act, the proposed settlement, along with a competitive impact statement, will be published in the Federal Register. Any interested person should submit written comments concerning the proposed settlement within 60 days following the publication to Jill Maguire, Acting Chief, Healthcare and Consumer Products Section, Antitrust Division, U.S. Department of Justice, 450 Fifth Street NW, Suite 4100, Washington, DC 20530.

Antitrust Division Statement

“In no sector of our economy is competition more important to Americans’ well-being than healthcare. This settlement protects quality and price competition for hundreds of thousands of vulnerable patients and wage competition for thousands of nurses. I commend the Antitrust Division’s Staff for doggedly investigating and prosecuting this case on behalf of seniors, hospice patients, nurses, and their families.”

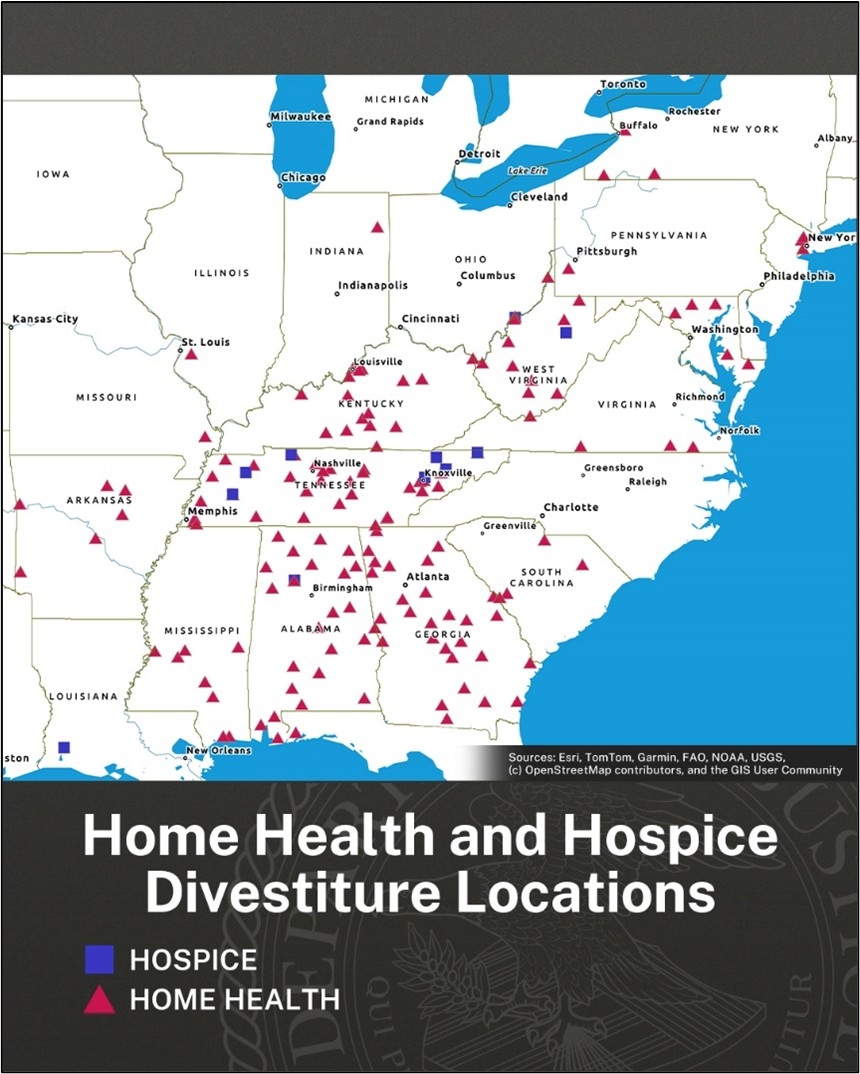

Divestiture Agreement

According to the new agreement, UnitedHealth will sell 164 home health and hospice locations across 19 states. In addition to the sale, the agreement provides the buyers of these locations with assets, personnel, and relationships to help them compete with remaining UnitedHealth locations. Also included are protections to deter UnitedHealth from interfering with the new owners’ ability to compete.

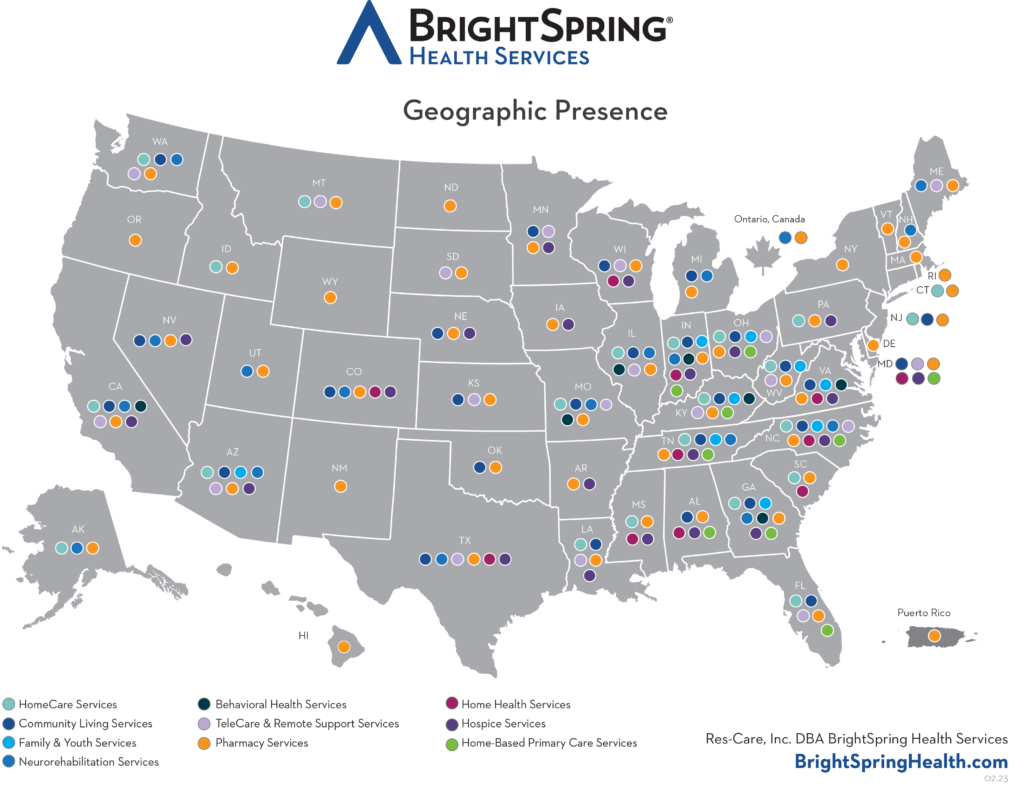

BrightSpring Health Services and Pennant Group will acquire the 164 locations. Slater said the settlement, which includes the largest ever divestiture of outpatient healthcare, protects quality and price competition patients as well as wage competition for nurses. However, antitrust specialist Robin Crauthers, a partner with McCarter & English, says it doesn’t go far enough. According to Crauthers, the settlement agreement does not address all of the markets that would have less competition and that the DOJ accepted less than they wanted in the agreement.

Additionally, critics argue the divestiture moves 164 home health and hospice agencies from one large player to two other large players in the space. Arguably, rather than preserve competition, this divestiture agreement will only serve to strengthen the largest players in the market, giving them a substantial advantage over smaller agencies in these areas.

Not the Only Concern

Vertical Integration

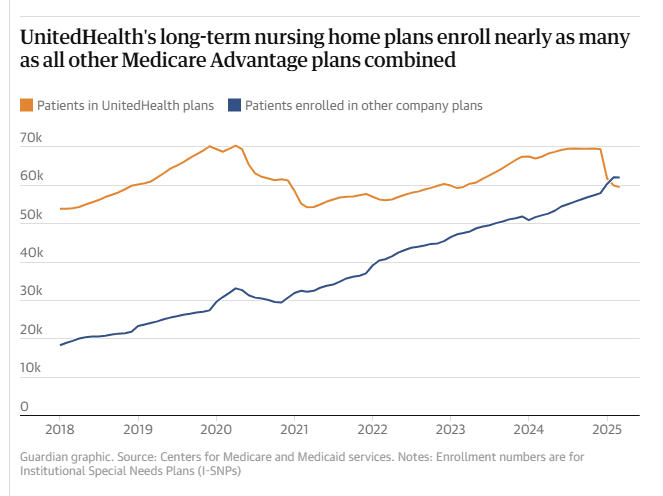

Joe Widmar, Director of M&A at West Monroe consulting firm, says that the number of home health and hospice agencies is not the tipping factor in competition. Rather, it is UnitedHealth’s vertical integration. A health insurance company that also owns nearly 2,700 subsidiaries, including pharmacies, home health and hospice, behavioral health, consulting for healthcare organizations, surgery centers, hospitals, mental health, managed care for Medicaid and Medicare, and specialty care. Virtually any referral from a PCP to any other health professional puts more money into the health care giant’s pockets. The lack of competition is across all forms of healthcare, leaving patients no choice buy to support UnitedHealth Group in areas where all local healthcare providers are subsidiaries. I 2024, UnitedHealth insurance paid $150.9 million to its subsidiaries for care. These provider companies are not counted in the profit caps placed on insurance companies.

Upcoding

In addition to side-stepping profit caps, vertical integration aids in upcoding. Upcoding is the practice of digging into a patient’s life to find (or create) additional patient needs. Insurers add as many codes as possible for the greatest reimbursement rates. According to a recent study, UnitedHealthcare overbilled Medicare Advantage by $14 billion through upcoding.

In-home health risk assessments and patient reviews, often offered to beneficiaries as a free service, result in an average risk score 7% higher than in patients seen in medical practices and hospitals. UnitedHealth generates more income from patient review diagnoses than any other MA insurer. The Department of Justice is currently investigating UnitedHealth’s Medicare billing practices.

Final Thoughts

If you own a home health, hospice, or palliative care agency in any of the states shown in the graphic above, write to Jill Maguire with comments and concerns. Our primary objective is providing quality care to patients in their homes. We know that home care is less expensive for the patient and government-funded insurance. But not when all the home care agencies in an area are owned by only a few of the largest home health agencies in the country. And not when the insurer is adding diagnostic codes to pad their bill.

# # #

Kristin Rowan has been working at The Rowan Report since 2008. She is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news, and speaker on Artificial Intelligence and Lone Worker Safety and state and national conferences.

She also runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2025 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com