by Kristin Rowan | Dec 12, 2024 | Advocacy, Editorial, Medicare Advantage, Regulatory

Will Thompson's death change healthcare?

On the same day that Brian Thompson died, Blue Cross Blue Shield announced a reversal of an earlier planned policy change. In November, the insurance giant announced it would change its process for anesthesia claims. The change would start in three states and begin on February 1st, 2025. The new process would limit the amount of time the company would cover anesthesia for surgeries and other procedures that called for anesthetization.

The announcements said the company would deny any claim for a surgery or procedure needing anesthesia that goes beyond the time limit they established. Reportedly, the policy would not apply to people under 22 or any maternity related care. A press release from the American Society of Anesthesiologists criticized the policy. It said BCBS “will no longer pay for anesthesia care if the surgery or procedure goes beyond an arbitrary time limit, regardless of how long the procedure takes.”

The new policy was confusing. Some reports indicated there would be a time limit set by the insurer and all claims over that time limit would be denied. Another interpretation said the company would initially approve the claim but would only cover the anesthesia up to a point, leaving the balance to the insured. Yet another report implied BCBS shield would still pay for the surgery, surgeon, and facility, but not for any of the anesthesia.

Though the initial announcement received backlash from anesthetists, surgeons, insured patients, and Connecticut Senator Chris Murphy, the policy was not widespread news. That is, until the shooting of Brian Thompson shed light on all health insurance company policies. Citing “misinformation” the company announced on Thursday, December 4, that it would not proceed with the policy change.

To be clear, it never was and never will be the policy of Anthem Blue Cross Blue Shield to not pay for medically necessary anesthesia services. The proposed update to the policy was only designed to clarify the appropriateness of anesthesia consistent with well-established clinical guidelines.

Anthem Blue Cross Blue Shield

The New York Times referred to the reactions to Thompson’s death as “morbid glee.” Comments on social media posts, videos, and news stories include:

“Thoughts and deductibles to the family.”

“Unfortunately my condolences are out-of-network.”

“I pay $1,300 a month for health insurance with an $8,000 deductible. When I finally reached that deductible, they denied my claims. He was making a million dollars a month.”

“Cause of death: Lead poisoning! It’s a pre-meditated condition. Payout denied.”

UnitedHealth Group Responds

UnitedHealth Group CEO Andrew Witty called the media interest in Thompson’s death “aggressive” and “frankly offensive.” In a video to UnitedHealth Group employees, Witty said, “I’m sure everybody has been disturbed by the amount of negative and in many cases citriolic media and commentary…particulary in the social media environment.” Witty noted there were few poeple who had a “bigger positive effect” on the U.S. healthcare system than Thompson.

Witty’s leaked internal video compounded the negativity towards health insurance companies. Witty decryied the media and public vitriol. He then praised Thompson’s impact on healthcare and defended the company policy.

“Our role is a critical role, and we make sure that care is safe, appropriate, and is delivered when people need it,” Witty said, “What we know to be true is the health system needs a company like UnitedHealth Group.” Witty followed his seemingly innocuous statement with, “We guard against the pressures that exist for unsafe care or for unnecessary care to be delivered in a way which makes the whole system too complex and ultimately unsustainable.” Public outcry was amplified after the video was leaked, with insured persons using this as proof that the company’s policy is to deny care.

Ron Culp, a public relations consultant at DePaul University said if the attack is related to health insurance policies it “could cause companies in the sector to make some changes,” noting that, “empathy and potential alternative solutions will play greater roles.”

Fortune predicts that the incident will cause fewer people to aim for the corner office.

While disgruntlement with corporate America is not new, The Wall Street Journal said this incident is “tinged with class rage and anti-corporate venom….[The] current outpouring is on a grander scale….”

Loss of Faith in Insurance Stock

Between close of business on Tuesday, December 3, the day before Thompson’s shooting, and Tuesday, December 10, major insurance stocks have dropped more than 6%. This includes UnitedHealth, CVS Health, and Cigna, three of the largest private health insurers in the country.

Jared Holz, a health-care equity strategist, said the stock performance appears to be in response to the rhetoric condemning health insurance business models that include denied claims in deference to higher profits.

After just one week, the public is still uncovering and pronouncing issues with the healthcare insurance industry. The long-term health insurance impact regarding company policies, denial rates, or anything else remains to be seen. The Rowan Report will never condone violence against another person. However, if Thompson’s death brings about changes in the corruption of for-profit insurance companies, we will all be the better for it.

This is an ongoing story. The Rowan Report will continue to provide updates as they become available.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Kristin Rowan | Dec 4, 2024 | Admin, Breaking News

United Health CEO in NY for Investor Event

On November 26, UnitedHealth Group announced it would host its annual Investor Conference for analysts and institutional investors in New York City on Wednesday, December 4, 2024. The purpose of Investor Day, according to the press release, was to discuss long-term growth priorities and the company’s efforts to advance high-quality health care, including expanding value-based care.

This morning, Wednesday, December 4, 50-year-old Brian Thompson, CEO of UnitedHealth Group’s insurance unit, arrived in midtown Manhattan in advance of the Investor Conference.

Mr. Thompson made his way to the Hilton Hotel for the meeting at approximately 6:45 a.m. The suspect had arrived on foot about five minutes prior. Several people recall passing him as he waited for Thompson to arrive. When Thompson approached the hotel, the suspect stepped from behind a car, approaching Thompson from behind, and fired several rounds. Thompson was struck at least once in the back and once in the leg. Reports state the suspect’s gun malfunctioned after the initial shots before he fired again.

The New York Police Department called it “a brazen, targeted attack.”

I want to be clear at this time, every indication is that this was a pre-meditated, pre-planned, targeted attack. This does not appear to be a random act of violence.

Police Commissioner, New York Police Department

NYPD Officers stand near the entrance of the hotel where Brian Thompson was reportedly shot and killed in Midtown, New York City, December 4, 2024.

Shannon Stapleton / Reuters

NYPD Officers responded to a call that a man had been shot outside the hotel. Officers arrived within 2 minutes of the call. When they arrived, they found Thompson on the sidewalk with gunshot wounds.

Emergency medical services arrived and transported Thompson to Roosevelt Hospital. He was pronounced dead at 7:12 a.m. ET.

UnitedHealth Group cancelled the Investor Day event immediately after the shooting.

Lorie Burleson, Provider Advocate Account Manager at UnitedHealthCare, issued a statement on LinkedIn about the fatal shooting.

“This morning, we learned of the devastating loss of our CEO, Brian Thompson, who was tragically taken from us,” she wrote. “This is an unimaginable loss for UnitedHealth Group and for everyone who knew him.

“To my UHC family, my heart is with each of you during this incredibly difficult time. Let us come together to honor Brian’s legacy and support one another as we navigate this tragedy.”

In a statement Wednesday, UnitedHealth Group said it was “deeply saddened and shocked at the passing” of Thompson. The company called him a “highly respected colleague and friend to all who worked with him.”

According to Daily Mail, Brian Thompson’s annual salary was $10 million. However, several outlets report he exercised more than $20 million worth of stock units in early 2024. Thompson had a net worth close to $43 million, according to multiple outlets.

Brian Thompson, 20 year veteran of UnitedHealthCare, is survived by his wife Paulette Thompson and their two children. Paulette indicated that Brian had received threats related to his job but that it did not deter him from maintaining his travel schedule.

This is an ongoing breaking story and The Rowan Report will continue to follow additional news.

UnitedHealth Group, which owns Optum, which owns LHC group, is among the nation’s largest healthcare companies and provides health insurance, pharmacy benefits and healthcare services. The company is currently trying to acquire Amedisys as well, but has been held up by DOJ inquiries.

UnitedHealthcare provides coverage for more than 29 million U.S. individuals, according to their website. In 2024, United Healthcare ranked number 8 on the Fortune Global 500, and its parent company, UnitedHealth Group employs 439,000 people, generating $379.5 billion in revenue in 2024, according to Forbes.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Kristin Rowan | Nov 15, 2024 | CMS, M&A, Medicare Advantage, Regulatory

In September of 2023, UnitedHealth Group made a bid to purchase Amedysis. That acquisition has been under scrutiny since last year. When the bid was announced, the Department of Justice began an inquiry, asking for additional information. At the time, Amedysis indicated that they anticipated the inquiry.

Now, more than a year later, the Department of Justice, along with the Attorneys General of Maryland, New York, New Jersey, and Illinois, have filed an antitrust lawsuit to block the acquisition. The proposed $3.3 billion acquisition would eliminate competition between the two companies. It would also give too much control to UnitedHealth Group, according to the suit.

Statement from the Department of Justice

The DOJ and the Attorneys General stated that the merger is illegal. The two companies own so much of the market share in the space already that combining the two would mean less choice for patients and fewer employment options for nurses seeking competitive pay and benefits.

UnitedHealth Group already acquired Amedisys’s biggest home health and hospice rival, LHC Group. Since that acquisition, UnitedHealth Group and Amedisys have been two of the largest providers of home health and hospice care in the United States.

American healthcare is unwell. Unless this $3.3 billion transaction is stopped, UnitedHealth Group will further extend its grip to home health and hospice care, threatening seniors, their families and nurses.

Assistant Attorney General, Justice Department anti-trust division

Surprisingly, the former CEO and current board chairman of Amedisys acknowledged the problems. He said that the competition between the two companies has helped keep them honest. He also said it has driven better quality to the benefit of their respective patients. The former CEO went on to say that the companies also compete for nurses and the merger may threaten the benefits nurses receive. It seems even the heads of the companies involved know this is a bad idea.

UnitedHealth Group's Proposed Solution

In response to the concerns voiced by the DOJ, UnitedHealth proposed to divest some of its facilities to VitalCaring Group. UnitedHealth said this would prevent the monopoly the merger creates. The DOJ responded to that proposal somewhat harshly.

The complaint alleges that the UnitedHealth Group’s market share would be illegal in home health markets in 23 states and the District of Columbia. It would also be illegal in hospice markets in 8 states, and in the nurse labor market in 24 states.

UnitedHealth’s proposed divestiture would only alleviate the monopoly in a few areas. This leaves hundreds of markets across the U.S. in jeopardy. Further, VitalCaring Group has poor quality scores and is facing its own legal judgement of close to half a billion dollars. Allegedly, the current CEO of VitalCaring Group was the CEO of a competitor while running VitalCaring behind the scenes.

Good News for Home Health and Hospice

The complaint describes home health and hospice services as “critically important parts of the American healthcare system….Patients rely on the skill and expertise of home health and hospice nurses, who must effectively treat patients at home.

Millions of patients depend on United and Amedisys to receive home health and hospice care in the comfort of their homes. The Department’s lawsuit demonstrates our commitment to ensuring that consolidation does not threaten quality, affordability, or wages in these vital healthcare markets.

Principal Deputy Associate Attorney General

Attorney General Merrick B. Garland said, “We are challenging this merger because home health and hospice patients and their families experiencing some of the most difficult moments of their lives deserve affordable, high quality care options. The Justice Department will not hesitate to check unlawful consolidation and monopolization in the healthcare market that threatens to harm vulnerable patients, their families, and health care workers.”

Mister Attorney General, please turn your attention to CMS and Medicare Advantage, as they continue to threaten the safety and well-being of patients, families, and caregivers with increasingly low reimbursement rates and denials of coverage.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Tim Rowan | Nov 8, 2024 | Admin, Editorial, M&A, Regulatory

by Tim Rowan, Editor Emeritus

Hospitals Divesting Home Health Departments

Is this an early omen of two related trends? A number of hospitals are divesting their home health departments, while large health insurance companies are swallowing up large home health companies.

Beckers reported on October 23 that Providence Health plans to spin off its home-health services along with hospice and palliative care into a new joint venture that will be managed by Compassus, a for-profit, Tennessee-based provider of home care services in 30 states. The move will affect about 700 patients receiving care every day in Spokane County.

The Catholic not-for-profit health system’s agreement with Compassus will be known as “Providence at Home with Compassus.”

After a regulatory review, the deal is expected to close in early 2025. Providence and Compassus will each own a 50% stake. The new venture is part of a strategy to expand and improve home-based services, but also to cut costs. Providence, which operates Sacred Heart Medical Center and Holy Family Hospital in Spokane, declined to disclose the financial details of the joint venture.

A news release that surfaced on October 25 said that UnitedHealth Group representatives are set to meet with Justice Department officials to make the case for the insurance giant’s acquisition of Amedisys to be approved. The meeting is often the last step before the Justice Department decides whether to file a lawsuit challenging an acquisition, according to the news outlet.

Amedisys operates more than 500 facilities in 37 states. Shareholders approved the acquisition in September 2023, but the deal has been held up by regulatory scrutiny. Justice Department officials are concerned the deal could increase prices for home health, according to Bloomberg.

If approved, this would be phase two of UnitedHealth’s historic foray into our sector. United acquired LHC Group, a home health provider with more than 900 locations, in February 2023. If UnitedHealth’s acquisition of Amedisys is approved, the company would own 10% of the entire home health market, with significant overlap between Amedisys and LHC acquisitions in some Southern states, according to Bloomberg.

Regulators could approve the deal with some changes to address competition concerns, Bloomberg reported. In August, Amedisys and UnitedHealth agreed to sell a reported 100 home health and hospice care centers to VitalCaring Group if the merger is approved.

UnitedHealth is not the only insurance company interested in owning home health agencies and hospices:

- Humana acquired Kindred, one of the nation’s largest HHAs, and rebranded it CenterWell Home Health. Today it operates more than 360 home health locations in 38 states. In 2023, the company said it would expand into in-home primary care in several states.

- In 2023, CVS Health acquired home health provider Signify Health for $8 billion. The company won a bidding war for Signify over UnitedHealth Group, Amazon and Option Care Health. Signify Health has more than 10,000 clinicians.

- Evernorth, Cigna’s health services arm, offers home health services with a staff of more than 430. In January, Cigna CEO David Cordani said home health was one area where it would focus on future acquisitions.

- In 2021, Centene sold its majority stake in home-based primary care provider U.S. Medical Management. Centene retained a minority stake in the company.

Our healthcare sector is changing as the entire U.S. healthcare scene changes. Next week we will delve further into the ramifications of the CMS 2025 final rule and of course the political events of this week.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Tim Rowan | Oct 25, 2024 | CMS, Editorial, Medicare Advantage, Regulatory

by Tim Rowan, Editor Emeritus

Is Medicare Advantage Killing Us?

Dr. Steve Landers has long been eloquent in his speaking and writing about the importance of Home Health over the years. Though I was already impressed, I gained a new level of respect this week. Simultaneously with his debut as CEO of the new Alliance, Dr. Landers released an article about a recent study on the impact of Medicare Advantage on Medicare beneficiaries.

It is an article that everyone in our healthcare sector should read.

In “Home Health Cuts and Barriers are Life and Death Issues for Medicare Beneficiaries,” Dr. Landers points readers toward a study conducted by Dr. Elan Gada of UnitedHealthcare’s Optum Group. The results are disturbing. That the findings were released by a Medicare Advantage company is surprising.

Yes, Virginia, Home Healthcare Really Does Save Lives

Landers cited the study’s primary finding. “Medicare Advantage beneficiaries in their plan who did not receive needed home health care after hospitalization were 42% more likely to die in the 30 days following a hospital stay than those who received the prescribed care.” If a drug proved to be as effective as post-discharge home healthcare in saving lives, Landers wrote, “it would dominate the news, restricting access would be considered immoral, and health officials would be pushing its adoption.”

Medicare Advantage Enrollees Go Without

There are a number of reasons a hospital discharged patient might not receive home healthcare, including system issues and patient refusal. However, Dr. Gada’s study also discovered that MA customers go without post-discharge home health at a higher rate than traditional Medicare beneficiaries. Traditional Medicare beneficiaries go without in-home care about 25% of the time. Medicare Advantage beneficiaries 38% of the time. Landers notes that this data is a few years old and that the denial rate for MA customers is likely higher today.

We know the life-saving impact of post-hospital home healthcare. The question becomes: how does our little corner of the U.S. healthcare system help regulators and payers to know it as well as we do? At this week’s inaugural conference of the National Alliance for Care at Home, at least three education sessions discussed Medicare Advantage. All three offered strategies for negotiating with insurance companies and surviving under their oppressive rate structures and their frequent care denials.

These Are Bandages, Not Cures

In previous opinion pieces, I have quoted revelations in government lawsuits against MA divisions of insurance companies. These prove the program that was originally launched to extend the lifespan of the Medicare Trust Fund actually costs CMS 118 percent of what traditional Medicare costs. At the same time, insurance company reports to shareholders proudly point out that their MA division is their most profitable.

One of last week’s most read stories was the report from UnitedHealth Group on their astounding Q3 growth.

Learning to cope with MA care denials and below-cost visit payments is fine for those focused on making next month’s payroll. An entirely different tactic is needed for those focused on the care needs of their elderly parents or who are approaching age 65 themselves. The question must be asked, “Why does Medicare Advantage exist?”

Medicare Advantage Lobbyists

AHIP is the insurance company lobby. It put extreme pressure on Congress in 2009 when the Affordable Care Act was being written. That pressure resulted in then-President Obama removing a core plank from his bill. Obama struck the public option healthcare insurance plan in order to win enough votes to get the bill to his desk.

That lobbying effort continues today precisely because MA is so profitable. How does it bring in so much cash? One after another, all of the large insurance companies have been caught padding patient assessments, the very fraud Home Health is so often accused of. Their monthly checks are determined by how much care they predict their covered lives will need, and they exaggerate it. Later, when it comes time to treat these same customers, MA plans deny care that would have been covered by traditional Medicare. They book profits at both ends, and they gladly pay the minimal fines when the practice is exposed.

The Reality of Medicare Advantage Fraud

To make each covered life more profitable, MA plans have begun calling customers to offer “free” nurse visits. These are essentially re-assessments where the MA staffer is rewarded for “finding” additional illnesses. This is not theoretical. My brother was offered a $50 gift certificate to CVS if he would allow his wife’s MA plan representative to drop in and chat with her, to “make sure she was getting all the benefits she was entitled to.”

Dr. Steven Landers: Call for Advocacy

In his article and in his speeches this week, Dr. Landers made it quite clear what must be done. EVERY person whose livelihood depends on the Medicare Trust Fund must make their voice heard. Letters and phone calls to Congress, to the Senate, to CMS, and to the Secretary of Health and Human Services, telling them you do not want to happen to your community what happened in Maine. After years of negative profit margins, in a state where MA adoption is at two-thirds, Andwell Health Partners ceased business in a wide swath of the northern regions of the state. Andwell was the only Home Health provider there.

The combined advocacy strength of NAHC and NHPCO is not enough to tip the scales. Your input is crucial.

- Your letter explaining the damage coming from shrinking CMS reimbursement and MA care denials will be opened by a Congressional staffer.

- The staffer will read only enough of your letter to see its topic and which side of that topic you are on.

- No need to be lengthy or eloquent

- Put your topic and your position in your first paragraph

- The staffer will add a checkmark in the pro or con side of their Home Health ledger.

- The Congressperson, Senator, HHS Secretary will see a one-page summary of the numbers.

- When the numbers are small, the summary goes into a file

- When the numbers are large, the elected or appointed official will pay attention

- In rare cases, you may even get a phone call

Dr. Landers, in His Own Words

The article Dr. Landers wrote detailing all of these includes wording suggestions for your message in your letter and/or call. For convenience, I have included one paragraph below,* but I urge you to spend three minutes reading the entire inspiring and frightening piece. In person, he explained all this in an emotional appeal. He said he cannot emphasize enough the importance of universal participation in our new organization’s advocacy effort. Based on what we have learned about post-hospital nursing care in the home, your letters and phone calls are a matter of life and death.

*To save lives and avoid unnecessary suffering, Medicare officials must reverse their plans to cut Traditional Medicare home health payments for 2025 and ensure payments are stable after adjusting for the dramatically increased healthcare labor cost inflation experienced over the past 5 years. Additionally, Medicare officials and lawmakers must study and address the possibility of the disproportionate administrative and financial barriers to home health in Medicare Advantage.

We are fortunate to have leaders in Congress like Senator Debbie Stabenow, Senator Susan Collins, Representative Terri Sewell, and Representative Adrian Smith who are working to champion a comprehensive bi-partisan legislative fix. Our leaders in Washington must act swiftly, before the end of the year, to save lives and avoid further destabilizing home health services for Medicare beneficiaries.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Oct 25, 2024 | Advocacy, CMS, Medicare Advantage, Regulatory

Medicare Advantage is Killing Us...Literally

This is part 2 of 2 in the interview with Dr. Steven Landers. You can read part 1 here.

Medicare Advantage article by Dr. Landers

Earlier this week, Dr. Landers published an article in the NAHC Report. The article cited three studies and analyses on the number of enrollees in both Medicare and Medicare Advantage who do not receive the care to which they are entitled. During our recent interview with Dr. Landers, he addressed this article.

Dr. Steven Landers: On the Record

The Rowan Report:

You wanted to address something you recently wrote. Is this the same topic you mentioned the opening session, or is this something else?

Dr. Steven Landers:

No, this is a focused piece on the emerging research that we’re seeing around when people miss out on home health. It’s a life and death issue. I want to be sure that we, as an alliance, I, as a physician, and us, as advocates, that we are conveying that these issues around home health cuts and barriers are potentially deadly. This is not a trivial matter. It’s not an administrative or technical financial issue. It’s about people’s lives.

RR:

The article mentioned a study that said that the numper of people not getting the home care that they’re entitled to is almost double with Medicare Advantage enrollees over traditional Medicare.

Steve:

That was from a study that’s referenced there from a few years ago. The Partnership for Quality Home Health Arcadia Analysis that came out this year actually showed that those trends are worsening. We know that they’re not getting the needed care in Medicare Advantage and traditional Medicare.

In both cases it’s too high, but it’s higher in Medicare Advantage. It’s more common that people don’t get the prescribed care in Medicare Advantage. And we also know that that’s going up in both traditional Medicare and Medicare Advantage. The access has gotten worse because of the Medicare home health policy and because of the way that Medicare Advantage has grown and handled these issues.

Interviewer:

I guess the big giant question is what do we do, especially when margins for both traditional Medicare and Medicare Advantage are so low?

Steve:

One, we’ve got to start improving access to home healthcare. And the way that we do that is we end this march of payment cuts that are being set forward by Medicare. I mean, right now the leaders of Medicare are in their rulemaking process and they have choices to make. They can either do things that reverse this trend and put us on a path to better access or I think continuing these cuts will hurt beneficiaries.

And the other piece is the Medicare advantage front. We need more scrutiny and evaluation and potentially oversight here to make sure Medicare Advantage beneficiaries have access to high quality home healthcare.

“The results of this study demonstrate that among MA members referred to home health after acute hospitalization, those who did not receive home health services experienced higher mortality and lower readmissions than those who received these services.”

Elan Gada, MD, Paul Pangburn, MHA, Chris Sahr, MS, MBA, Chad P. Schaben, MPH, Richard Young, MS

RR:

Where does the problem lie?

Steve:

People don’t get home health when it’s prescribed and mortality rates are substantially higher. There could be [anecdotal] reasons that this is happening. I’ve tried to think of them. I can’t really come up with them when you see it in three different analyses, especially one done within the Medicare Advantage plan. They have great data. It was well thought out and this is serious business and it really should be a kitchen table discussion for families like ‘what’s going here?,’ because obviously home healthcare is a beloved service that families care deeply about.

We’ve seen home care become a presidential campaign issue because it’s good policy and also because the folks running, Vice President Harris, who brought it up, and former President Trump, who chimed in sort of a me too, being enthusiastic about the concept. They’ve got to know that this polls well, that the families care about this stuff.

Editor Emeritus Tim Rowan provides an analysis of the study from UnitedHealth Group here.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Kristin Rowan | Oct 18, 2024 | CMS, M&A, Medicare Advantage, Regulatory

UnitedHealth Group Earnings Show Strong Q3 Revenue Growth

For most of 2024, and even going back into 2023, The Rowan Report has written about UnitedHealth Group and its acquisitions, its over diagnosing patients for financial gain, its dropping of Medicare Advantage plans, and, of course the Change Healthcare cyberattack.

Despite all the negativity, UnitedHealth Group continues to grow. The company’s revenue grew more than 9% over last year’s Q3 numbers. Even after the cyberattack, Optum grew by more than $2 billion. According to UnitedHealth Group CFO John Rex, the growth is due to an increase in both the number and type of care services offered. Optum operates three subsidiaries, OPtum Health, OptumRx, and OptumInsight, with total revenue of $63.9 billion.

CyberAttack did not Impact Earnings

According to the Q3 financial statement, per share earnings of $6.51 include the cyberattack impacts. The annual adjusted net earnings outlook for 2024 is between $27.50 and $27.75, in line with earlier projections. The 2024 net earnings outlook reflects both the selling of South American properties and the impacts from the Chnage Healthcare cyberattack. Net earnings outlook is $15.50 to $15.75 per share.

More UnitedHealth Group Acquisitions on the Horizon

UnitedHealth Group CEO Andrew Witty said the company is using a five pillar growth strategy. They will continue to spend money acquiring companies for United Healthcare, value-based care, pharmacy businesses, financial services, and what he called “technology-ed opportunities.

While UnitedHealth Group and Optum post higher revenue and cash flow and their shareholders se an increase in per share earnings, subscribers to UnitedHealth insurance plans are losing. Monthly premiums and annual deductibles for Medicare Part B increased from 2023 to 2024. Part B standard premiums are expected to increase by almost 6% in 2025. For seniors with higher income, the adjustment amount will go up to $74 per month, making monthly premiums jump to $259. The base beneficiary premium for Part D also increased in 2024 and will again for 2025.

Effective September 1, 2024, UnitedHealthcare started requiring prior authorization for Medicare Advantage member to receive PT, OT, and ST services when performed outside of the home. Not surprisingly, United Health owns multiple practices that offer PT, OT, and ST at home. Those services don’t require prior authorization. UnitedHealth Group is enjoying higher revenue, higher net income, and is funneling the money from insurance premiums back into its own pocket.

This announcement came just after UHC announced a gold card program to reduce prior authorization requirements. The gold card program started October 1st and was supposed to reduce the prior authorization request volume for provider groups. Providers groups who are in-network, have a minimum number of prior authorizations for two years, and have at least a 92% approval rate qualify for gold status.

Home health agencies are struggling to survive with lower payment rates from Medicare plans and operating in the negative under Medicare Advantage plans. Physician practices, surgery centers, urgent care, and pharmacy benefit managers are operating under UHC for even greater profits. More patients are seeing delays in care due to increased prior authorization requirements, unless the patient is seeing a caregiver owned by UHC. Shareholders are getting increased per share revenues. Perhaps there’s a solution hidden in the math there somewhere.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Elizabeth E. Hogue, Esq. | Aug 1, 2024 | Clinical

by Elizabeth E. Hogue, Esq.

What do Managed Care Plans Really Want from Providers of Services to Patients in Their Homes?

Medicare Managed Care Plans have a long history of disinterest in provision of services to patients in their homes. Despite the fact that they are mandated to provide the same services that enrollees in Medicare fee-for-services receive, they just haven’t done it. Common practices among Plans of draconian, untimely preauthorization processes and doling out authorizations for visits a few at a time make it clear that Plans have seen no real value in services to patients at home.

Plans, of course, should have been very interested in services at home. These services save money and keep patients at home where they want to be. Services at home are just generally a beautiful thing!

At the same time, it’s fair to say that the Office of Inspector General (OIG) of the U.S. Department of Health and Human Services (HHS), the primary enforcer of fraud and abuse prohibitions, has Medicare Managed Care Plans in its crosshairs. A key area of concern for the OIG is that Medicare Managed Care Plans make visits to patients in their homes looking for additional diagnoses so that the Plans will receive more money per patient. The OIG is especially critical of this practice because review of medical records of patients who received visits at homes and whose acuity increased as a result never received any care for these new diagnoses.

Managed Care Plans in the News

The Wall Street Journal recently reported that between 2018 and 2021 Plans received $50 billion for diagnoses added to members’ charts, at least some of which resulted from visits to patients in their homes.

After years of disinterest, Plans are now quite interested in at home services. Is it possible that Plans’ newfound interest is related to a desire to increase revenue through home visits? It appears so. Take, for example, comments by the CEO of UnitedHealth Group, Andrew Witty, during an investment call on July 16, 2024.

Managed Care Plan Responds

UnitedHealth Group CEO Andrew Witty

Mr. Witty reported to investors that staff made more than 2.5 million home health visits to Plan members in 2023. “As a direct result, our clinicians identified 300,000 seniors with emergent health needs that may have otherwise gone undiagnosed,” Mr. Witty said. “They connected more than 500,000 seniors to essential resources to help them with unaddressed needs.”

Former UnitedHealth employees told The Wall Street Journal that home visits were used to add diagnoses to patients’ records. They said that clinicians used software during visits that offered suggestions about what illnesses patients might have.

It now looks like it’s possible that at-home care is being hijacked by Medicare Advantage Plans to help Plans engage in practices that the OIG views as questionable.

Elizabeth Hogue is an attorney in private practice with extensive experience in health care. She represents clients across the U.S., including professional associations, managed care providers, hospitals, long-term care facilities, home health agencies, durable medical equipment companies, and hospices.

©2024 Elizabeth E. Hogue, Esq. All rights reserved.

No portion of this material may be reproduced in any form without the advance written permission of the author.

by Tim Rowan | May 2, 2024 | Admin, Privacy and Security, Regulatory, Telehealth

by Tim Rowan, Editor Emeritus

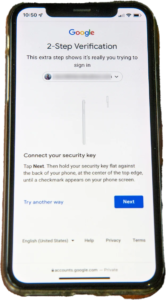

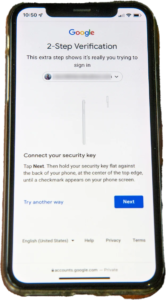

You know the routine. Everyone does. You log into your bank, airline account, or health insurance web portal, enter the correct password, and are directed to look on your smartphone  for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

United Health Grilled by Congress

In his testimony to the House Energy and Commerce Committee Wednesday, UnitedHealth Group CEO Andrew Witty blamed the absence of MFA as the weak link that allowed a ransomware attack to cripple subsidiary Change Healthcare in February. The breach had ripple effects throughout healthcare, given Change’s role as fiscal intermediary for thousands of providers. Healthcare systems on every level were unable to file claims and receive payments.

Asked by the committee why Change Healthcare, which United acquired in late 2022, did not have MFA in place, Witty testified, “Change Healthcare was a relatively older company with older technologies, which we had been working to upgrade since the acquisition. But for some reason, which we continue to investigate, this particular server did not have MFA on it.”

CBS News reported that Change Healthcare processes 15 billion transactions a year. “The scale of the attack,” their report stated, “meant that even patients who weren’t customers of UnitedHealth were potentially affected. Personal information that could cover a ‘substantial portion of people in America’ may have been taken in the attack.” The breach has already cost UnitedHealth Group nearly $900 million, plus the $22 million ransom Witty decided to pay to the hackers.

The Russia-based ransomware gang, ALPHV, or “BlackCat,” claimed responsibility for the attack, bragging that it stole more than six terabytes of data, including “sensitive” medical records. The attack triggered a disruption of payment and claims processing around the country.

We followed up our initial report on the attack with CMS guidance on March 20, 2024 and an update on April 11, 2024, with reports that Change Healthcare was being blackmailed again by another ransomware gang, RansomHub, who claimed to have 4TB of data from Change Healthcare and demanded another ransom payment.

Walmart & Optum, UnitedHealth Trouble Spots?

UnitedHealth Group is also in headline news this week for two other reasons. The company’s Optum division, which owns home care giant CenterWell, formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

A planned 10-year collaboration between UnitedHealth and Walmart to provide virtual healthcare services ended Tuesday after only one year. On April 30, the retail giant announced that it will close its 51 health centers across five states due to the “challenging reimbursement environment” and rising operating costs, which have resulted in a lack of profitability. Like Optum Virtual Care, the centers were providing virtual services via telehealth.

A sign of the post-pandemic times? Perhaps. We will keep watching.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Apr 11, 2024 | Admin, CMS, Regulatory

by Kristin Rowan, Editor

For a few weeks now, we have been covering the Change Healthcare cyberattack by ALPHV/BlackCat and the subsequent updates from CMS. Pharmacy and medical orders have been delayed, providers and patients are suffering, and CMS has issued “guidance” with no real solution. Underground reports indicate that Change Healthcare paid $22 million to BlackCat following the first cyberattack and that BlackCat stole 6TB of data from the system. Change Healthcare has refused to respond to questions about the alleged payment. Three weeks after the attack, Change Healthcare started to come back online, starting with the pharmacy services, which returned on March 7th. Parent company UnitedHealth Group indicated that other services would return in the coming weeks.

Legal Action

More than 87% of physicians are see more than a 20% drop in daily claim submissions. As of April 9th, physicians are still reporting issues with cash flow and anticipate higher than expected losses due to financing and loans that may be needed to cover them as the effects of the attack continue. Rivals of Change Healthcare are reportedly onboarding hundreds of customers who have left the organization. One of these, Availity, has processed more than $5 billion in claims that were left unprocessed by Change Healthcare’s system and has onboarded 300,000 providers with a backlog of more than 50 health systems waiting to start using the platform.

The attack has caused long-term disruptions, delays, cash flow problems, patient care disruptions, prescription delays, and billing issues. Some physician practices have started using personal money to cover payroll and other expenses. The US Department of Health and Human Services (HHS) has launched a formal inquiry into Change Healthcare’s data protection standards. This inquiry follows six class action lawsuits filed against the organizations. Physicians were still reporting significant impacts on their claims.

Adding Insult to Injury

Change Healthcare has barely gotten their systems up and running were still putting out fires when they were hit again.  On April 8, RansomHub contacted Change Healthcare and alleged to have 4TB of data stolen from the system and are demanding an extortion payment to keep the data private . RansomHub has threatened to sell the data, which includes US military personnel and patient data, medical records, and financial data, to the highest bidder in 12 days if the ransom isn’t paid.

On April 8, RansomHub contacted Change Healthcare and alleged to have 4TB of data stolen from the system and are demanding an extortion payment to keep the data private . RansomHub has threatened to sell the data, which includes US military personnel and patient data, medical records, and financial data, to the highest bidder in 12 days if the ransom isn’t paid.

Among the prevailing theories as to why Change Healthcare has been hit again is that the first ransom was supposed to have been split between ALPHV/BlackCat and an associate known as “notchy”, but ALPHV absconded with the ransom, leaving the other with nothing. Looking for a payout equal to what they lost, notchy partnered with RansomHub to try to recoup their losses. A second theory is that ALPHV and RansomHub are one in the same and that ALPHV went to ground after the ransom payout and have resurfaced as RansomHub. RansomHub, however, claims that after ALPHV went to ground, some of their affiliates joined the RansomHub operation and this is how they came by the data. Either way, it seems that the data stolen in the first attack was not returned after the ransom was paid and Change Healthcare is still susceptible to further extortion. This also means that the Change Healthcare system was not hacked a second time, but rather this is just an extension of the first data breach.

No word yet on whether Change Healthcare and UnitedHealth Group will pay the second ransom demand.

We will continue to follow this story and provide updates as it impacts payment and claims processing.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or

www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. www.therowanreport.com One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare. formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services. On April 8, RansomHub contacted Change Healthcare and alleged to have 4TB of data stolen from the system and are demanding an extortion payment to keep the data private . RansomHub has threatened to sell the data, which includes US military personnel and patient data, medical records, and financial data, to the highest bidder in 12 days if the ransom isn’t paid.

On April 8, RansomHub contacted Change Healthcare and alleged to have 4TB of data stolen from the system and are demanding an extortion payment to keep the data private . RansomHub has threatened to sell the data, which includes US military personnel and patient data, medical records, and financial data, to the highest bidder in 12 days if the ransom isn’t paid.