Overtime Ruling Upheld

by Kristin Rowan, Editor

Ruling Upheld

Agencies must pay minimum wage and overtime

A District Court of Pennsylvania ruled in favor of the Secretary of Labor against the WiCare Home Care Agency. The parties engaged in a lawsuit alleging the agency failed to pay minimum wage and overtime.

Background

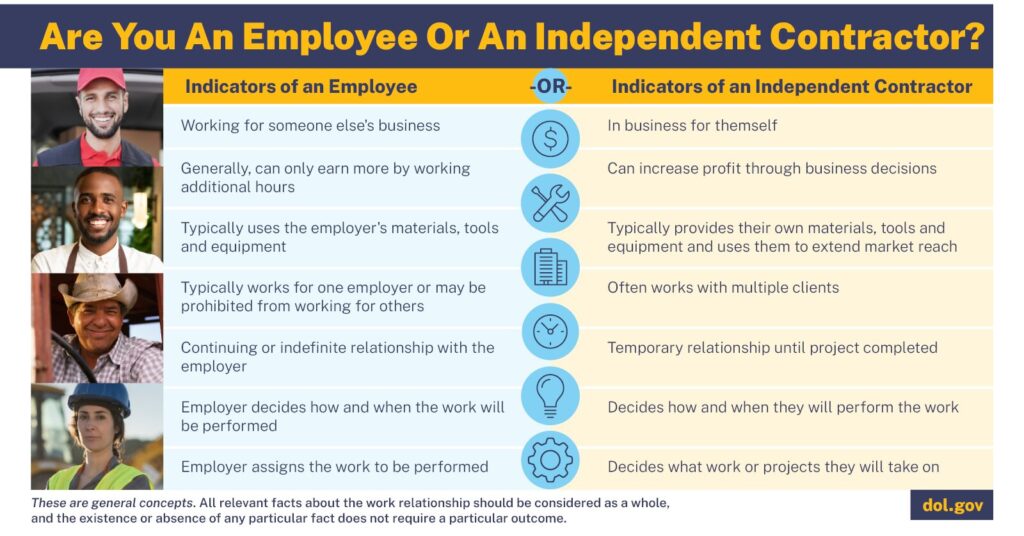

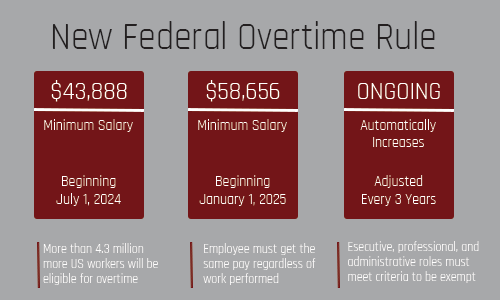

The battle on overtime wages for home health aides continues to create more questions than answers. The FLSA in 1974 extended overtime coverage for all domestic service workers with two exceptions: companion services and live-in employees. In 2013, the Department of Labor published a rule that created an exception to the exceptions: third-party employers, such as home care agencies and staffing agencies, cannot use the exception. This forced most home health and personal care agencies to pay minimum wage and overtime rates. Courts upheld this rule, applying deference to the DOL interpretation of the FLSA. This is in keeping with the Chevron Doctrine, which has since been overturned.

In July of 2025, the DOL proposed a rule that would revert back to the 1974 interpretation of the exceptions. Later that month, the Wage and Hour Division (WHD) of the DOL stated it would no longer uphold the 2013 change for new and existing cases. The DOL used the overturning of the Chevron case in support of the proposed rule.

Arguing Deference

WiCare lost the first case and the court ordered them to pay more than $1 million in back wages and damages. WiCare filed an appeal and argued that the DOL does not have standing to change the parameters of FLSA. The agency argued that government agencies should not be shown deference in their interpretation of a statute (Chevron Deference). They also argued that the DOL does not have the authority to override the exceptions for companion and live-in caregivers.

Court Unpersuaded

The opinion was filed by some but not all of the court of appeal judges. The court held that it is “well established” that agencies have the authority to give meaning to statutory terms. The decision upholds the now overturned Chevron Deference and conflicts with the 2025 statement from the WHD that it would not uphold the rule.

What it all Means

The proposed rule to undo the 2013 rule and revert to the 1974 rule is still undecided. This means that the existing FLSA rule remains intact. That rule requires overtime pay from an agency or other third-party employer.

This ruling on appeal is unlikely to impact other Chevron Defense cases. The court stated that the DOL has the express right to establish meaning and would have that right with or without Chevron. This ruling may, however, influence the proposed rule that would eliminate overtime requirements. The industry is split on support for this change and advocates continue to argue on both sides. This ruling may be used in attempts to stop the proposed rule from being finalized.

Final Thoughts

Until there is a clear change to the FLSA overtime and minimum wage exemptions and exceptions, individual employers and agencies should continue to ensure caregivers are paid both minimum wage and overtime wages in accordance with the existing exemptions.

# # #

Kristin Rowan is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news. She is also a sought-after speaker on Artificial Intelligence, Technology Adoption and Lone Worker Safety. She is available to speak at state and national conferences as well as software user-group meetings.

Kristin also runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. She works with care at home software providers to create dynamic content that increases conversions for direct e-mail, social media, and websites. Connect with Kristin directly at kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2026 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com