UnitedHealth Causes Heightened Alarm

by Kristin Rowan, Editor

UnitedHealth Causes Heightened Alarm

Guardian Investigation Launches Probe

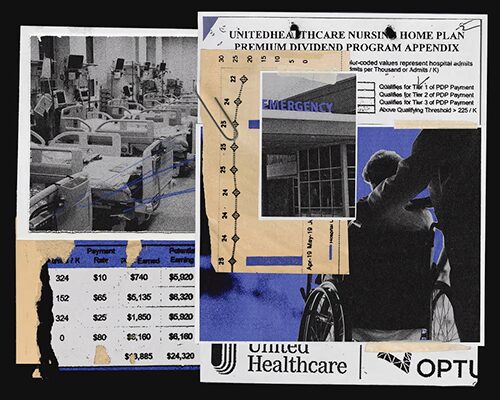

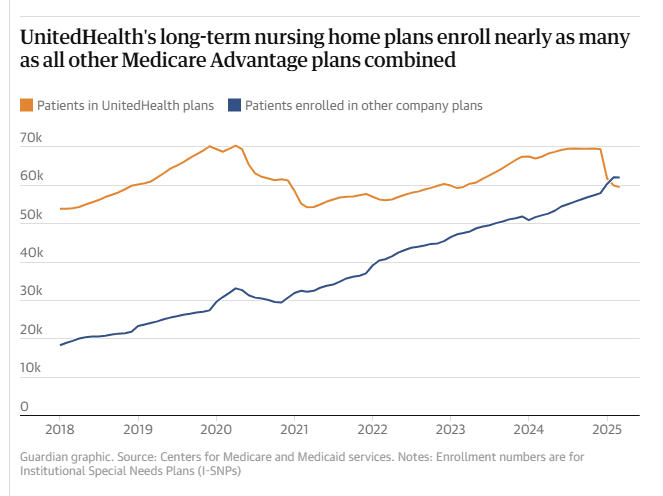

In July of 2025, The Guardian reported that UnitedHealth had secretly paid nursing homes to reduce hospital transfers. The investigation revealed that UnitedHealth was placing its own medical teams inside nursing homes and pushing them to cut care expenses, delay transfers, and deny care.

Senators Push for Answers

In the weeks following The Guardian report, Senators Ron Wyden (D-OR) and Elizabeth Warren (D-MA) launched their own investigation of the insurance giant’s cost cutting measures in nursing homes. Wyden and Warren sent a letter to then UnitedHealth Group leaders requesting documents and information about the nursing home incentive program.

New Allegations

A new letter from Senators Wyden and Warren states that UHG has refused to comply with the initial request. In the months since the demand for information, UHG has provided only “brief and unsubstantial answers” to their questions.

“Because you have failed to respond adequately to our inquiry – and in light of additional recent reporting – we are renewing our inquiry with heightened alarm.”

Additional Reports

The Senators’s letter alludes to recent additional reports. They were referring to a December story, also from The Guardian, reporting allegations of wrongful deaths inside the nursing home care program. In a statement, UnitedHealth denied any allegations their practices “endanger patient safety or violate ethical standards.”

No Response is a Response

When asked about the second letter, UnitedHealth Group did not respond to reporters at The Guardian. UHG leadership said in statement that they would “continue to engage” with the senators. The company’s leadership also maintains that its nursing home program “improves outcomes” and “reduces unnecessary hospitalizations.”

Unanswered Questions

UnitedHealth attended a briefing with the senators’ offices last July. During that meeting, UnitedHealth made several claims the Senators are now questioning.

- UHG maintained their nurses are not required to contact company representatives prior to taking a nursing home patient to the hospital, but a document provided by a whistleblower alleges the opposite

- UHG failed to adequately explain why hospital admission rates are part of the metrics for determining bonuses

- UHG chose not to respond to questions about pending wrongful death lawsuits for Mary Grant, Cindy Deal, and an unnamed nursing home resident in New York

Deadline to Comply

Senators Wyden and Warren allege that UnitedHealth Group has withheld internal documents that directly relate to their initial request for information. The senators gave a deadline of January 28, 2026 to respond with the following information:

- Hospitalization policies, including clinical protocols for determining when transfers are warranted, definitions of avoidable versus unavoidable hospitalizations, and whether staff must consult Optum supervisors before hospital transfers.

- Bonus program metrics and thresholds, including how UnitedHealth determines APK limits, whether facilities are penalized for exceeding thresholds, and five years of documentation on bonus payments to nursing homes.

- Advance directive policies, including training materials for end-of-life conversations, the mortality risk assessment tool used, and who participates in those discussions with residents.

- Marketing and enrollment practices for I-SNP plans at contracted nursing homes.

- Federal oversight and compliance, including any CMS sanctions or enforcement actions in the past five years.

Failure to Respond

Without adding details, the letter states that should UnitedHealth Group fail to respond it full, they will seek answers to their questions using “all tools at the Committee’s disposal.”

This is an ongoing inquiry/investigation and story. The Rowan Report will continue to provide updates as they become available.

# # #

Kristin Rowan is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news. She is also a sought-after speaker on Artificial Intelligence, Technology Adoption and Lone Worker Safety. She is available to speak at state and national conferences as well as software user-group meetings.

Kristin also runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. She works with care at home software providers to create dynamic content that increases conversions for direct e-mail, social media, and websites. Connect with Kristin directly at kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2026 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

The financial and health implications of uninformed disenrollment from PACE to conventional MA plans are significant. The needs of PACE beneficiaries, most of whom have multiple complex medical conditions, cognitive or functional impairments – or all three – are not comprehensively addressed by MA plans. The loss of PACE services is harmful and, in some cases, can be life-threatening.

The financial and health implications of uninformed disenrollment from PACE to conventional MA plans are significant. The needs of PACE beneficiaries, most of whom have multiple complex medical conditions, cognitive or functional impairments – or all three – are not comprehensively addressed by MA plans. The loss of PACE services is harmful and, in some cases, can be life-threatening. We share CMS’ stated desire that people have access to accurate and complete information when they make health care choices. We have numerous examples of vulnerable seniors being induced to enroll in MA plans without being fully-informed of what they are giving up when they enroll.

We share CMS’ stated desire that people have access to accurate and complete information when they make health care choices. We have numerous examples of vulnerable seniors being induced to enroll in MA plans without being fully-informed of what they are giving up when they enroll.