by Kristin Rowan | May 9, 2025 | M&A

UnitedHealth, Amedisys to Divest Home Health & Hospice...Again

UnitedHealth, Amedisys to divest home health and hospice properties to satisfy DOJ. Almost two years ago, the health services division of UnitedHealth Group, Optum, announced plans to by Amedisys. The purchase announcement came after Optum outbid Option Care Health with an unsolicited offer. The Department of Justice launched an anti-trust probe shortly after the announcement. To satisfy the DOJ, UnitedHealth and Amedisys plan to divest some of its businesses as part of the acquisition agreement.

We previously reported that Amedisys entered into an agreement with VitalCaring to divest some of its home health and hospice locations. This agreement was meant to satisfy the DOJ concerns raised in its anti-trust lawsuit against Amedisys and UnitedHealth.

In January of 2025, VitalCaring lost a lawsuit filed by Encompass Health and Enhabit and were ordered to pay 43% of all future profits to the two companies. In the wake of that court decision, VitalCaring pulled the agreement and signed a mutual release with UnitedHealth, with all parties walking away from the deal.

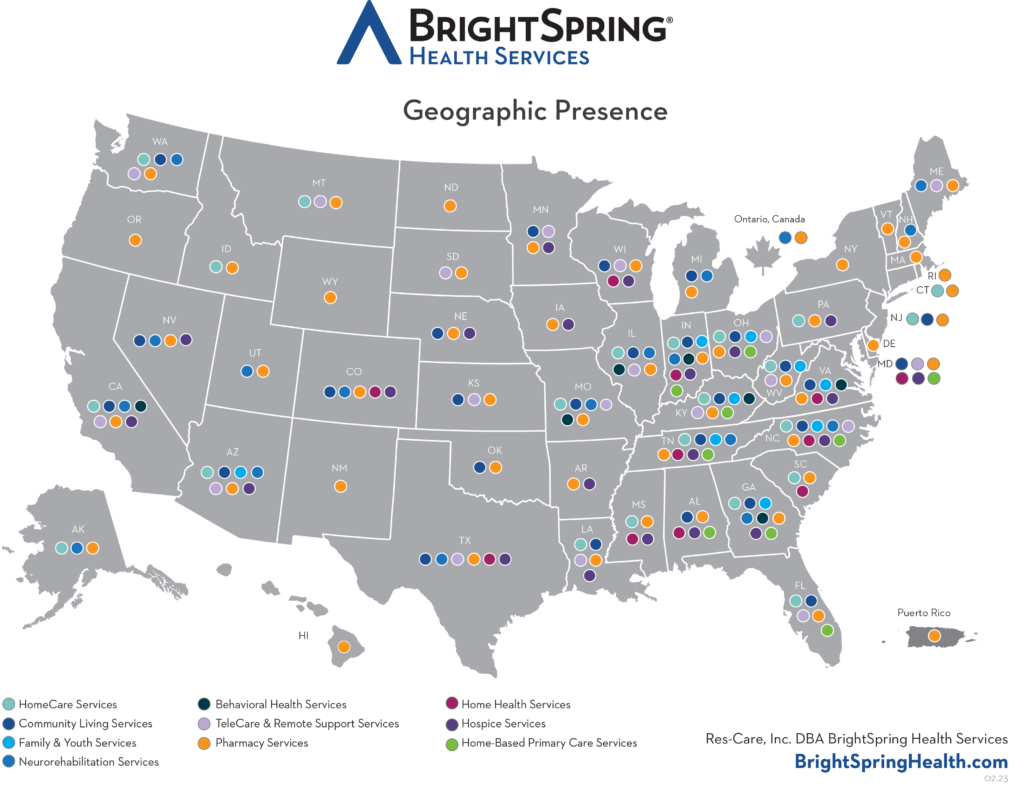

BrightSpring Health Services is an $11.5B company with locations across the United States and employing more than 37,000 people. In January of this year, BrightSpring sold is Community Living Business to Sevita. BrightSprings intends to acquire additional properties, focusing on its home- and community-based businesses. According to the BrightSpring President and CEO Jon Rousseau, BrightSpring is “focused on getting to 3x leverage within the next two years.”

Amedisys operates in 38 states with more than 500 locations. The document Amedisys submitted to the SEC does not indicate how many of its properties and those of UnitedHealth will be divested. A UnitedHealth statement said the company plans to divest at least 128 home health and hospice facilities.

One has to wonder whether we are trading one monopoly for another.

As the DOJ lawsuit enters mediation this August, UnitedHealth and Amedisys search for another way to divest its properties. Enter the New Deal. BrightSpring Health Services, parent company to Adoration Home Health Acquisition LLC, Adoration Hospice Care Acquisitions LLC and Senescence LLC, DBA All Saints Hospice will purchase some of the properties from both Amedisys and UnitedHealth. The Pennant Group, parent company to Cornerstone Healthcare, Inc. and Tensaw River Healthcare, LLC, will purchase additional properties from bother companies.

According to documents submitted to the Securities and Exchange Commission (SEC), both agreements have mulitple contingencies, including the finalization of the UnitedHealth/Amedisys merger. Financial information on the two deals was not included in the Amedisys SEC filing. In a separate filing, Pennant valued their part of the agreement at nearly $102.5 million.

The sale of properties to BrightSpring and Pennant Group relies on the finalization of the merger between Amedisys and UnitedHealth. A magistrate will oversee mediation between the two companies and the DOJ beginning this August.

The SEC and the DOJ have not yet responded to the intent to divest to BrightSpring and Pennant Group.

The proposed merger between UnitedHealth and Amedisys has been ongoing for two years. The two companies, who previously stated their competition helped keep them honest and keep costs low, now state that the merger will lower costs even more. The DOJ disagrees. To alleviate concerns, the merger includes the release of properties anywhere the merger would create an unfair advantage. Mediation in August will reveal more on the position of the DOJ, the response from UnitedHealth and Amedisys, and the specifics of the divestment of home health and hospice agencies. The merger proposal expires December 31, 2025. We will continue to follow the story as the parties enter mediation.

Kristin Rowan has been working at The Rowan Report since 2008. She is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news, and speaker on Artificial Intelligence and Lone Worker Safety and state and national conferences.

She also runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2025 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Kristin Rowan | Jan 9, 2025 | Breaking News, Regulatory

Just as we were setting the article on UnitedHealth Group and Amedisys for publication, we received the following breaking news story:

VitalCaring Divestment Agreement Cancelled

VitalCaring entered into the agreement on June 28, 2024, just after the merger announcement and initial pushback from the Department of Justice. The DOJ approved the divestiture, despite some misgivings about the quality of care. VitalCaring said at the time that it believed the merger and the divestment were in the “best interest of patients and stakeholders.”

VitalCaring has been under its own scrutiny since 2022 when Encompass Health and its home health and hospice arm, Enhabit, Inc. accused VitalCaring CEO April Anthony of using unethical practices to establish the company. Anthony is the founder of Encompass Home Health & Hospice, the previous owner and CEO of Liberty Health Services, and founder and former CEO of Homecare Homebase.

She Who Shall Not be Named

Encompass Health filed an injunction against April Anthony, and her partners Vistria Group and Nautic Partners in 2021 for violation of the terms of her employment agreement, non-competition agreement, non-solicitation, and misappropriation of trade secrets.

Anthony and her partners purchased a small home health agency in Louisiana and started plan for its growth while Anthony was still CEO of Encompass. Additionally, Anthony recruited employees of Encompass to work at her new venture using a fake recruiter to cover her tracks. Anthony used fake names, spouses’ phones, and her personal laptop to remain undetected during this time. Anthony asked her partners and recruits to refer to her as Voldemort.

In August of 2022, a judge called the actions of Anthony and her partners “willful misconduct” and agreed with almost all of Encompass’s allegations. The judge found that Anthony was in violation of her non-compete agreement and that she was actively running a direct competitor while still serving as CEO of Encompass. The judge stated, “These are not the actions of a person complying with her contractual obligations.” Although Encompass’s injunction asked to have the non-compete agreement extended, the judge only enforced the existing non-compete agreement, and found that that Anthony had violated the covenant.

The Delaware Court of Chancery, in December of 2024, agreed with the earlier findings of the court and found that Anthony, two former senior officers of Encompass, and the investment companies were complicit in their miconduct and that VitalCaring was a result of their deceit.

The court awarded an upfront payment for mitigation damages of $1.62 million dollars plus attorneys’ fees. The court also imposed a trust entitling Encompass Health and Enhabit to 43% of al of VitalCaring Group’s future profits, paid quarterly as well as 43% of proceeds if and when the company is sold.

Depending on the source, each of the companies involved in the divestiture agreement are claiming credit for filing for divorce.

- An equity analyst for UnitedHealth Group said, “UNH has abandoned VitalCaring as a divestiture buyer after the Delaware Chancery decision against VitalCaring’s executives.”

- An article from a hospice website stated, “Amedisys has halted the divestiture of some of its home health and hospice locations to Texas-based VitalCaring.

- A stock market website reported “VitalCaring Group cancelled the acquisition of certain home health care centers from UnitedHealth Group, Inc.”

Regardless of who filed for divorce, UnitedHealth Group and Amedisys are courting new partners to acquire the home health centers that need to be divested before their marriage can be blessed by the DOJ.

Kristin Rowan has been working at The Rowan Report since 2008. She is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news .She also has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2025 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Kristin Rowan | Jan 9, 2025 | M&A, Regulatory

UHG and Amedisys Waive Termination

The UnitedHealth Group and Amedisys merger has been an ongoing story since the initial merger agreement was signed in June of 2023. The proposed merger came under scrutiny by the Federal Trade Commission (FTC) and the Department of Justice (DOJ). UnitedHealth Group and Amedisys are competitors in the home healthcare market and the merger would hurt patients.

“UnitedHealth’s plan to extinguish Amedisys as a competitor is the result of an intentional, sustained strategy of acquiring, rather than beating, competition.”

Late in 2024, the DOJ filed a lawsuit against the merger, claiming that both companies have acknowledged that their competition helps keep them honest and drive quality both in patient and employee care. The DOJ noted that the acquisition would be presumptively illegal in multiple markets. UHG, Amedisys, and Optum proposed selling off some of its care centers to address the concerns about competition.

Under the initial merger agreement, UHG would pay $3.3 billion to acquire Amedisys, which would remain as a subsidiary of UHG. That agreement was set to be finalized on December 27, 2024. There has been no decision made on the DOJ lawsuit, so the merger could not be completed. UHG and Amedisys have mutually agreed to extend the merger and added a break fee of $275 million.

Indefinite Merger Extension Through 2025

The new agreement has an indefinite ending. According to the wording, the merger agreement will now expire either on December 31, 2025 or 10 days after a final court decision in the lawsuit, whichever comes first.

According to the new filing with the SEC, UnitedHealth and Amedisys will be divesting assets to secure the merger and satisfy the DOJ. If not, they will incur a break fee of up to $325 million. Both companies have an agreement with VitalCaring Group to acquire the necessary assets.

If…The Trump administration is less stringent in antitrust matters, as expected.

The lawsuits currently at the U.S. District Court and five states will likely fail.

If…the U.S. District Court for the District of Maryland either decides to block the merger permanently or does not reach a final order by the end of the year…

The merger agreement will expire.

If…UnitedHealth Group, Optum, and/or Amedisys fails to divest holdings…

The merger agreement will not satisfy the antitrust regulations and the failing party will pay hundreds of millions in damages, and the merger agreement will end.

This is an ongoing story and we will continue to report on updates as they occur. See our accompanying BREAKING NEWS story.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2025 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Kristin Rowan | Oct 18, 2024 | CMS, M&A, Medicare Advantage, Regulatory

UnitedHealth Group Earnings Show Strong Q3 Revenue Growth

For most of 2024, and even going back into 2023, The Rowan Report has written about UnitedHealth Group and its acquisitions, its over diagnosing patients for financial gain, its dropping of Medicare Advantage plans, and, of course the Change Healthcare cyberattack.

Despite all the negativity, UnitedHealth Group continues to grow. The company’s revenue grew more than 9% over last year’s Q3 numbers. Even after the cyberattack, Optum grew by more than $2 billion. According to UnitedHealth Group CFO John Rex, the growth is due to an increase in both the number and type of care services offered. Optum operates three subsidiaries, OPtum Health, OptumRx, and OptumInsight, with total revenue of $63.9 billion.

CyberAttack did not Impact Earnings

According to the Q3 financial statement, per share earnings of $6.51 include the cyberattack impacts. The annual adjusted net earnings outlook for 2024 is between $27.50 and $27.75, in line with earlier projections. The 2024 net earnings outlook reflects both the selling of South American properties and the impacts from the Chnage Healthcare cyberattack. Net earnings outlook is $15.50 to $15.75 per share.

More UnitedHealth Group Acquisitions on the Horizon

UnitedHealth Group CEO Andrew Witty said the company is using a five pillar growth strategy. They will continue to spend money acquiring companies for United Healthcare, value-based care, pharmacy businesses, financial services, and what he called “technology-ed opportunities.

While UnitedHealth Group and Optum post higher revenue and cash flow and their shareholders se an increase in per share earnings, subscribers to UnitedHealth insurance plans are losing. Monthly premiums and annual deductibles for Medicare Part B increased from 2023 to 2024. Part B standard premiums are expected to increase by almost 6% in 2025. For seniors with higher income, the adjustment amount will go up to $74 per month, making monthly premiums jump to $259. The base beneficiary premium for Part D also increased in 2024 and will again for 2025.

Effective September 1, 2024, UnitedHealthcare started requiring prior authorization for Medicare Advantage member to receive PT, OT, and ST services when performed outside of the home. Not surprisingly, United Health owns multiple practices that offer PT, OT, and ST at home. Those services don’t require prior authorization. UnitedHealth Group is enjoying higher revenue, higher net income, and is funneling the money from insurance premiums back into its own pocket.

This announcement came just after UHC announced a gold card program to reduce prior authorization requirements. The gold card program started October 1st and was supposed to reduce the prior authorization request volume for provider groups. Providers groups who are in-network, have a minimum number of prior authorizations for two years, and have at least a 92% approval rate qualify for gold status.

Home health agencies are struggling to survive with lower payment rates from Medicare plans and operating in the negative under Medicare Advantage plans. Physician practices, surgery centers, urgent care, and pharmacy benefit managers are operating under UHC for even greater profits. More patients are seeing delays in care due to increased prior authorization requirements, unless the patient is seeing a caregiver owned by UHC. Shareholders are getting increased per share revenues. Perhaps there’s a solution hidden in the math there somewhere.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Tim Rowan | May 2, 2024 | Admin, Privacy and Security, Regulatory, Telehealth

by Tim Rowan, Editor Emeritus

You know the routine. Everyone does. You log into your bank, airline account, or health insurance web portal, enter the correct password, and are directed to look on your smartphone  for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

United Health Grilled by Congress

In his testimony to the House Energy and Commerce Committee Wednesday, UnitedHealth Group CEO Andrew Witty blamed the absence of MFA as the weak link that allowed a ransomware attack to cripple subsidiary Change Healthcare in February. The breach had ripple effects throughout healthcare, given Change’s role as fiscal intermediary for thousands of providers. Healthcare systems on every level were unable to file claims and receive payments.

Asked by the committee why Change Healthcare, which United acquired in late 2022, did not have MFA in place, Witty testified, “Change Healthcare was a relatively older company with older technologies, which we had been working to upgrade since the acquisition. But for some reason, which we continue to investigate, this particular server did not have MFA on it.”

CBS News reported that Change Healthcare processes 15 billion transactions a year. “The scale of the attack,” their report stated, “meant that even patients who weren’t customers of UnitedHealth were potentially affected. Personal information that could cover a ‘substantial portion of people in America’ may have been taken in the attack.” The breach has already cost UnitedHealth Group nearly $900 million, plus the $22 million ransom Witty decided to pay to the hackers.

The Russia-based ransomware gang, ALPHV, or “BlackCat,” claimed responsibility for the attack, bragging that it stole more than six terabytes of data, including “sensitive” medical records. The attack triggered a disruption of payment and claims processing around the country.

We followed up our initial report on the attack with CMS guidance on March 20, 2024 and an update on April 11, 2024, with reports that Change Healthcare was being blackmailed again by another ransomware gang, RansomHub, who claimed to have 4TB of data from Change Healthcare and demanded another ransom payment.

Walmart & Optum, UnitedHealth Trouble Spots?

UnitedHealth Group is also in headline news this week for two other reasons. The company’s Optum division, which owns home care giant CenterWell, formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

A planned 10-year collaboration between UnitedHealth and Walmart to provide virtual healthcare services ended Tuesday after only one year. On April 30, the retail giant announced that it will close its 51 health centers across five states due to the “challenging reimbursement environment” and rising operating costs, which have resulted in a lack of profitability. Like Optum Virtual Care, the centers were providing virtual services via telehealth.

A sign of the post-pandemic times? Perhaps. We will keep watching.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Sep 13, 2023 | Editorial, M&A, Regulatory

UnitedHealth Group Makes Bid to Buy Amedisys after Acquiring LHC Group

Amedisys is one of the leading providers of home health, hospice, and other healthcare at home services. It operates more than 500 locations in 37 states and the District of Columbia. After acquiring Contessa Health in 2021 for $250 million, Amedisys added hospital-at-home, SNF-at-home, and palliative care to its list of services.

Optum Outbids Option Care Health

In May of this year, Option Care Health and Amedisys issued joint statements announcing a merger of the two companies in an all stock-option bid. Option Care Health provides home and alternate site infusion services, while Amedisys provides home health, hospice, and high-acuity care. The merger was valued at $3.6 billion. It would have increased stockholder value, increased access to care across the United States, and created a network of more than 16,000 health care professionals, according to the joint statement.1

By June 26th, Option Care Health confirmed the termination of the merger and a $106 million termination payment from Amedisys, after Amedisys accepted an all-cash bid from UnitedHealth Group.2

UnitedHealth Expanding Service Options

UnitedHealth Group acquired LHC Group earlier this year for $5.4 billion.3 That acquisition folded LHC Group into UnitedHealth Group’s Optum. The acquisition came after increased demands for home care services. UnitedHealth Group considered this a move toward value-based care. The Federal Trade Commission stalled the merger with requests for additional details in mid-2022. Despite the FTC probe and a shareholder lawsuit, the deal was ultimately approved and the LHC Group delisted its stock on February 22.4

New Merger Faces Federal Scrutiny

Optum and Amedysis expected concerns over anti-trust issues surrounding the merger, according to a joint statement from the two groups. The Department of Justice recently asked for more information.5 The request will push back the timeline for the merger. Amedisys believes there is little geographic overlap between Amedisys and LHC Group and that the scrutiny is a result of other UnitedHealth Group acquisitions.

In a press release about the merger, Optum CEO Patrick Conway, M.D. said, “Amedisys’ commitment to quality and care innovation within the home, and the patient-first culture of its people, combined with Optum’s deep value-based care expertise can drive meaningful improvement in the health outcomes and experiences of more patients at lower costs, leading to continued growth.”6

Even with the recent acquisitions and mergers, if this deal with Amedisys proceeds, Optum will have only a 10% market share across the U.S. For this reason, as well as the demand for home care far exceeding the supply, Optum believes this merger will be approved.

Should a company that brokers health insurance also be allowed to be the provider of care? In this author’s experience, job-based healthcare insurance does not come with many options. There may be different levels of care to fit your budget, but the insurance company is already chosen by the employer. This means that employees and their families choose to have health insurance or not but cannot choose the insurance company.

Home Care, Hospice, Post-Acute Care, Palliative Care, and other in-home services are very personal. The company you choose and the care provider you get have to fit your needs and personality and there is a high level of trust needed to allow a stranger into your home when you are in a vulnerable state. If the insurance company is also providing the care, the option to find a care provider that suits the level of trust needed almost disappears.

In 2021, President Joe Biden signed an executive order for more vigorous oversight of the healthcare market. Mergers and acquisitions are being scrutinized more heavily to preclude monopolies of care. The FTC and DOJ, in response to this executive order, have proposed updates to antitrust guidelines that will make healthcare mergers and acquisitions more difficult.7

Medicare beneficiaries enrolled in Medicare Advantage has now reached 50%, making insurance companies more involved in senior care than ever before.8 Insurance companies only recently increased the percentage of revenue spent on patient care to 80%, up from as low as 50% before 2010.9 Given these facts, it may be worth questioning whether the insurance companies have too much control over care now, and if the acquisition of care providers by insurance providers should be eliminated completely to avoid a complete takeover of healthcare by insurance companies that already focus more on profit than people.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare. formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services. Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information:

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: