DOJ Rejects Plan

by Kristin Rowan, Editor

DOJ Rejects Plan to Divest Assets

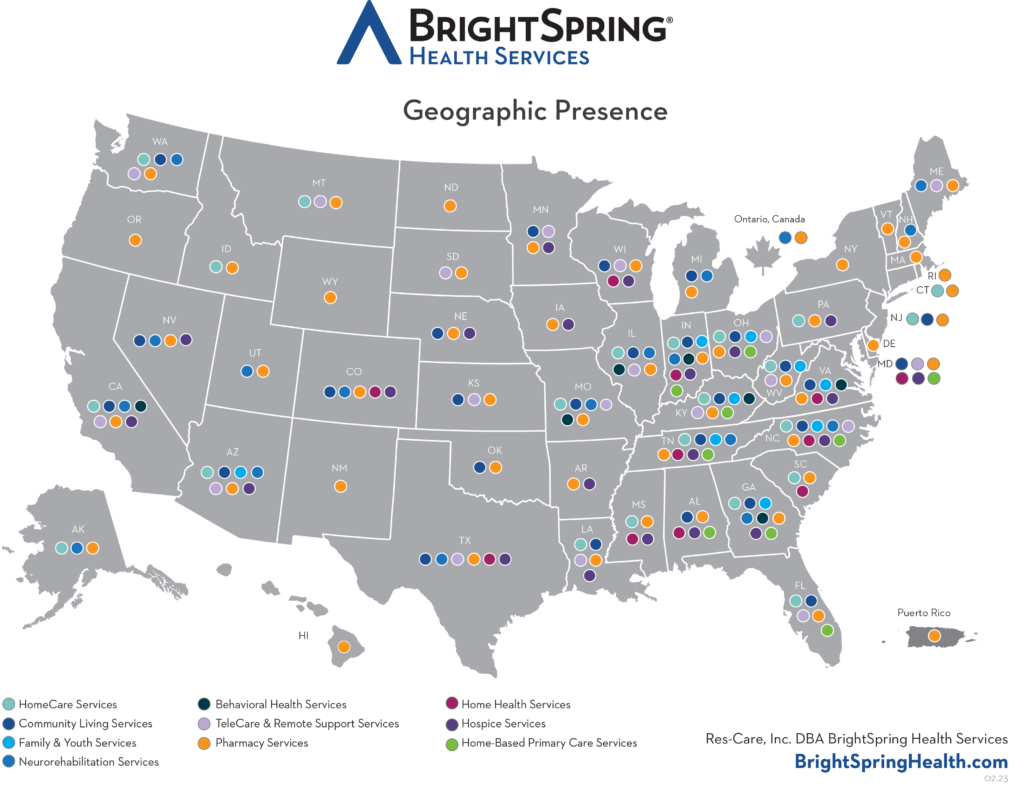

DOJ rejects plans to divest assets from UnitedHealth and Amedisys to BrightSpring Health Services and the Pennant Group. Last week, we reported that Amedisys and UnitedHealth had entered an agreement to divest certain home health and hospice agencies to satisfy anti-trust concerns. The plan is contingent on the finalization of the merger between UnitedHealth and Amedisys.

Divesting Assets

The merger between UnitedHealth and Amedisys has been ongoing since last summer. Shortly after the announcement, the Department of Justice sued under anti-trust allegations to stop the merger. According to the DOJ, even if the companies offload the 120 planned locations, it would not safeguard competition in home health and hospice markets. The DOJ cited overlap in certain markets where UnitedHealth and Amedisys both currently have agencies.

This could spell T-R-O-U-B-L-E

Following the lawsuit, Amedisys and UnitedHealth started talks with VitalCaring to divest properties. That deal fell through after VitalCaring lost its own lawsuit last year. This latest blow could stall the merger altogether. The DOJ reportedly rejected the divestiture stating that it wasn’t enough. Unless Amedisys and UnitedHealth divest more properties in certain markets, the DOJ is unlikely to approve the merger.

Mediation

The parties are scheduled to enter mediation on August 18th. The judge has now scheduled a follow-up mediation appointment on August 25th, anticipating that one day of mediation will not resolve the lawsuit. Amedisys and UnitedHealth have 90 days to secure additional divestiture that will satisfy the DOJ before mediation begins.

This is an ongoing story and The Rowan Report will continue to bring you the latest news on the merger. Please see our accompanying articles this week on the new UnitedHealth CEO and the new DOJ investigation on UnitedHealth Group.

# # #

Kristin Rowan has been working at The Rowan Report since 2008. She is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news, and speaker on Artificial Intelligence and Lone Worker Safety and state and national conferences.

She also runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2025 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com