Dementia Care Model Test

ClinicalFOR IMMEDIATE RELEASE

Contacts: PocketRN

William Leiner

Chief Operating Officer

will.leiner@pocketrn.com

Daughterhood

Becca Dittrich

becca@daughterhood.org

PocketRN and Daughterhood Announce a National Strategic Partnership to Test Medicare Dementia Care Model Developed by Centers for Medicare & Medicaid Services

Guiding an Improved Dementia Experience (GUIDE) Model, a Centers for Medicare & Medicaid Services Innovation Program, Aims to Increase Care Coordination, Support for Caregivers

WASHINGTON, D.C., MARCH 18, 2025 – Today, PocketRN, a leader in virtual nursing, and Daughterhood, a leading non-profit organization empowering family caregivers with community and resources, announced they will form a National Strategic Partnership to test the Centers for Medicare & Medicaid Services (CMS) alternative payment model designed to support people living with dementia and their caregivers.

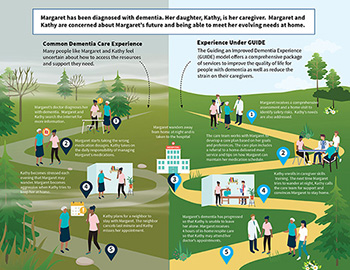

Under CMS’ Guiding an Improved Dementia Experience (GUIDE) Model, PocketRN will be one of almost 400 participants building Dementia Care Programs (DCPs) across the country, working to increase care coordination and improve access to services and supports, including respite care, for people living with dementia and their caregivers.

Launched on July 1, 2024, the GUIDE Model will test a new payment approach for key supportive services furnished to people living with dementia, including: comprehensive, person-centered assessments and care plans; care coordination; 24/7 access to an interdisciplinary care team member or help line; and certain respite services to support caregivers. People with dementia and their caregivers will have the assistance and support of a Care Navigator to help them access clinical and non-clinical services such as meals and transportation through community-based organizations.

“We couldn’t be more thrilled to bring our revolutionary nurse-led care model to the millions of dementia patients and families who need it most. With PocketRN, patients and families get unwavering support from a Nurse for Life as they navigate the complexities of managing dementia at NO cost to them. Nurses are hands-down the best clinicians to be the ‘glue’ for patients and their families throughout their dementia journey–they’ve been doing so forever, and it’s high-time their work is valued by our system.”

“We are so excited to embark on this partnership that will bring invaluable expertise and resources to the dedicated dementia caregivers in our Daughterhood community. Dementia caregiving is a uniquely complex and deeply emotional journey—one that requires not only knowledge and support but also compassion and resilience. This partnership will further empower caregivers with the tools, guidance, and encouragement they need to navigate this journey with confidence, connectivity, and care.”

PocketRN and Daughterhood’s partnership in delivering the GUIDE Model will help people living with dementia and their caregivers have access to the education, supports, and services they need to feel more empowered and less alone in their journey – including unique “circle” community groups, podcasts, educational videos, and other curated resources. The GUIDE Model also provides respite services for certain people, enabling caregivers to take temporary breaks from their caregiving responsibilities. Respite is being tested under the GUIDE Model to assess its effect on helping caregivers continue to care for their loved ones at home, preventing or delaying the need for facility care.

More information on CMS’ GUIDE Model

# # #

About Daughterhood

Daughterhood is a 501(c)(3) organization that fosters community that empowers individuals to navigate the practical and emotional complexity of caregiving. Its unique blend of “circle” community groups, blogs, podcasts, and curated partner resources gives family caregivers emotional relief along with real, practical, and tangible solutions to navigate the stress, overwhelm, and confusion they often face – and to do so with the support of others on a similar path. For more information, visit https://daughterhood.org/ or engage with Daughterhood on LinkedIn, Facebook, and Instagram.

About PocketRN

PocketRN gives patients, families, and caregivers a Nurse for Life. Its mission is to close the gap between home and healthcare by: enabling nurses to care proactively and continuously at the top of their license, enabling caregivers with peace of mind and the confidence to support others, and enabling patients to access whole-person, trusted, empathetic care when and where they want it. PocketRN is the glue that holds together fragmented experiences in care so that partners, clinicians, patients, and families get back more of what they need: quality time. For more information, visit www.pocketrn.com or engage with PocketRN on LinkedIn, Facebook, and Instagram.

© 2025 This press release originally appeared on the PocketRN website and is reprinted here with permission. For more information, please see press contact information above.