by Kristin Rowan | Mar 22, 2025 | CMS, Editorial, Medicare Advantage, Regulatory

MedPAC Comments on CY 2026

MedPac Sends Recommendations to Congress

MedPAC makes recommendations to Congress and HHS on issues affecting the Medicare program. The March report for 2025 includes recommendations for hospice, home health, and SNFs, in addition to in-patient and out-patient hospital services.

Using the exact terminology from the 2024 report, MedPAC recommends that Congress eliminate the update to the 2025 Medicare base payment rates for hospice. MedPAC pointed to a number of statistics to support the evaluation:

- The number of hospice providers increased in 2023

- Some of the growth in hospice providers occurred in states where CMS has concerns over program integrity

- The percentage of patients using hospice increased by .8 percent nationwide, as did the days of care and visits per week

- Medicare payments exceeded marginal costs by 14 percent

- The population of the U.S. is aging as more and more Baby Boomers qualify for Medicare; there is an increased need for hospice agencies to accommodate the volume of patients

- Whether there are more hospices in states where program integrity is questioned does not impact the need for hospice care; program integrity reform changes this, not reimbursement rates

- The rise in use, length of stay, and days of care explain the increase in the number of hospice; need, not profitability drives this growth

- The average markup in 2022 was 72 percent above marginal cost

Marginal cost is the cost of adding one more unit of production. In simple terms, that would be the overall costs of adding one hour of care for a hospice patient. This would include scheduling, hourly wage, and other operational costs. MedPAC believes that if an agency adds one hour of care and make 14 percent more than their costs, that is sufficient.

Keeping with tradition, MedPAC used the same language again from 2024 to recommend that Congress reduce the 205 Medicare base payment rate for home health agencies by 7 percent.

- The number of HHAs participating in Medicare increased by 3.4 percent.

- Most of the growth in HHAs was in LA County. Outside LA County, the number of HHAs decreased by 2.8 percent.

- The number of 30-day episodes per beneficiary decreased by 1.8 percent, but is still higher than in prepandemic years

- MedPAC was unable to compute the marginal profit for 2023

- Quality of care (percent discharged to community) increased by 1.3 percent

- The all-payer margin in HHAs was 8.2 percent, attracting investors

- The projected Medicare payment margin for 2025 is 19 percent

- LA County has more HHAs, but the rest of the country has fewer. We believe if you ask The National Alliance for Care at Home, Bill Dombi, or any number of prior HHA owners, low reimbursement rates forced them out of business

- Pandemic numbers skewed the need for care at home because everyone was at home; if you only look at prepandemic numbers compared with 2023 numbers, the need for home health is increasing

- HHAs keep patients out of the hospital, which accounts for more Medicare payments and higher costs

- Again, the average margin across the U.S. is 72 percent, but MedPAC somehow believes 8 percent will attract investors and buyers; volume is attracting buyers, not margins

- The projected 2025 margin is 19 percent and MedPAC recommends lowering it to 14 percent, matching hospice, and is 58 percent lower margins than the average industry

Surprisingly, there is an overlap in thinking between providers and MedPAC. In the February 2025 comment on the CMS notice of proposed rulemaking for 2026, MedPAC addressed the coding intensity and increased Medicare Advantage payments.

Last summer, Editor Emeritus Tim Rowan reported on the inflated health conditions filed by payers. Medicare Advantage payers also routinely deny care that traditional Medicare plans would cover. MA payers are collecting on both the front and back ends of the “Bank of CMS.” According to the Center for Economic Policy Research, upcoding by MA plans costs CMS 106 percent of traditional Medicare costs. Quality bonus payments add an additional 2 percent. Operating surplus from enrolling healthier beneficiaries adds another 11 percent. Payments to MA plans are 19 percent higher. MedPAC agrees and urges CMS to further investigate coding intensity from MA payers.

Although we agree with MedPAC’s assessment of MA coding intensity, that is where the similarity ends. Let’s take that recommendation one step further and require that MA plans pay hospice and home health providers a higher percentage of their risk-assessment adjustment and let the payers make their profits elsewhere.

Given the recent upheaval in D.C. and the fear that Medicare, Medicare Advantage, Medicaid, Social Security, and other benefits would be done away with completely, we are relieved to see the House Budget Bill passing without the drastic reductions to care at home.

Following the passing of the House Budget Bill, The National Alliance for Care at Home issued a response statement. We’ve published the full response here for you.

Kristin Rowan has been working at The Rowan Report since 2008. She is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news. She also has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2025 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Kristin Rowan | May 30, 2024 | Admin, Advocacy, CMS, Regulatory

by Kristin Rowan, Editor

NAHC President Bill Dombi announced at last week’s CAHSAH annual meeting and expo that he would end his tenure at NAHC and retire at the end of 2024. We reached had an interview with Dombi on Thursday, May 23rd. He said he was not prepared to speak yet about his upcoming retirement, but we should hear more about that soon.

In the meantime, he provided additional details from his session at CAHSAH. We also discussed updates on the lawsuit against CMS and the status of the merger between NAHC and NHPCO. Tim’s article from last week talks about Dombi’s progress with Senator Wyland.

Ongoing Litigation

When we last spoke with Bill, he told us about the lawsuits filed against CMS. The suit claims that the budget-neutral calculations were based on faulty data and outdated software. These calculations determined the reimbursement rate reductions. Dombi explained the process for those lawsuits.

“The first round of the battle is around whether the court has the power to hear the case either at all or at that point in time. The courts are littered with litigation that have been dismissed on jurisdictional grounds,” Dombi offered. The court dismissed the lawsuit and the case is now closed. The Department of Justice (DoJ) attacked jurisdiction to get the case dismissed. Most concerning, according to Dombi, was the DoJ’s question of whether the statute passed by Congress precluded any litigation. If the courts had found in their favor, they would have dismissed the lawsuit no further suits could be filed. Luckily, that argument didn’t hold. The second attack was whether NAHC had expedited administrative review, which is the argument that caused the dismissal. Now, they have to establish that it would be futile to get CMS to agree to expedited judicial review.

Next Steps

In light of the dismissal, NAHC had to decide whether to appeal the ruling, exhaust the expedited review step with CMS, or both. Ultimately, they decided not to appeal and is pursing the review with CMS. This process could take up to 6 months, according to Dombi. Although they are pursuing the review, CMS has already stated that their final position is that the budget neutrality has been calculated within the law. Dombi feels the review is futile because CMS is not going to change their position. Now, they just have to prove the futility.

Two-Step Approach

Advocacy from NAHC, NHPCO, and other individuals and organizations was always intended to be a two-pronged effort: Litigation and Congress. The two do not interfere with each other. Even though the court dismissed the litigation suit in favor of judicial review, the approach in Congress continues. Of Senator Wyland, Dombi said, “A year ago at this time, his view was that home health agencies needed no relief. Now, he’s indicated a willingness to find a way to help home health agencies and recognizes that the cuts have been harmful to home health agencies and others that provide care.” According to Dombi, it was the personal stories and individual provider information that was crucial in swaying Wyland. The organizations continue to meet with other members of Congress to persuade them in the same way.

Dombi Provides Merger Update

Last year, NAHC and NHPCO announced they would join forces and merge into a new, as yet to be named, organization. That merger is still moving forward, but there are a lot of odds and ends to tie up. Dombi told us, “Nothing is final, final, but I don’t see anything but tailwinds moving forward.” The two organizations are still hoping for a July 1, 2024 launch of the organization. There is an active, open search for a new CEO to actively run both organizations as one. According to Dombi, no one has been slated for that position yet, so they may end up launching before there is a CEO in place.

The two organizations have already started integrating. They have lobbied together and they have worked on policy together. Additionally, they are integrating the association management system and building a website. “We feel confident enough that it’s going to reach the finish line that we’re investing time and money in these elements,” Dombi said. The two organizations can continue to operate together without a CEO, but there are a lot of decisions that need to be made that won’t be made until after there is a CEO.

After the Merger

Once the merger is complete and the two organizations operate under a new name with a new CEO, Dombi and his counterpart Bill Marcantonio of NHPCO will stay on for some time. Dombi will take the title President Emeritus and Council to the organization and Marcantonio will become the Chief Integration Officer. The new name of the organization has not been announced. Dombi says a lot of things are tied together, from an action standpoint, and it’s better to announce all of those details together along with the new name.

Reflections From Bill Dombi

When asked what was next for him after the merger is completed and he moves to retirement, Dombi reflected on his career:

“I’m proud of what I’ve accomplished in my life, but I’m more proud of what the people I work with I have accomplished. It’s not the first time we’ve tried to merge the two organizations, but this time, we had all the right ingredients and I’m proud of that. I live with the confidence that my constituency is up to the challenge. Every time they get kicked back, they’re right back at it.

To see where we are today compared to the 70s, we are so many light years ahead of where we were then. I mean, we’re talking about a hospital level of care at home. That was part of the dream. The fore-runners of healthcare at home truly believed those things were possible. The problems that caused the workforce shortage are multi-faceted, so the solutions are multi-pronged.”

We will continue following the story of both the lawsuits and the merger and update you as soon as there is more information.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or

www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only.

editor@therowanreport.com

by Tim Rowan | May 2, 2024 | Admin, Privacy and Security, Regulatory, Telehealth

by Tim Rowan, Editor Emeritus

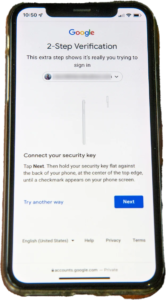

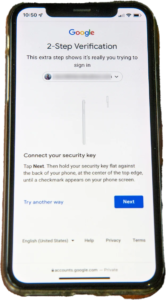

You know the routine. Everyone does. You log into your bank, airline account, or health insurance web portal, enter the correct password, and are directed to look on your smartphone  for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

United Health Grilled by Congress

In his testimony to the House Energy and Commerce Committee Wednesday, UnitedHealth Group CEO Andrew Witty blamed the absence of MFA as the weak link that allowed a ransomware attack to cripple subsidiary Change Healthcare in February. The breach had ripple effects throughout healthcare, given Change’s role as fiscal intermediary for thousands of providers. Healthcare systems on every level were unable to file claims and receive payments.

Asked by the committee why Change Healthcare, which United acquired in late 2022, did not have MFA in place, Witty testified, “Change Healthcare was a relatively older company with older technologies, which we had been working to upgrade since the acquisition. But for some reason, which we continue to investigate, this particular server did not have MFA on it.”

CBS News reported that Change Healthcare processes 15 billion transactions a year. “The scale of the attack,” their report stated, “meant that even patients who weren’t customers of UnitedHealth were potentially affected. Personal information that could cover a ‘substantial portion of people in America’ may have been taken in the attack.” The breach has already cost UnitedHealth Group nearly $900 million, plus the $22 million ransom Witty decided to pay to the hackers.

The Russia-based ransomware gang, ALPHV, or “BlackCat,” claimed responsibility for the attack, bragging that it stole more than six terabytes of data, including “sensitive” medical records. The attack triggered a disruption of payment and claims processing around the country.

We followed up our initial report on the attack with CMS guidance on March 20, 2024 and an update on April 11, 2024, with reports that Change Healthcare was being blackmailed again by another ransomware gang, RansomHub, who claimed to have 4TB of data from Change Healthcare and demanded another ransom payment.

Walmart & Optum, UnitedHealth Trouble Spots?

UnitedHealth Group is also in headline news this week for two other reasons. The company’s Optum division, which owns home care giant CenterWell, formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

A planned 10-year collaboration between UnitedHealth and Walmart to provide virtual healthcare services ended Tuesday after only one year. On April 30, the retail giant announced that it will close its 51 health centers across five states due to the “challenging reimbursement environment” and rising operating costs, which have resulted in a lack of profitability. Like Optum Virtual Care, the centers were providing virtual services via telehealth.

A sign of the post-pandemic times? Perhaps. We will keep watching.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare. formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services. Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information:

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: