The 4 M Framework for Age-Friendly Care

by Kristin Rowan, Editor

Pitfalls of Care at Home

Patient assessment has largely used the same formula for years. Patient care is more successful and less expensive in the home, but it is not without its frustrations. Agency owners and managers know that patients won’t always follow recommendations. Some patients leave an acute-care setting without understanding their own diagnosis or after care. Disruption from depression, dementia, or delirium impacts recovery. There are a reported 36 million falls among older adults in the U.S. And the list goes on.

Age-Friendly Health Systems

The care provided to older adults both in acute and post-acute settings is not always designed around the patient. Age-Friendly Health Systems is a joint initiative of The John A. Hartford Foundation and the Institute for Healthcare Improvement (IHI) in partnership with the American Hospital Association (AHA) and the Catholic Health Association of the United States (CHA).

Age-Friendly Health Systems, according to the John A. Hartford Foundation, is a movement helping hospitals, medical practices, retail pharmacy clinics, nursing homes, home-care providers, and others deliver age-friendly care.

Components of an Age-Friendly Health System:

-

- Follow an essential set of evidence-based practices in the 4Ms Framework

- Cause no harm

- Align with What Matters to older adults and their family caregivers

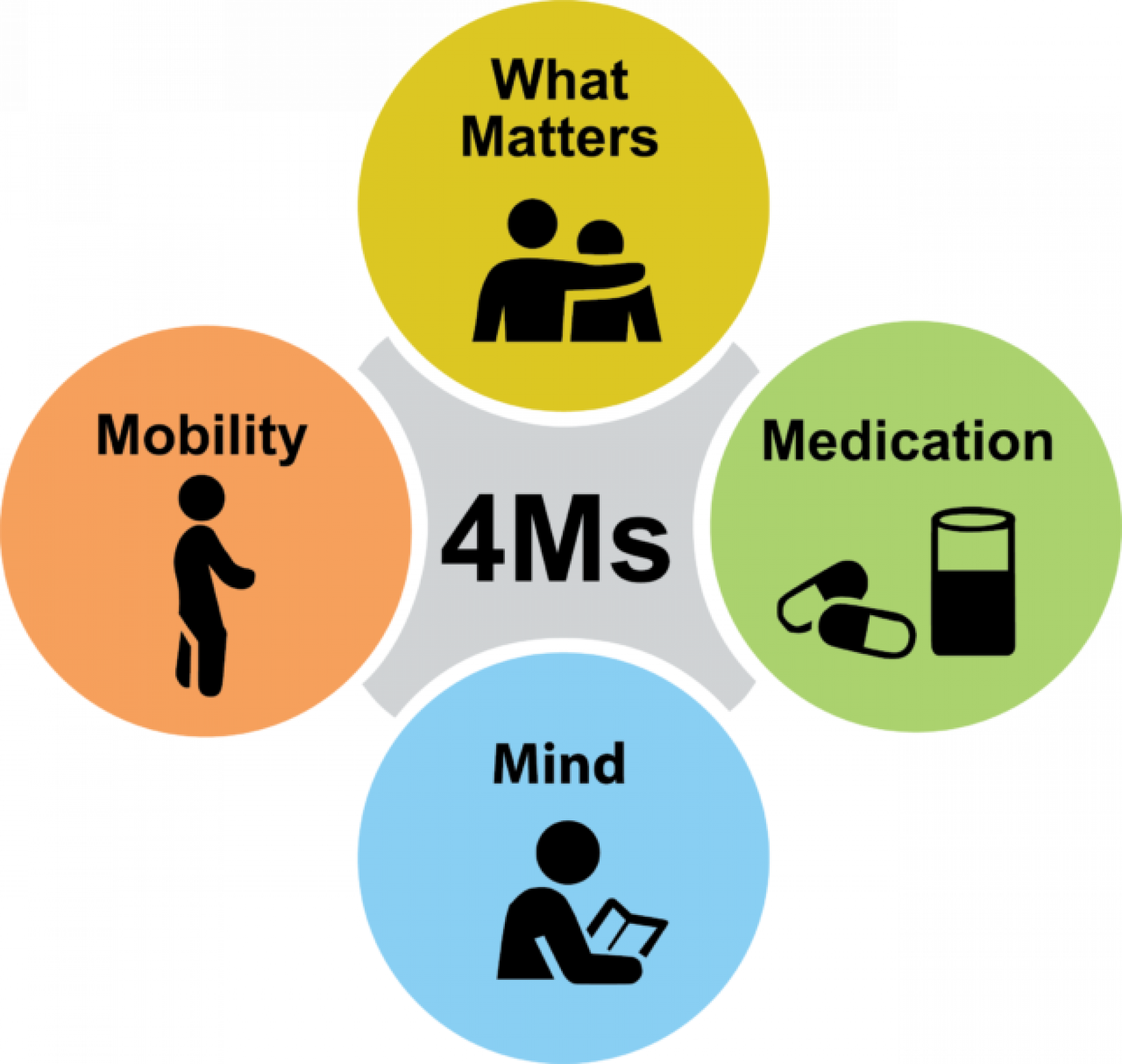

The 4Ms Framework

What Matters

Know and align care with each older adult’s specific health outcome goals and care preferences including, but not limited to, end-of-life care, and across settings of care.

Medication

If medication is necessary, use Age-Friendly medication that does not interfere with What Matters to the older adult, Mobility, or Mentation across settings of care.

Mentation

Prevent, identify, treat, and manage dementia, depression, and delirium across settings of care.

Mobility

Ensure that older adults move safely every day in order to maintain function and do What Matters.

CHAP Certification for Age-Friendly Care

The Rowan Report spoke with Teresa Harbour, COO of CHAP, about the 4M Framework. CHAP has developed a standardized form that agencies can use to educate patients and families and find out what matters most to them. The 4Ms Framework changes the perspective on patient care by looking at the 4Ms as a set, rather than as separate assessments. Resources, standards, and learning modules for your agency are also included and can be downloaded. The Age-Friendly Care at Home Certification is included at no charge with your CHAP Accreditation.

First Age-Friendly Certification Awarded

On December 2, 2024, St. Croix Hospice announced its achievement of Age-Friendly Care certification across all 70+ locations. Harbour said in a statement, “This effort not only raises the bar for compassionate, patient-centered care but also underscores St. Croix Hospice’s role as a leader in the hospice field.”

St. Croix Hospice is dedicated to providing compassionate, individualized care tailored to the unique needs of older adults. It’s especially important to us that this certification is recognized across our entire organization, reflecting the unified efforts of our teams to ensure every patient receives the highest quality care they deserve.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com