by Kristin Rowan | Feb 14, 2024 | Product Review, Vendor Watch

By Kristin Rowan, Editor

For those of us who didn’t grow up with a smartphone in our pockets and every tool imaginable available on the internet, mobile apps are still a bit of a mystery and a marvel. There are 25 categories of mobile apps, including gaming, finance, education, business, dating, travel, and health. Development, testing, and execution of an app that actually works is difficult, time consuming, and expensive, so it may seem out of reach for most small businesses. Last week, we spoke with the creators of an app that not only coordinates care for your patients and families, but makes it seem like you have your own agency app.

The Story

Dr. TJ Patel, PT DPT, grew up in India, where he studied physical therapy. After landing his dream job, he started to notice a lot of patients returning to the hospital because they got an infection or just didn’t know how to care for themselves. There was no one providing care after discharge; there was no concept of home based care. Patel soon learned that if he was passionate about home-based care he needed to move to a country that had the infrastructure already built because it didn’t exist there.

Dr. Patel moved to the U.S. and received his masters in kinesiology and doctorate in physical therapy. He was working in home health within a week and did 27,000 home visits in his fifteen year tenure. During this time, Patel noticed that in healthcare, “the right hand does not talk to the left hand.” Communication was a huge pain point and Patel set out remedy that.

By combining care management, care delivery, and what the patient wants into one centralized location, it creates connectivity to all care providers for a patient. Thus, Care Coordinations was designed.

The Concept

Care Coordinations is a tech solution for an impactful experience for patients, caregivers, and families. It opens the lines of communication between the parties customized for each patient.

Patient Channels include all caregivers associated with the patient. Users both inside and outside the organization can be added to the channel. Each patient channel is a secure, private channel for all internal and external care providers. The patient channel can include smaller groups within the channel.

Care Circles include the primary agency caregiver, patients, and family members. The app allows for unlimited two-way communication that protects the personal information of the caregiver. This removes the need for the caregiver to use a personal cell phone or give the patient access to personal information like social media profiles. The two-way communication inside the app is HIPAA compliant, unlike standard text messaging.

Group Channels are non-patient specific for other members of your agency to feel connected, especially in a remote working environment. Department specific group channels for marketing, sales, or HR can also be created. Management functions allow for one-way communication to all employees, anonymous employee surveys, and read-only access to all other channels.

CAHPS Survey

The patient and family experience is captured in the CAHPS survey and impacts agency reimbursement rates. Care Coordinations includes a mock CAHPS survey for patients and families that goes out before the CAHPS survey. The agency can make any needed adjustments to the patient and family experience prior to the actual CAHPS survey, improving scores and reimbursement rates.

Additional Features

Care Coordinations integrates directly with EMRs to upload an episode of care.

Robust read-receipts allow you to see if caregivers have seen a notification inside a communication channel.

Phone and video call capability inside the app adds additional secure communication.

Remote patient monitoring is built in with integrations with more than 500 devices to monitor blood pressure, pulse ox, weight, blood sugar, and temperature.

Direct communication to the agency allows the patient or family to notify the agency in the event a caregiver does not show up for an appointment.

Similar to the user experience with Uber and Lyft, the map feature alerts the patient that the caregiver is in route and estimates time of arrival with a pictogram of a car.

Optional 24/7 functionality to allow the patient to contact the agency after hours. Your call center can input details of the call into the app for real-time updates and assist with reaching other family members in case of an emergency when calling 911 is not necessary.

Post-visit surveys are customizable and can help struggling caregivers to improve and recognize high-performing employees.

The Good, The Bad, and The…Just kidding, there’s nothing ugly

Overall, we found the Care Coordinations app to be useful and well-designed. The app is charged on a per patient basis, making it more cost effective to include multiple care providers in one patient channel for increased connectivity. The available integrations, ability to upload files and videos, HIPAA compliant communication, and familiar messaging structure all point to ease of adoption.

As we’ve noted before, many home health nurses are technology adverse and will fight against the adoption of anything new. Care Coordinations stresses the legality of HIPAA compliant communication and not using your personal cell phone as selling points for nurses. Still, we know this isn’t always enough to convince a steadfast (read stubborn) care provider. Caregiver benefits and a gamified system to track timeliness, survey results, and other metrics may add some incentives for those harder-to-convince nurses.

The Uber-like experience for the patient and family to see where the caregiver is and when they will arrive is a great feature. On the flip-side, there is no tracking of the caregiver on the agency side. With increased reports of workplace violence in home-based care, a feature that allows the caregiver to alert the agency of any change in schedule, without constant tracking of caregiver movements, would allow the caregiver and agency some peace of mind.

I found Care Coordinations to be robust and detailed. Current EMR integrations include Axxess, Kantime, and HomeCare HomeBase, all through Worldview. Direct integrations are in the works. As Care Coordinations adds features and integrations, we are bound to hear more from and about them.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Feb 14, 2024 | CMS, Regulatory

By Kristin Rowan, Editor

Republican and Democratic leaders joined forces to introduce the Credit for Caring Act (S. 3702, H.R. 7165) in support of family caregivers across the country. Family caregivers are those who are caring for a family member but are not nurses or employees of any home care agency. They are not eligible for Medicare or Medicaid payments, nor is there an employer paying them for the endless hours of support they provide. Family caregivers are often under a lot of emotional and financial stress. Some have full-time jobs in addition to the care provide. Others are caring for more than one family member, sometimes in different homes.

The Credit for Caring Act, a bipartisan effort to recognize the personal cost to family caregivers with a $5,000 federal tax credit for eligible working family caregivers. As is generally the case with government intercession, the “eligible” part will exclude many family caregivers. From Congress.gov:

“This bill allows an eligible caregiver a tax credit of up to $5,000 for 30% of the cost of long-term care expenses that exceed $2,000 in a taxable year. The bill defines eligible caregiver as an individual who has earned income for the taxable year in excess of $7,500 and pays or incurs expenses for providing care to a spouse or other dependent relative with long-term care needs.”

The bill also includes the caveat that eligible caregivers must incur qualified expenses, limited to goods, services, and supports. The language excludes the time and energy a family caregiver expends, essentially limiting the tax credit to repayment of money paid out of pocket for care that should have been covered by Medicare, Medicaid, or private health insurance, but isn’t. The cost of a direct care giver is included in eligible expenses, but doesn’t consider the family caregiver to be one.

As I break down the math in my head, I come up with this:

A tax credit of $5,000 is received if the caregiver has spent $16,600 in the previous year (5,000/.3). This leaves a total out of pocket amount of $11,100. Supportive home care services average $30/hour. $16,660 is equivalent to 555 hours of non-medical home care. That’s roughly 10 hours per week or 1-1/2 hours per day. This doesn’t include the costs for DME, doctor visits, lost wages from time off work, medication, or any of the other eligible expenses included in the bill.

This is getting us one step closer to paying for supportive in-home care and palliative care services, but I don’t think it goes far enough. An under-served, under-paid population who makes $7,500 per year cannot afford $16,000 in out-of-pocket expenses in order to qualify for the maximum tax credit. Once this bill is (hopefully) passed, we should move on to including additional services in the Medicare/Medicaid reimbursement model. The Rowan Report joins NAHC in its support of the Credit for Caring Act and urges you to reach out to your representatives to urge them to support the passing of the bill.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

Read the article and statement from NAHC here

Read the full text of the bills: H.R. 3321 and S. 3702

Find your Senator here

Find your Representative here

by Kristin Rowan | Feb 14, 2024 | Admin, M&A

By Kristin Rowan, Editor

Home care is no stranger to mergers and acquisitions. It seems there is news almost daily about companies joining forces or selling parts of their company to new entities. Notably, we reported just last week that Cigna has dropped its entire Medicare Advantage book of business. This week, we have two M&A stories to share with you.

Acquisition

Texas-based agency Angels of Care, previously of Varsity Healthcare Partners, has been bought by Nautic Partners, a private equity company. Angels of Care provides pediatric home health, including private duty and skilled nursing services, along with physical and speech therapy, and respite care. Angels of Care operates in seven states, up from two states prior to their partnership Varsity Healthcare Partners, and employs more than 2,000 nurses, physical therapists, and other service providers.

Nautic Partners, based in Providence, RI, is already a backer of VitalCaring Group, a similar agency with locations across the southern United States, Integrated Home Care Services, providers of DME, home care, and infusion services in Puerto Rico, almost 30 additional healthcare companies. Nautic is a middle-market firm founded in 1986. They specialize in healthcare, industrials, and services.

Partnership

CVS’ Aetna has partnered with Monogram Health to offer in-home care services to Medicare Advantage members with chronic kidney disease. Nurses from Monogram will provide in-home and virtual appointments to eligible members. The two companies will also reportedly work to get timely referrals for kidney transplant evaluations.

Monogram Health is a tech start-up for in-home kidney disease management. Their latest growth funding round garnered $375 million in new funding from health care companies and financial backers, including CVS. Monogram has raised a total of $557 million. Monogram operates by creating value-based care deals with health insurance plans and risk-bearing providers to manage chronic and end-stage renal diseases.

If this model sounds familiar to you, it might be because we wrote last week about Gentiva, which is partnering with risk-based providers to offer palliative care services with risk-sharing benefits on both sides. I expect this is not the last time we will hear/write about risk-sharing partnerships to pay for services that aren’t covered by health care plans.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Feb 7, 2024 | Admin, Marketing, Regulatory

by Kristin Rowan, Editor

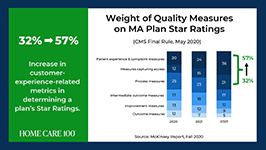

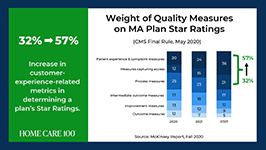

Medicare Advantage has multiple measures of success for payment bumps and bonuses. Rehospitalization rates has long been the most important measure of how well a care at home agency is performing, but there are additional measures that can help or hurt your agency. One that is gaining a lot of traction with MA and can impact your agency’s ability to survive is the overall patient experience. Measuring the patient experience can be subjective, but a great marketing tool to use is the Net Promoter Score (NPS). NPS is a calculation of patient responses regarding their likelihood to recommend you to others. A NPS score of “0” means that, overall, your clients are not going to speak positively or negatively about you; there just isn’t anything outstanding enough to bother saying anything. Anything above zero is better than nothing, but 30 and above is ideal.

During January’s HomeCare 100 Winter Conference, Tim Craig moderated the panel, “The MA Member Experience and Why it Matters” with a panel of experts. He posed this question to the audience:

“How well do home care providers perform when it comes to delivering on patient experience?”

Rating care provider performance on a scale of 1-5, the responses during the panel were somewhat surprising

- 47% of those who responded rated the delivery on patient experience 3

- 43% said 4

- 6% responded 2

- A mere 4% responded 5

- There were no responses of 1

If we turn these answers into a Net Promoter Score, we get -6. If caregivers, administrators, and providers don’t believe we’re doing a good job, how can we expect our clients, patients, and families to be happy with the care they receive?

Statistics

- Patient experience and complaint measures count higher toward star rating than they have before

- CAHPS Scores have changed weight from 1.5 to 4 since 2021

- Star Ratings Determine Bonus Eligibility and Amount – starts at 4 stars and above

- Number of plans that have a 4.0 or higher star rating dropped from 64% to 43%

- Disenrollment is on the rise from 10% in 2017 to 17% in 2021

Net Promoter Score

Glen Moller, CEO of Upward Health, whose net promoter score is a whopping 86, said:

“The Member Experience has always been important. What has changed is the way we manage it, given the implication of the CAHPS rating, you can’t be a 4 star without high CAHPS scores.” Moller improved his patient experience with internal surveys to get actionable intel and asking open-ended questions. Look at change and innovation and how that could be disruptive to members. Member experience is at the center of all the other measures. No matter what benefits you’re offering, embed member experience measures at every step of the process.

Because your star rating directly impacts your ability to receive bonuses and because experience-related metrics are increasingly weighted in determining star ratings, you should be looking at the member experience more closely in all of your process. You should also be measuring the member experience and looking at ways to improve it.

Ways to measure ME

• HHCAHPS

• Quality of Patient Care Ratings

• Word of Mouth

• Net Promoter Score

• Glassdoor

• YelpCalculating a Net Promoter Score can be challenging, especially when trying to get older or infirmed patients to answer a survey. For the most accurate NPS, send a single question survey to all of your current and past customers asking them to rate, on a scale of 1 to 10, “How likely are you to recommend us to a friend or family member.” If you aren’t able to do this, you can still calculate a rough NPS using your other measures. You can use your Google and Yelp reviews with a simple formula: % of promoters – % of detractors = NPS. Three stars and below are detractors; four and five stars are promoters.The NPS score is more about comparative to the usual experience rather then the actual experience. A high score from a customer doesn’t necessarily meant it’s “great”, only that it’s much better than what they’re used to or what they expected.

The NPS is not the only measure of customer experience. To get the whole picture, use all the data you have to find out what interventions should be done and implement them. Whether the change is in training your staff, updating your scheduling process, using AI to help communicate directly with patients and families, or simply streamlining your website for a better user experience, you can improve your chances for higher ratings and bigger bonuses in a few easy steps.

I won’t often insert a shameless plug into an article, but if increasing patient satisfaction and member experience can help your agency survive the CMS pay cuts, and you need help with getting a NPS, understanding how to measure your patient experience, or getting online reviews, please contact me for more information. My marketing agency is happy to help get you started.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Feb 7, 2024 | Uncategorized

By Kristin Rowan, Editor

Last month, we published an article in partnership with Bob Roth of Cypress HomeCare Solutions in Scottsdale, AZ about paying for long-term care at home. Since then, I have come across some interesting information as we continue to tackle the issue of paying for care that is not reimbursed by the current Medicare/Medicaid system.

Medicare and Medicare Advantage have set pay rates for home health and hospice care. Home Health Value-Based Purchasing (HHVBP), implemented by CMS, was designed to incentivize agencies by paying more for quality care rather than a higher number of services provided. This is similar to giving advances and pay raises based on performance rather than longevity in a job, which I’m all for. However, the HHVBP overlooked palliative care altogether and neither the fee-for-service model nor the HHVBP model includes supportive (read private duty) care at home. Since these services are not reimbursed, there is no incentive to provide them nor way to get paid for them if the patient cannot pay out-of-pocket.

This causes two problems:

1. Home Health and Hospice Agencies are reluctant to provide unreimbursed care, with good reason, so the overall patient experience is less than ideal, rehospitalization rates increase, star-ratings and scores decrease, bonuses go away, and the agencies make less money than before.

2. Patients can’t get the care they need and want. Palliative care patients may receive Hospice care too early, or they may not receive care at all because they fall between home health and hospice. Patients who need supportive care at home can’t afford it so they either go without, causing increased complications or they rely on friends and family members who burn out under the stress of being a full-time caregiver.

Innovative care strategies can overcome the obstacles faced by agencies and patients alike. There may not yet be a perfect solution, but there are some innovative ideas out there and something has to disrupt the current pay model.

Palliative Care Partners

Medicare Advantage organizations and primary physician groups receive a “cost of care” analysis for the duration of the patient care. The organization takes on the risk of that patient costing more than what the MA plan will pay, but can make more money if patient care costs less than anticipated. Palliative care at home costs less. David Causby, President and CEO of Gentiva, a Hospice organization that operates in 35 states across the U.S. and has an average daily census of 26,000, has implemented a plan of care in cooperation with these organizations in what he calls Advanced Illness Management (AIM) Model for Risk-Based Partnerships. Designed for palliative care, Gentiva creates a plan of care that includes visit frequency and care needs and employs nurse practitioners, care managers, after hours RNs and social workers. The hospital pays Gentiva on a PMPM model with shared savings. The hospital still gets paid the full amount from MA but uses fewer resources, has lower costs, and sees reduced rehospitalizations, saving more than what they pay out. According to Gentiva, this partnership “provides value to contracted organizations by decreasing the overall end-of-life spend on this high-risk patient population.”

Supportive Care at Home Innovations

Supportive Care at Home (Private Duty Home Care, Private Pay, Non-medical home care) is not covered by Medicare, Medicare Advantage, or most health insurance plans. Limited Medicaid grants, VA plans, and long-term health insurance pay for some supportive care at home. Without one of these plans, patients and family members pay out-of-pocket for supportive care at home, averaging $22-$27 per hour with a 4-hour minimum. In some states it can cost up to $50 per hour. At $80 per day, that’s around $20,000 per year.

One software company we recently spoke with is upending the home care model with fee-for-service model that charges by the minute, rather than by the hour, making care more affordable for more people. You can see our product review of Caring on Demand here. By reducing the cost for customers and reducing the time for caregivers, agencies can onboard more customers without hiring more caregivers. The system is being used in facilities where these services are not provided, which allows a caregiver to visit several people in one stop. The agency and the caregiver can see the same income in the same time, spread out across multiple private payers.

Combining Innovation for a Win-Win-Win

I heard about Caring on Demand and spoke with its founder in August of 2023. I spoke with one Home Care agency owner who recently started working with Caring on Demand. “Times have changed,” the agency owner said. With fewer caregivers joining the workforce, increased levels of burnout since 2020, and CMS changes that overlook palliative and non-medical care, maybe there’s another way…

- Partnerships with organizations and physician groups that have Medicare, MA, and traditional health insurance patients, non-medical home care agencies, and palliative care providers.

- Localized groups of patients in limited areas like retirement villages, planned communities, neighborhoods, or small towns.

- Cost sharing and care coordination that includes in-home palliative care visits, supportive care, communication with primary care providers and specialists

- Preventative intercessions to avoid unnecessary ER visits and hospitalizations

- Shorter visits per caregiver with multiple visits to a community each day

- Cost sharing among patients splitting a 4-hour minimum visit among 4-8 patients

- Shared savings from reduced hospital stays, shorter durations of hospice care, and nursing visits that are supplemented by supportive care

Gentiva has experienced some success already in using shared savings as a payment model. Can costs be decreased even more by adding supportive home care to this plan? Is there enough shared savings for three payees instead of two? I don’t have the answers to these questions, but I do believe providers of supportive care and palliative care have been in the background, overlooked by CMS and MedPAC for long enough. If they aren’t going to recognize the positive impact and cost savings of home care and palliative care and include them in the reimbursement model, we may have to do it for them.

We’d love to hear your feedback on this and other innovative ways to combat the crisis of paying for care at home.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Feb 7, 2024 | Regulatory

by Kristin Rowan, Editor,

On Wednesday, January 31, Cigna and HCSC signed an agreement to sell all of Cigna’s Medicare business — including traditional Medicare, supplemental benefits, Medicare Part D offerings, and CareAllies, a value-based care management subsidiary. — to HCSC, a Blue Cross / Blue Shield partner with operations in Illinois, Texas, New Mexico, Oklahoma and Montana. The $3.3 billion deal will quadruple the size of HCSC’s Medicare Advantage population, which numbered 217,623 as of this month.

Medicare Advantage had not been a significant business for Cigna. CEO David Cordani explained that it required resources disproportionate to its size in the company. With 19 million insurance customers, Cigna had a little over a half million in its MA business, a little under a half million Medicare supplement members, and 2.5 million in Part D.

It had previously been reported that Cigna believed divesting its Medicare business would make its merger with Humana more acceptable to regulators. The company completed its HCSC deal even though negotiations with Humana had already broken down. Though inked today, the deal is not expected to close until the first quarter of 2025.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Jan 31, 2024 | Clinical

By Kristin Rowan, Editor

The National Association for Home Care and Hospice joined other advocacy groups this month on Capitol Hill to fight against the looming pay cuts from CMS. Some members of Congress joined the fight for “common sense policies” to expand access to care in the home for Americans.

Rep. Adrian Smith (R-NE-3), who spoke at the event, decried moves against home health, saying “there are cuts looming that are not based on reality” and “we want to make sure reimbursement policies are reflective of the actual realities.” Smith is also the representative who introduce the “Homecare for Seniors Act,” H.R. 1795, which would allow the use of Health Savings Accounts (HSAs) to be used for home care.

Rep. Terri Sewell (D-AL-7) has a personal connection to home care and spoke about how her mother cared for her father through a series of strokes he suffered. She expressed strong opinions about payment reductions that could see home health lose as much as $20 billion dollars over the next ten years. Sewell called the idea “frightening” and said, “I am a big fan of making sure that my constituents have access to quality, affordable health care.”

The Medicare program has admitted that home health is not just a bringing of great care and not just a more cost effective way to provide care, but is a service that provides dynamic value. Care in the home has decreased overall costs by $3.2 billion dollars just in the small segment of value-based payment model test cases. Patients who receive care in the home are re-admitted to the hospital 37% less frequently than those who do not and are 43% less likely to die than patients who do not receive care at home. Still, CMS is looking at additional pay cuts which bring the total payment reduction down 13.72% since 2019. The costs of everything else have increased in that time. According to the U.S. Bureau of Labor and Statistics, the average cost of living has increased 22% since 2019. NAHC President Bill Dombi said, “Where we’re headed in 2024 is that half of all home health agencies will be operating in the red with the cuts facing them in the Medicare program. It’s not a recipe for continued access to care.”

Dombi, along with many others, is predicting that 50 percent of agencies will be operating in the red after the next round of payment reductions and that without a reversal of these pay cuts we could see the end of care at home altogether with a collapse of the home health payment system.

The advocacy event on Capitol Hill helped raise awareness of the plight of care at home among some policymakers, but more help and advocacy is needed. Please, take a few minutes to click the link below and tell your members of Congress to support the Preserving Access to Home Health Act of 2023.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

- Please GO HERE to tell your members of Congress to support the Preserving Access to Home Health Act of 2023

by Kristin Rowan | Jan 31, 2024 | Admin, CMS, Regulatory

By Kristin Rowan, Editor

The National Association for Home Care and Hospice joined other advocacy groups this month on Capitol Hill to fight against the looming pay cuts from CMS. Some members of Congress joined the fight for “common sense policies” to expand access to care in the home for Americans.

Rep. Adrian Smith (R-NE-3), who spoke at the event, decried moves against home health, saying “there are cuts looming that are not based on reality” and “we want to make sure reimbursement policies are reflective of the actual realities.” Smith is also the representative who introduce the “Homecare for Seniors Act,” H.R. 1795, which would allow the use of Health Savings Accounts (HSAs) to be used for home care.

Rep. Terri Sewell (D-AL-7) has a personal connection to home care and spoke about how her mother cared for her father through a series of strokes he suffered. She expressed strong opinions about payment reductions that could see home health lose as much as $20 billion dollars over the next ten years. Sewell called the idea “frightening” and said, “I am a big fan of making sure that my constituents have access to quality, affordable health care.”

The Medicare program has admitted that home health is not just a bringing of great care and not just a more cost effective way to provide care, but is a service that provides dynamic value. Care in the home has decreased overall costs by $3.2 billion dollars just in the small segment of value-based payment model test cases. Patients who receive care in the home are re-admitted to the hospital 37% less frequently than those who do not and are 43% less likely to die than patients who do not receive care at home. Still, CMS is looking at additional pay cuts which bring the total payment reduction down 13.72% since 2019. The costs of everything else have increased in that time. According to the U.S. Bureau of Labor and Statistics, the average cost of living has increased 22% since 2019. NAHC President Bill Dombi said, “Where we’re headed in 2024 is that half of all home health agencies will be operating in the red with the cuts facing them in the Medicare program. It’s not a recipe for continued access to care.”

Dombi, along with many others, is predicting that 50 percent of agencies will be operating in the red after the next round of payment reductions and that without a reversal of these pay cuts we could see the end of care at home altogether with a collapse of the home health payment system.

The advocacy event on Capitol Hill helped raise awareness of the plight of care at home among some policymakers, but more help and advocacy is needed. Please, take a few minutes to click the link below and tell your members of Congress to support the Preserving Access to Home Health Act of 2023.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

Please GO HERE to tell your members of Congress to support the Preserving Access to Home Health Act of 2023

by Kristin Rowan | Jan 24, 2024 | Clinical, Regulatory, Vendor Watch

The Arizona Healthcare Cost Containment System (AHCCCS American Rescue Plan (ARP) Program has awarded a grant to a collaborative group of care providers, solutions providers, and educators. On January 18th, Arizona home care agency Cypress HomeCare Solutions announced they have been selected at the recipient of this program award along with solutions provider PocketRN and educator Nevvon. As a team, they will implement services that improve client and provider experiences while also creating health system savings.

Last week, we spoke with PocketRN CEO Jenna Morganstern-Gaines. “Nevvon and PocketRN are working with Cypress to implement [the use of] PocketRN by Cypress’s caregivers to study cost of care, experience for clients, families, and the care team, and outcomes,” explained Morganstern-Gaines. She further explained that part of the requirements of the grant is to issue quarterly reports and a final evaluation of the program after one year. They are currently through the first phase of the study, which was to onboard patients, families, and caregivers.

PocketRN is a telehealth platform that engages in “whole person clinical care.” It is a flexible, virtual nursing and clinical service application that wraps clinical care around non-medical care in the home. The use a proactive approach by assigning a virtual nurse to each patient who continues to check in with the patient and the family to provide coaching and assistance and to help coordinate care.

“There’s a real reason we use the phrase ‘nurse you back to health’ and not ‘doctor you back to health’. The person that will help follow through is the nurse and PocketRN provides you a one-to-one relationship with a nurse that will follow through with all of your care providers to ensure that you are ‘nursed’ back to health.”

CEO, PocketRN

We will be following this ongoing study and providing updates from the reports we receive.

Kristin Rowan has been working at The Rowan Report since 2008. She is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news .She also has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2025 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Kristin Rowan | Jan 17, 2024 | Admin, Clinical

with Bob Roth, Managing Partner at Cypress HomeCare Solutions

Saving for Long-term Care Starts in High School

What is the primary focus for an 18-year-old? Graduating high school, getting into the college or career training program of their choice, their first apartment, perhaps their first car, and their first adult job are things that come to mind. As the parent of a 20-year-old and a 16-year-old, I can attest to most of these and have encouraged both my kids to plan for them. Of course, the 18-year-olds might tell you they are focusing on spending time with friends, travelling, having fun, “finding” themselves, discovering their passion, and learning how to adult. These are all important as well. I’m sure there are other items you would add to these lists. But, how many of you would put long-term care on that list? How many of you were planning for private pay personal care services when you were 18? I’d guess not many of you.

Bob Roth, Managing Partner at Cypress HomeCare Solutions knows all too well that so many families are ill-prepared for long-term care needs for themselves and their families. In his recent article, “The aging dilemma: Long-term care”, which originally appeared in Jewish News, Roth says we should start planning for long-term care when we graduate high school. Not knowing how to provide and, especially, afford this kind of care is something Bob has seen countless times in his more than 20 years in the industry.

Long-term care can be a critical part of the health care spectrum as we age and long-term care insurance alone in the United States is inadequate. According to Roth, this stark reality prompts a crucial conversation on the state of continuing care here and around the globe. The costs of long-term care are up, the need for quality care threatens economic fallout, and the current models are unsustainable.

According to a recent study from the Joint Center for Housing Studies of Harvard University, most older adults are unable to afford in-home or assisted living care. The number of older adults continues to rise, as does the number of cost-burdened older adults. Cost-burdened older adults pay 30 percent or more of their total household income for housing. When you add in the costs for food, transportation, medicine, etc., there is nothing left for in-home care.1

Neither Bob nor I have answers or solutions to this problem. For many years, we’ve talked about the continuity of care across hospitals, doctors, home health, and home care. (Read our article this week on the patient data exchange network.) Perhaps a trusted exchange framework that includes personal care might one day lead to insurance coverage. In the meantime, we are looking for alternative solutions to the widening gap between people who need in-home care and people who can afford it.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

Bob Roth is Managing Partner of Cypress HomeCare Solutions. Bob assisted in creating Cypress HomeCare Solutions with his family in 1994. With nearly 36 years of consumer products, health care and technology experience, Bob has successfully brought the depth and breadth of his experience to the home care trade and in doing so, Cypress HomeCare Solutions has been honored to receive a number of awards over the years.

He is a well-respected and knowledgeable member of our community.

1. Harvard (2023) Housing America’s Older Adults Key Facts chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.jchs.harvard.edu/sites/default/files/interactive-item/files/Harvard_JCHS_Housing_Americas_Older_Adults_2023_Key_Facts.pdf

• HHCAHPS

• HHCAHPS

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or