by Tim Rowan | Oct 11, 2023 | Product Review

Home Health owners are used to walking tightropes. Indeed, there are many they are forced to walk every year, if not more often. One tightrope is a daily one. It delineates the fine line between regulatory compliance and risking being accused of non-compliance — and Home Health has a lot of regulations.

Owners, CEOs, CFOs, and boards struggle with a policy of spending money to ensure compliance with regulations or risking the expense of fines and payment denials for being found to be out of compliance.

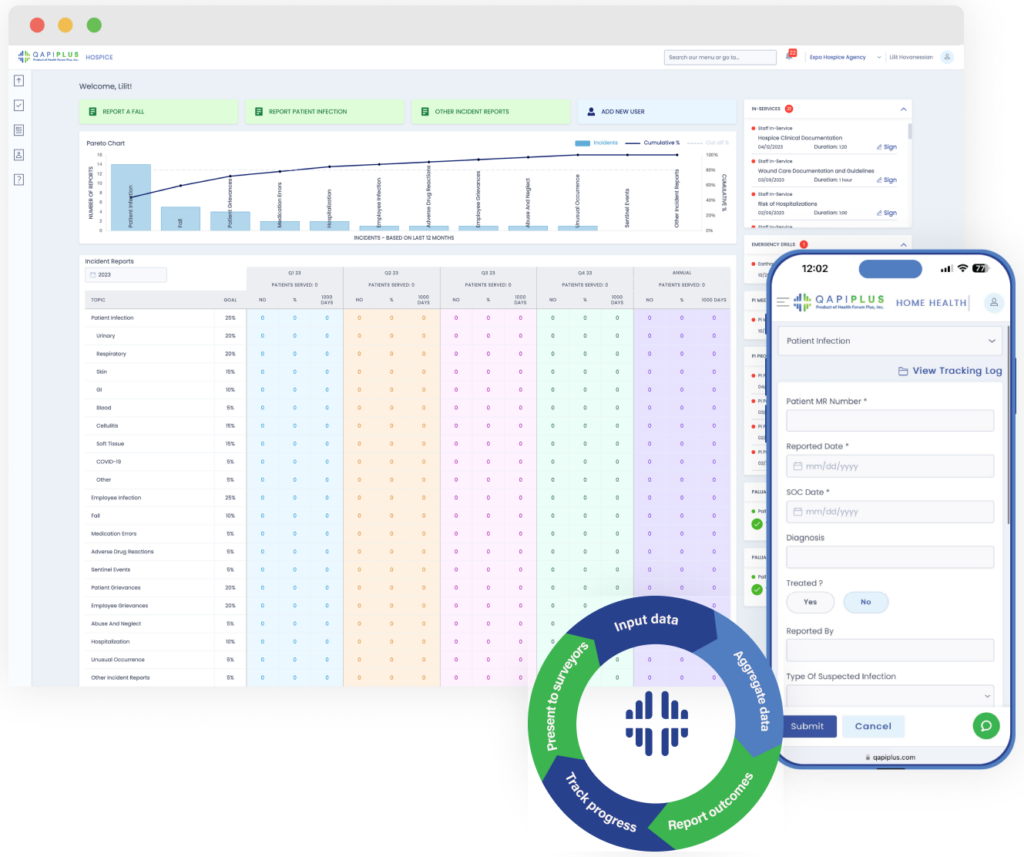

QAPIplus Automates Compliance

There may be a way to widen that tightrope to make it easier to walk. We participated in a product demonstration last week, courtesy of Armine Khudanyan, CEO/Founder, and Lara Koraian, Lead Software Developer, of QAPIPlus. In our view, automating the many processes involved in ensuring compliance should save many times the cost of a product such as this one. To date, however, we are not sure there is another product like this one.

Discussions of strategies to improve compliance occur during team and board meetings. Someone must know all the suspected deficiencies and assemble a meeting agenda. This is the first, and perhaps most important, piece that QAPIPlus automates. By drawing data from nearly every Electronic Medical Records product an HHA might be using, the tool identifies problem areas and creates a complete Quality Improvement meeting agenda, saving hours of work.

Management benefits from a clear, well-organized dashboard that can be customized to display the daily data each person in a position to monitor, flag, or improve compliance needs.

Items the software examines to alert staff about compliance problem areas include:

-

- Gaps in Emergency Management Planning

- Patient Infections

- Employee Infections

- Medication Errors

- Falls

- “Sentinel” events

- Patient Grievances

- Employee Grievances

- Abuse and Neglect

- Hospital Admissions

- Emergency Department Visits

- More

In addition to automating the assembly of meeting agenda items, QAPIPlus also builds in-service curricula. Recommendations for supplemental training can be used by the HHA or Hospice for individual or group training. The company, however, also offers online lessons, enough to cover most educational needs, from OASIS documentation to wound care.

Quick Clinician Training Modules

We were shown examples of 5-minute trainings — perhaps better described as reminders — that nurses like to use immediately before a visit. “For example,” CEO Armine Khudanyan offered, “a nurse knows a particular procedure will be required in the next patient home. He or she knows the procedure but has not done it in a long time. Our 5-minute “brush-up” can be viewed after parking in front of the patient’s home, and the nurse feels more confident going in.”

These lessons can also be given by Directors of Nursing or QA nurses to individuals who have an issue with some one regulation, perhaps a Condition of Participation about patient instructions, or about one OASIS item. Instead of dragging the entire clinical staff to one of those dreaded Saturday classes, the needed lesson is delivered to one person about one problem area.

QAPIPlus is the only quality management software solution to earn CHAP Verification and ACHC Certification for home health and hospice organizations. (The Joint Commission does not have a certification service.)

As is our custom, we rarely ask readers to take our word for it. The QAPIPlus leadership let us share a few quotes:

“I would like to thank you and the QAPIPlus platform for helping us achieve the GOLD seal of approval from The Joint Commission Triennial Survey. The surveyor was impressed with the program and the phone application. We were just cruising with the QAPI and in-service, the quickest and smoothest survey ever. Again, kudos to the team and developers. Such an amazing tool!”

Administrator, St. Agatha Home Health

“I have peace of mind that things are in order and that compliance is less of an issue to be concerned about.”

Director of Nursing, Home Health Agency

“The surveyor looked over the QAPIplus reports for about 15 minutes, and said ‘Okay, perfect. You guys have everything here,’ and that was that.”

Supervisor, Patient Care Services, Home Health Agency

This last comment brings up one final point that the QAPIPlus team said was important to make. “We have heard two types of comments from surveyors,” CEO Khudanyan added. “One is from surveyors who see the dashboard we customized just for them. They call it unique, easy to use, and comment on how much time it saves them to have everything in one place that they usually have to find by searching several applications on the screen and hundreds of papers in drawers. The second comment is from surveyors who walk into an HHA or Hospice after having used QAPIPlus at other agencies. They use words like ‘thank heavens’ when they see that this agency uses it too, knowing how easy their audit is going to be.” She added that it is hard to estimate the value of hosting a happy surveyor.

The Rowan Report rates QAPIPlus “worth serious consideration” for Home Health agencies and Hospices.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2023 by Rowan Consulting Associates, Inc., Colorado Springs, CO. All rights reserved. This article originally appeared in Home Care Technology: The Rowan Report. homecaretechreport.com One copy may be printed for personal use; further reproduction by permission only. editor@homecaretechreport.com

by Tim Rowan | Aug 23, 2023 | CMS, Regulatory

by Tim Rowan, Editor

Home Care Agency Removed Black and Hispanic Home Health Aides from Assignments to Accommodate Racial Preferences of Clients, Federal Agency Charges

There is a question that appears on social media chat pages with great regularity. What does a home care agency do when a client places it in a difficult legal position? The family of a Spanish-speaking grandmother asks for a Spanish-speaking caregiver. An elderly white gentleman insists on a white, English-speaking caregiver.

For agencies across the country, the only reasonable answer to this question is, “I don’t like my choices.” Those choices are to either offend, likely lose, a client, or risk violating Equal Employment Opportunity laws. It is common knowledge that home care clients have ample options should they become disillusioned with their current agency. In this situation, an agency has to choose between confronting a client’s racial bias and risk losing the client, or accommodating a client and losing a federal lawsuit. In other words, here we have the very definition of “no-win.”

With a recent action, the EEOC has put our entire industry on notice which option it expects. On July 31, the federal agency issued a public news release announcing it has filed a lawsuit against a New York agency. Four Seasons Home Care is a licensed personal care agency under a corporate umbrella with sister companies that offer Nursing and Rehabilitation, Certified Home Health, a Dialysis Center, Pharmacy, and an Adult Health Day Care Center. The company was faced with this common dilemma and made a choice of which the EEOC disapproved.

Reaction to the announcement, reprinted verbatim below, has already begun to appear on social media sites, including LinkedIn and home care groups on Facebook. One eloquent comment came from the CEO of an organization that serves an elderly client base made up of elderly people, mostly first-generation, who come from dozens of other countries and speak dozens of languages.

He pointed out that, in a diverse market like New York, it is common for patients and clients to express preference for an aide who can relate to their culture and speak their language. He even mentioned data that shows a connection between culture match and care effectiveness. The reason there has been a push to achieve diversity in the caregiving community expressly for the purpose of culture matching.

What stood out to this writer is that some of the language violates a journalistic rule, specifically the one against revealing the author’s bias within an otherwise facts-only story. In the second paragraph, the phrasing “including by removing Black and Hispanic” caregivers implies that the entire lawsuit is about disadvantaging these two groups. By looking beyond any implied meaning and parsing the language as written, one can see that removing these two specific ethnic groups is part of the accusation, but the writer offers no clue as to whether “part of” means 10 percent or 90 percent of the people discriminated against were Black and Hispanic.

Without this knowledge, one is led to assume that the entire accusation is that Four Seasons discriminated against Black and Hispanic caregivers. However, it is just as possible, based on the vague term “including,” that other ethnic groups were also victims of discrimination. It is just as possible that some Black and Hispanic caregivers were recipients of bonus work hours when assigned to clients who requested a caregiver with their cultural or language backgrounds. Sadly, the bottom line is that the language of the news release does not actually say what it appears to say. We will have to wait for the case to arrive in court to know what percentage of Four Seasons policy discriminated against minorities and what percentage help them.

Complete Announcement From EEOC

NEW YORK — ACARE HHC Inc., doing business as Four Seasons Licensed Home Health Care Agency, a Brooklyn-based company that provides its clients with home health aides, violated federal law by removing aides from their work assignments due to their race and national origin to accommodate client preferences, the U.S. Equal Employment Opportunity Commission (EEOC) charged in a lawsuit filed today.

According to the EEOC’s lawsuit, Four Seasons routinely would accede to racial preferences of patients in making home health aide assignments, including by removing Black and Hispanic home health aides based on clients’ race and national origin-based requests. Those aides would be transferred to a new assignment or, if no other assignment were available, lose their employment completely.

Such alleged conduct violates Title VII of the Civil Rights Act of 1964, which prohibits employers from discriminating against employees on the basis of race and national origin.

The EEOC filed suit, (EEOC v. ACARE HHC d/b/a Four Seasons Licensed Home Health Care, 23-cv-5760), in the U.S. District Court for Eastern District of New York, after first attempting to reach a pre-litigation settlement through the agency’s conciliation process. The EEOC seeks compensatory damages and punitive damages for the affected employees, and injunctive relief to remedy and prevent future discrimination based on employees’ race and national origin.

“Making work assignment decisions based on an employee’s race or national origin is against the law, including when these decisions are grounded in preferences of the employer’s clients,” said Jeffrey Burstein, regional attorney for the EEOC’s New York District Office.

“It is long past the day when employers comply with the discriminatory requests of its clients or customers, to the detriment of its Black and Hispanic workers,” said Timothy Riera, acting director of the New York District Office.

The EEOC’s New York District Office is responsible for processing discrimination charges, administrative enforcement, and the conduct of agency litigation in Connecticut, Maine, Massachusetts, New Hampshire, New York, northern New Jersey, Rhode Island, and Vermont.

More information about race discrimination can be found at eeoc.gov/racecolor-discrimination. More information about national origin discrimination can be found at eeoc.gov/national-origin-discrimination.

The EEOC advances opportunity in the workplace by enforcing federal laws prohibiting employment discrimination. More information is available at eeoc.gov. Stay connected with the latest EEOC news by subscribing to our email updates.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Tim Rowan | Aug 16, 2023 | Admin, Caring for the Caregiver, Clinical, Marketing, Recruitment & Retention

by Tim Rowan, Editor

When Joseph Furtado, RN, COS-C, moved from one Phoenix-area Home Health agency to another earlier this year, he faced a seemingly insurmountable problem. The new place had dropped to a 600 census during the pandemic and got stuck there. Marketers had nurtured strong relationships with referring physicians, but the agency was turning away most of them for lack of nursing staff.

Over a span of 70 days, Furtado hired 60 nurses. As of our conversation this week, none of them have left.

Furtado, the Administrator at MD Home Health told us about his hiring philosophy that helped grow the company’s census to 1,000 and boost it to second largest in the area. “People want to work here because of the way we treat them,” he said. His plan includes several strategies:

- Pay clinicians what they are worth:

- Free up funds for salaries by eliminating marketing positions

- Free up funds for salaries by reducing most training costs

- Reduce training costs by hiring only experienced nurses from other agencies who need little or no training

- Treat clinicians like professionals:

- Center orientation days around presentations about company culture, not nuts and bolts of the job

- Include presentations by top employees

- Include presentations by actual patients, who talk about what the company has done for them

- Eliminate obligatory mass training sessions. Replace them with as-needed meetings with nurse supervisors, sometimes in a patient home, sometimes in a nearby coffee shop.

- The invitation is never “you need to stop doing this wrong” but “may I take you to lunch?”

- Adapt schedule and pay policy to accommodate the needs of the professional

- Replace minimum productivity requirement with mission-driven expectation and rewards

- Replace marketers with a single visit from the administrator:

- We are the best, we will keep your patients out of the hospital, we will not turn away your referral

- Constantly monitor Indeed and other online job sites:

- respond to new job seekers within seconds

- schedule same-day interviews when possible

Favorite Hiring Story

Furtado enjoys telling the story of his favorite hiring win. “I was a few minutes late to call a top-notch, experienced Home Health nurse who showed up on Indeed,” he began. “When I called her, she had just parked her car and was on her way into an interview appointment with another agency. Thinking fast, I said, ‘What do I have to say to stop you from walking in that door?’ She couldn’t believe I was asking her to do that; actually, I couldn’t believe I had said it either. I told her our agency was the best place to work in Arizona and she should get back in her car. I kept her on the phone and said, ‘Let me hear you start your car.’ Then ‘Let me hear you drive away.’ She drove straight to my office and I hired her.

Today, she is our Director of Nursing.

Productivity Without Mandate

He told us that he has heard criticism from peers at various conferences and other meetings for his lack of a visit-per-week requirement. “I use a point system,” he explained to us. “A one-hour visit is one point, an OASIS visit is two, and there are other points for driving distance and other factors. We ask for an average of five points per day, and we pay bonuses when they exceed that. We tell clinicians during an interview that we offer a generous base salary, but that he or she can earn 20 or 30 thousand more than that. By doing that, we achieve two things. We hire an enthusiastic clinician, and we have the luxury of not having to hang onto underperforming nurses out of desperation.

Next Up

Now that MD Home Health has a full clinical staff, Furtado plans to implement a medical scribe system, based on the concept taught to him by his Medicare reimbursement consultant, Michael McGowan, a former CMS OASIS instructor and founding owner of OperaCare. During an OASIS visit, the field nurse consults live on a speaker phone with a QA nurse in the office. There is no computer between the nurse and the patient, and the OASIS is complete, quality checked, and ready to be submitted that day.

“We will make it optional,” Furtado said. “If it works as well as it has for Michael’s other clients, our hope is that more and more OASIS nurses will opt in once they see their co-workers going home at the end of the day with all their documentation already complete.”

©2023 by Rowan Consulting Associates, Inc., Colorado Springs, CO. All rights reserved. This article originally appeared in Home Care Technology: The Rowan Report. homecaretechreport.com One copy may be printed for personal use; further reproduction by permission only. editor@homecaretechreport.com

by Tim Rowan | Aug 9, 2023 | Editorial

analysis by Tim Rowan, Editor

It is good to occasionally remind ourselves that 2023 is the year enrollment in Medicare Advantage reached a full half of Medicare beneficiaries. Originally conceived as a plan to control spending, MA does seem to be achieving that goal.

At what cost, however?

The Medicare trust fund pays insurance companies participating in the MA program a per-patient-per-month fee based on the company’s own declaration of each customer’s health and likely future needs. With those monthly payments, MA companies provide care as needed. Or at least they are supposed to.

Frequently, since the program began, whistleblowers have told the government that employees are rewarded for increasing a patient’s risk-adjustment, the clinical assessment that is supposed to be scored by a physician but is often instead scored through data mining. That practice involves employees searching through patient records, looking for signs of health conditions that would raise their assessment, and thus their value to the insurer. In other words, a class of crime that would earn an HHA a hefty fine if they did it with their OASIS assessments.

Evidence has been mounting lately that these insurance companies not only fudge the numbers to gather more than they should from Medicare, but they also provide as little care as they can get away with. Our industry is familiar with the penny-pinching MA companies practice when authorizing in-home care. The problem is larger than that.

String of Recent Accusations

- The HHS Office of Inspector General issued a report revealing how Elevance, the company formerly known as Anthem, made $5.5 billion in profits in the first six months of this year, a 14.4% jump from the $4.8 billion in profits it made during the same period of 2022. The profits, OIG said, came mostly from denying care to Medicaid beneficiaries, care that their physicians had recommended.

- The largest insurer, with 27 percent of the market, UnitedHealth’s investors were distraught in June when it appeared the company was spending too much on patient care. Their fears were calmed, however, when United reported revenue of $56.3 billion for 2Q 2023, compared to $45.1 billion in the same quarter of 2022.

- Cigna is the target of a class action suit in California, in which it is accused of using an algorithm to deny care, overriding and sometimes ignoring physician recommendations.1

Last October, the New York Times summarized the problem with a list of recent government findings and accusations:

“Kaiser Permanente called doctors in during lunch and after work and urged them to add additional illnesses to the medical records of patients they hadn’t seen in weeks. Doctors who found enough new diagnoses could earn bottles of champagne, or a bonus in their paycheck.

“Elevance Health paid more to doctors who said their patients were sicker. And executives at UnitedHealth Group, the country’s largest insurer, told their workers to mine old medical records for more illnesses — and when they couldn’t find enough, sent them back to try again.

“Each of the strategies — which were described by the Justice Department in lawsuits against the companies — led to diagnoses of serious diseases that might have never existed. But the diagnoses had a lucrative side effect: They let the insurers collect more money from the federal government’s Medicare Advantage program.”

Comparison to Home Health and Hospice

Naturally, these examples reach into the hundreds of billions because MA covers hospital and physician claims, but the comparison to our sector is nevertheless valid.

Since payments to HHAs were first attached to patient assessments a quarter century ago, clinicians have gotten better and better at the task. OASIS assessments are more accurate and thorough than they used to be. Professional coders are more adept at identifying and sequencing appropriate diagnosis codes. AI-assisted tools entering the fray promise an enhanced level of accuracy. (See our product review of the most promising of these tools.)

From the beginning, more accurate assessments have always meant a 10 to 15 percent increase in an agency’s episodic payment over less accurate OASIS scores. Wary of being accused of upcoding, nurses have always been unnecessarily cautious with their intake assessments.

Upcoding Accusations

CMS has always responded to increasing accuracy with accusations of upcoding, even though the Medicare trust fund more often benefits from the above described undercoding habit. Regulatory adaptations have enshrined the fear of upcoding into an assumption that it will happen, with payments slashed in advance just in case it does.

When errors in assessments and claims are discovered by CMS contractors through sampling, the overpayment amount found in the sample is extrapolated to an agency’s entire patient census. The result has at times crossed the line into seven figures, with a payback demand that occasionally cripples the HHA.

Compare this practice to the gift given to MA companies that we revealed in these pages last February: “Government Lets Health Plans That Ripped Off Medicare Keep the Money” In researching that story, we found that CMS typically postpones its duty to audit the risk adjustment figures that MA plans submit annually. After getting more than a decade behind, they decided to write off overpayments to MA plans prior to 2018 and start auditing from that year forward.

As an additional gift they said they would demand repayments only on the amounts turned up in their sample dataset, without extrapolating to each MA’s total patient population as they do with HHAs.

What can one conclude from this comparison? Possibly that CMS is very good at policing millions of dollars but gets overwhelmed and gives up with amounts in the billions.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

1 https://sharylattkisson.com/2023/08/class-action-suit-filed-against-cigna-over-alleged-use-of-algorithm-to-review-reject-patient-claims/

by Tim Rowan | May 17, 2023 | Admin, Regulatory

by Tim Rowan, Editor

T

he Department of Labor, Wage and Hour Division, has selected several southeastern states as targets for its investigation into a practice that appears to be quite common, underpaying in-home caregivers. It appears, based on early DoL reports, that some Home Care agency owners in Alabama, Florida, Georgia, Kentucky, Mississippi, North Carolina, South Carolina and Tennessee either do not understand the law, or simply try to get away with it.

According to a mid-February, 2023 report:

“From 2020 to 2022, Wage and Hour Division investigators identified violations in nearly 89 percent of more than 1,200 home care and nursing care investigations. These reviews led the agency to recover more than $16.2 million in back wages and liquidated damages for more than 13,000 workers.

The department produced an instructional webinar on federal wage and hour regulations for home care, residential care and nursing care industry employers, workers and other stakeholders in the Southeast. “Caring For Those Who Care: Fair Labor Standards Act Requirements in the Care Industry,” is part of the DoL’s ongoing education and enforcement initiative to improve compliance in those states.

On October 13, 2022, the DoL published a Notice of Proposed Rulemaking to revise the Department’s guidance on how to determine who is an employee or independent contractor under the Fair Labor Standards Act. The NPRM proposes to rescind the rule, Independent Contractor Status Under the Fair Labor Standards Act (2021 IC Rule), that was published in the closing days of the previous administration, January 7, 2021, and replace it with an analysis for determining employee or independent contractor status that is more consistent with the FLSA as interpreted by longstanding judicial precedent. The Department believes that its proposed rule would reduce the risk that employees are misclassified as independent contractors, while providing added certainty for businesses that engage (or wish to engage) with individuals who are in business for themselves.

A DoL publication explained this targeted effort aligns with the agency’s initiative to protect essential workers in the Southeast. See an April 28 update on progress of the proposed rule here.

Writing for a Polsinelli Law firm bulletin, home care attorney Angelo Spinola stated, along with the caveat that this is not to be construed as legal advice, “The DOL is not required to give employers prior notice of an audit. In fact, WHD investigators often initiate unannounced investigations to observe normal business operations. As such, the best way to prepare for a DOL audit is to conduct regular and periodic internal audits of employment records and policies to ensure compliance with the FLSA. Internal audits typically include a review of exempt employee classifications, independent contractor classifications, payroll and time records, and FMLA and other leave law compliance. It is advisable to work with knowledgeable employment attorneys who can counsel employers on current wage and hour laws and best practices.”

Abuse Found to be Widespread

From 2020 to 2022, Wage and Hour Division investigators identified violations in nearly 89 percent of more than 1,200 home care and nursing care investigations. These reviews led the agency to recover more than $16.2 million in back wages and liquidated damages for more than 13,000 workers. In addition, the division assessed employers a total of $156,404 in civil money penalties. The February DoL report cited two recent North Carolina cases as examples of the practices it uncovered throughout the South:

Gentle Shepherd Care – which provides home healthcare services in the Charlotte area – failed to combine hours when employees worked at more than one of its locations during the same workweek. By doing so, the employer did not pay the affected workers their additional half-time premium rate for overtime for hours over 40 in a workweek. The Fair Labor Standards Act requires all hours worked in a workweek be combined when calculating wages, regardless of where employees performed the work. Back wages and liquidated damages recovered: $193,768 for 98 workers.

A separate investigation found Greenville”s At Home Personal Care paid employees straight-time rates for all hours worked, including hours over 40 in a workweek. By doing so, the employer did not pay the additional half-time premium rate for overtime as the FLSA requires. In addition, the employer failed to pay for travel time between the clients’ homes when the employees visited multiple clients during the same day. The agency also did not keep accurate records as required. Back wages and liquidated damages recovered: $187,148 for 28 workers.

North Carolina Wage and Hour Division District Director Richard Blaylock stated, “Workers who provide home healthcare services deserve to be paid every penny of their hard-earned wages as they care for our loved ones. When employers choose to ignore the law, they deny workers the wages they earned and need to support their families. Employers must use this investigation’s outcome as a reminder to review their pay practices to ensure they comply with the law.”

Employers can contact the Wage and Hour Division at its toll-free number, 1-866-4-US-WAGE. The division also offers online resources for employers, such as a fact sheet on Fair Labor Standards Act wage laws overtime requirements. Workers who feel they may not be getting the wages they earned may contact a Wage and Hour Division representative in their state through a list and interactive online map on the agency’s website. Workers and employers alike can help ensure hours worked and pay are accurate by downloading the department’s Android Timesheet App for free. Learn more about Wage and Hour Division.

My former colleagues in the health insurance industry claim they are waiving all costs of testing and treatment for COVID-19. This is a lie.

My former colleagues in the health insurance industry claim they are waiving all costs of testing and treatment for COVID-19. This is a lie.