UnitedHealth Group Publicity Stunt

CMSby Kristin Rowan, Editor

UnitedHealth Group Publicity Stunt

How to Distract the Public: 101

When customers and regulatory bodies start to complain about company practices, reputation management usually gets involved. An internal or external public relations, crisis communication, and/or reputation management specialist advises the company on how to overcome negative press.

Transparency & Action

When Dominos Pizza employees recorded a disturbing “hoax” video, the CEO went to the same medium (YouTube) to address the video, apologize, and reassure customers. This issue was handled so well that it is used as a teaching tool in PR classes.

In 1982, when a couple tampered with bottles of Tylenol in Chicago and seven people died, parent company Johnson & Johnson stopped advertising, recalled 31 million bottles across the country, switched to tamper-proof packaging, and personally communicated with 450,000 retailers.

Subterfuge, Smoke & Mirrors

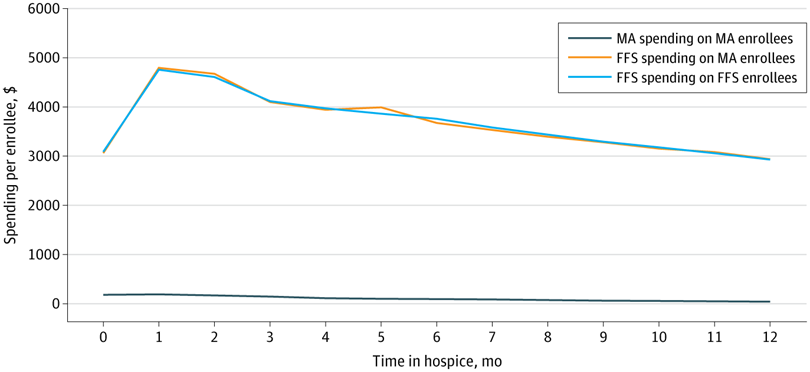

Last week, when UnitedHealth Group, already under investigation for bribing nurses, wrongful death, and Medicare Advantage billing fraud, was called to testify before House committees about their record-high premiums, rising claims denials, and unneccessary waiting over prior approvals, UHG CEO prepared a written statement to read to the Energy & Commmerce Committee that included blaming hospital costs, pricing differences, frequency of testing, drug prices, and pharmaceutical advertising for higher premium rates; extolling the virtues of Medicare Advantage over Traditional Medicare, using incorrect and misleading information; and casually mentioning that they will “voluntarily eliminate and rebate our profits” for their ACA customers.

Gesture too Small to be Meaningful

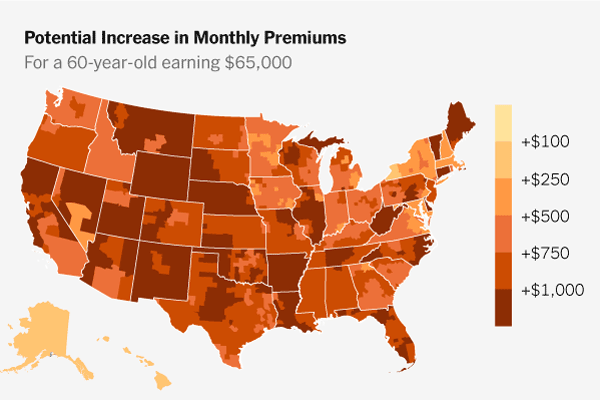

The months long Congressional stand-off on healthcare premium subsidies continues. Affordable Care Act participants saw healthcare premiums jump over night when the subsidies expired. (Mine went up 400%).

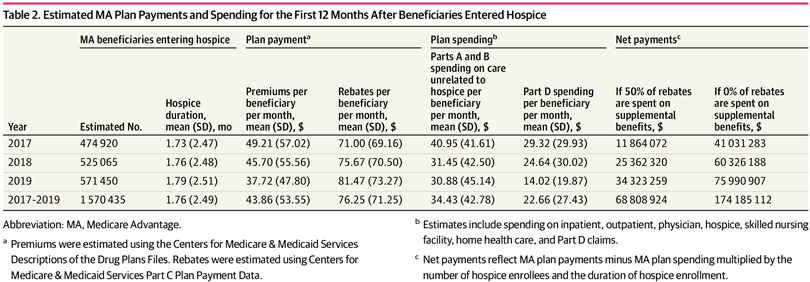

In 2025, UnitedHealth recorded $12.1 billion in profit. But, that profit is spread out over nearly 3,000 wholly owned subsidiaries who take almost 30% of what UHG pays out in care costs. The company has increased its Medical Loss Ratio to 87% by hiring their own subsidiaries to engage in “quality improvement,” virtually eliminating ACA profit.

Of its 50 million subscribers, only about 1 million are ACA customers. Even if the company returns the ACA profits, it will return 1/50th of its profits and keep the rest. In their third quarter earnings call, UHG said it expected 2026 enrollment to be 1/3 of that in 2025. The 2026 outlook estimates an overall increase in profit to more than $14 billion, most of which will never find its way back to ACA participants.

The Truth Behind the Curtain

On January 27, 2026, just one week after the profit-sharing announcement, UnitedHealth Goup addressed shareholders in its Q4 and 2025 Earnings Call. During that call, newly appointed UnitedHealthcare CEO Tim Noel said:

“Nearly all of our employer Group and fully insured pricing align with continued increases in care activity for 2026. In the Individual ACA market, we repriced nearly all states in response to higher medical trends and the elevated needs of ACA beneficiaries in 2025…. These actions should expand operating earnings margins for UnitedHealthcare by 40 basis points, and are expected to result in membership contraction of 2.3 to 2.8 million.”

Other statements during the call reinforced the company’s drive toward profit.

They are focusing attention in markets where they have “complimentary wrap-around services” already in place. Which means they have owned subsidiaries to shift money to instead of lowering premium rates. Additionally, they have “narrowed [their] affiliated network…with the goal of having a more optimal alignment of physicians….”

New Speak

Throughout the earnings call, company spokespeople used terms like repositioned, streamlined, aligned, membership contraction, and repriced. They carefully avoided saying that they dropped physician services outside those they owned, removed plans that paid out too much, consolidated businesses to increase profits, lost millions of members due to price increases and other plan problems, and raised prices across the board, even on plans that were already profitable.

Final Thoughts

UHG CEO Hemsley made a few statements to Congress I agree with. Drug prices are too high. Hospital and Ambulance prices are too high. Pharmaceutical companies advertise too much and use the cost to offset tax liability.

There were also some statements Hemsley almost got right.

- He said small businesses should be allowed to join AHPs with fewer restrictions. There should be no restrictions on industry or geography.

- He said HSA thresholds should be lowered for HDHPs. HSAs should be available to everyone, regardless of plan, deductible, payer, or whether they are on a group, individual, or ACA plan.

- Hemsley thinks broker compensation should be standardized in the ACA market. If payers want broker compensation, standardized or not, ACA or Medicare Advantage, the compensation should come from the payer and not be included in premiums.

- He wants consumers to have expanded access to catastrophic plans and to allow the use of premium tax credits. All plans and payers should be available to everyone, everywhere. Increasing competition in plans and players will drive down costs.

I applaud Congress for bringing the large payers in to discuss exhorbitant premium rates, but I’m still waiting on them to take action based on the information they received.

# # #

Kristin Rowan is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news. She is also a sought-after speaker on Artificial Intelligence, Technology Adoption and Lone Worker Safety. She is available to speak at state and national conferences as well as software user-group meetings.

Kristin also runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. She works with care at home software providers to create dynamic content that increases conversions for direct e-mail, social media, and websites. Connect with Kristin directly at kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2026 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com