Enhabit Sells Out to PE

M&Aby Kristin Rowan, Editor

Enhabit Sells Out to PE

Kinderhook proposes billion dollar deal

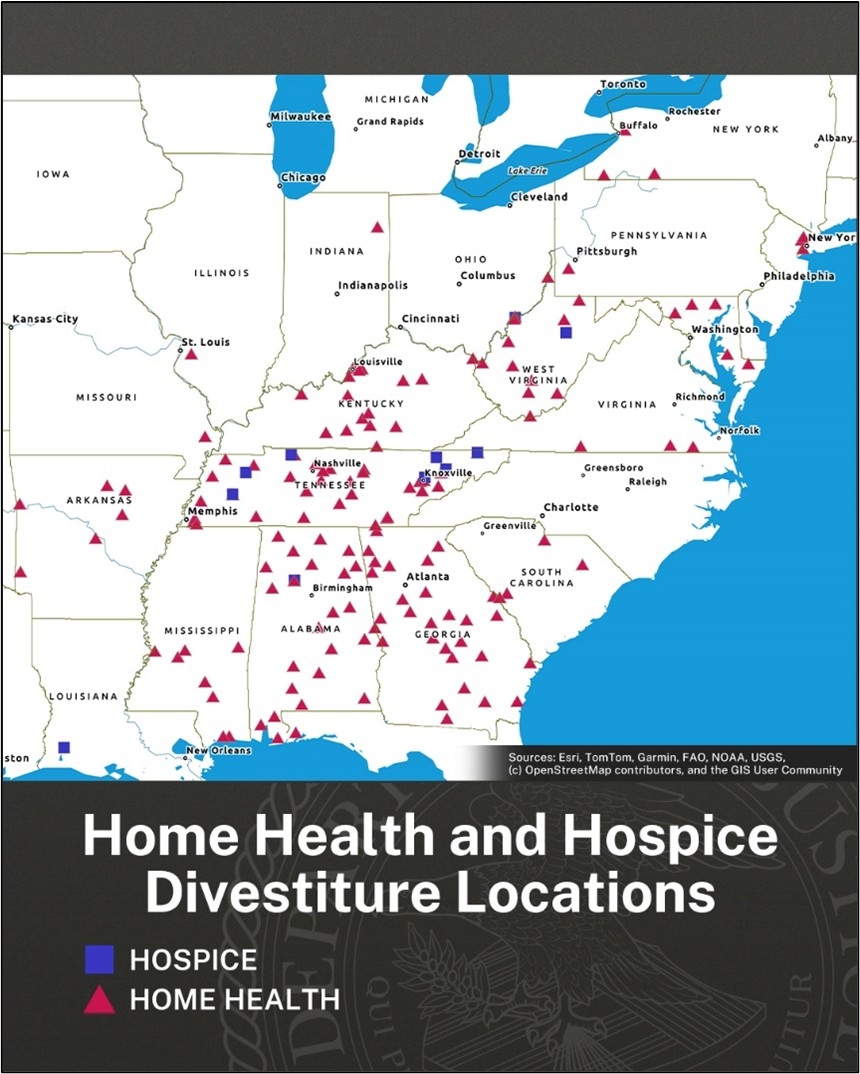

Enhabit Home Health & Hospice announced this week they agreed to be acquired by Private Equity company Kinderhook industries. Enhabit has 247 home health and 115 hospice locations across 34 states. Stockholders will receive $13.80 per share from the publicly traded company after the acquisition is final and the company will longer be listed on the stock exchange. The stock buyout is reportedly just shy of 25% more than the stock value as of the close of business on February 20th.

Enhabit History

Enhabit made headlines in 2025 and again earlier in February surrounding its lawsuit against Chris Walker, Vistria Group, and Nautic Partners. In 2024, Encompass and Enhabit sued the parties for breach of duty when the principles involved created VitalCaring while still serving as senior officers for Enhabit. Enhabit, the former home health and hospice division of Encompass Health, collected $43 million in attorneys’ fees and mitigation damages on February 12, 2026.

Enhabit’s registered mission is A Better Way to Care®. The company purpose is to provide high-quality, compassionate care to every patient. Their core values and fundamental beliefs guide their behaviors and actions.

Deciding to Sell Out

“Following a thorough evaluation and extensive deliberations in consultation with our independent advisors, we are pleased to reach this agreement with Kinderhook. The Board evaluated the current state of the business, its outlook and opportunities, and is confident this transaction maximizes value for our stockholders and is in their best interest.”

CEO Barb Jacobsmeyer said the agreement is a “terrific outcome” for stockholders, clinicians, caregivers, patients, and families, citing resources and expertise that will come from Kinderhook. Meanwhile, Chris Michalik, Managing Director at Kinderhook said the company admires Enhabit’s leadership, patient-centered culture, and strong market position.

Pending Approval

Enhabit’s Board of Directors unanimously approved the acquisition. However, the deal still awaits approval from stockholders and regulatory bodies. Enhabit has scheduled a special meeting of stockholders for the vote. In conjunction with the SEC filing, some Enhabit executive officers filed a customary voting and support agreement, meaning they have granted proxy voting rights to Kinderhook. It is almost certain the acquisition will be approved by both companies. Only the regulatory approval is unknown.

# # #

Kristin Rowan is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news. She is also a sought-after speaker on Artificial Intelligence, Technology Adoption and Lone Worker Safety. She is available to speak at state and national conferences as well as software user-group meetings.

Kristin also runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. She works with care at home software providers to create dynamic content that increases conversions for direct e-mail, social media, and websites. Connect with Kristin directly at kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2026 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com