MedPAC Finalizes Recommendation to CMS

Advocacyby Kristin Rowan, Editor

MedPAC Recommends 7% Cut

Vote Finalized

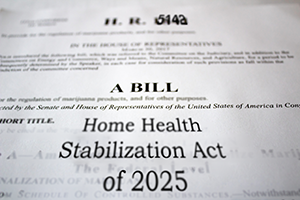

In December, MedPAC published a proposed recommendation for calendar year 2027 that included a 7% cut to home health reimbursement rates and no increase for hospice. Last week, MedPAC voted to finalize that recommendation and send it to CMS.

Industry Objection

Both the proposal and final recommendation met with strong industry backlash.

“MedPAC’s dangerous and misguided recommendations to reduce the Medicare home health base payment rate by 7% for CY 2027 and eliminate the update to the 2026 Medicare base payment rate for hospice do not reflect both home health and hospice agencies’ operating realities as well as the cumulative impact of recent policy changes. For home health agencies, any cut – let alone one of such great magnitude – will threaten the ability to meet individuals’ healthcare needs. Yet again, the Commission is failing to understand the operating reality providers face and the potential patient harm that any further payment cuts pose.”

Consistently Wrong

The MedPAC recommendation may not be built on solid data, use accurate calculations, consider Medicare Advantage and Medicaid rates along with Traditional Medicare FFS, consider the number of agencies that will go out of business, have any recommendations for maintaining nurse and caregiver hourly rates, or fairly distribute Medicare funds across disciplines, but, wait…where was I going with this? Oh, right! At least they’re consistent. MedPAC recommended a 7% decrease in Medicare payments for 2027, 2026, 2025, 2024, and 2023. They may be completely wrong, but they are dedicated to maintaining their wrongness.

Final Thoughts

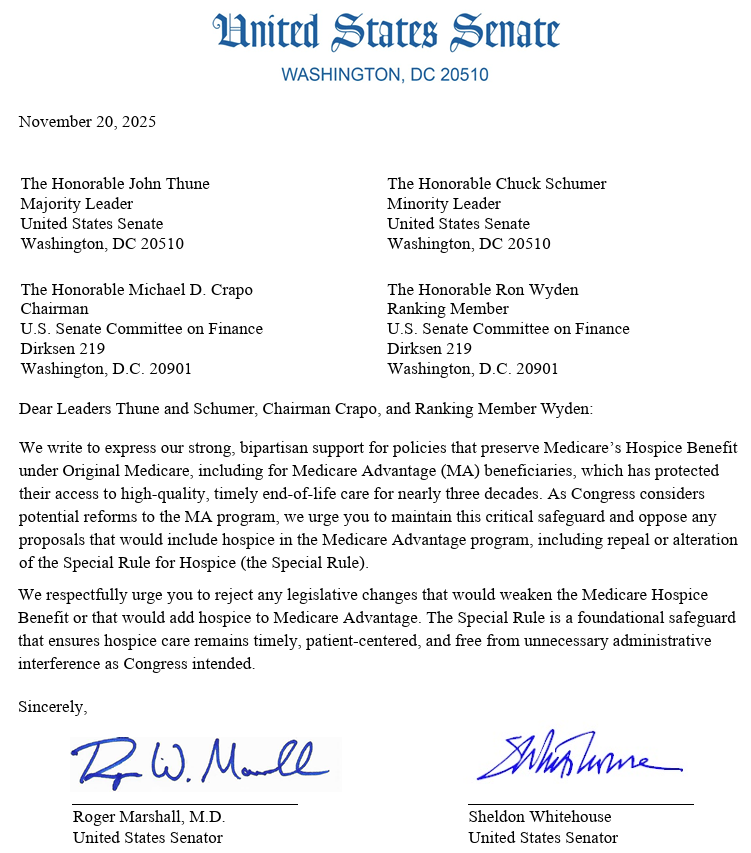

Despite the years of 7% cut recommendations from MedPAC, the final numbers from CMS are rarely in line with those recommendations. We will, of course, know more when CMS publishes their proposal later this year. LeadingAge, National Association for Care at Home, individual and corporate HHAs and Hospices, and anyone else with a stake in the care at home industry, should contact their congressional representatives and CMS directly to voice concerns over these cuts.

# # #

Kristin Rowan is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news. She is also a sought-after speaker on Artificial Intelligence, Technology Adoption and Lone Worker Safety. She is available to speak at state and national conferences as well as software user-group meetings.

Kristin also runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. She works with care at home software providers to create dynamic content that increases conversions for direct e-mail, social media, and websites. Connect with Kristin directly at kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2026 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com