by Kristin Rowan | Aug 16, 2024 | CMS, Editorial, Marketing, Medicare Advantage, Regulatory

Leading Associations Attempt to Curb Medicare Advantage Marketing Practices that Prey on the Unsuspecting

For some time now, we’ve been reporting on the marketing practices that Medicare Advantage uses to lure new members. And, it’s working, as more than 50% of eligible patients are now on Medicare Advantage plans. From federal lawsuits to fraud, to upcoding, Medicare Advantage has made headlines more often than almost any other topic in the industry in the last few years. A joint move last week by two national associations may bring the issue to a head once and for all.

The National PACE Association (NPA) and LeadingAge wrote to the Centers for Medicare and Medicaid Services (CMS) urging them to employ stricter oversight on Medicare Advantage marketing practices. The letter, dated July 25, 2024, cited the impact of these marketing tactics on adults served by Programs for All-Inclusive Care for the Elderly (PACE). They called the marketing “aggressive and misleading” and called upon CMS to protect PACE beneficiaries from harm.

One of the selling points in the marketing of Medicare Advantage is the supplemental benefits. Medicare Advantage plans are allocated nearly $64 billion dollars to pay for dental, vision, gym memberships, and other benefits that are not available with traditional Medicare. However, the government has no idea where this money is going, who is using it, and what it’s for. Limited available data suggests that a very low number of Medicare Advantage enrollees are using these supplemental benefits. The rest of the money just sits with the payers at taxpayer expense.

The false promise of cash benefits draw even more of this population away from traditional Medicare and into Medicare Advantage plans. Cash benefits from MA plans are only available to dual eligible members. What they don’t tell you, though, is that if you are dual eligible and you switch from Medicare to Medicare Advantage, you are subject to prior authorization rules, care denials, and smaller networks, meaning you may lose your physician when you switch plans. Some of those cash benefits are restricted to use in particular stores. For example, Aetna restricts the use of cash benefits to stores owned by CVS Health. If there isn’t a CVS Health near you, the cash benefits can’t be used.

Programs of All-Inclusive Care for the Elderly (PACE) are typically traditional Medicare and Medicaid joint programs that provide medical and social services in home and community-based care settings. The programs cover prescriptions, dental care, emergency services, home care, meals services, primary care providers, nurses, social workers, and more. The program’s goal is to keep patients at home or in their communities and get the health care they need. There is no out-of-pocket costs to these programs for dual eligible members. Medicare only members have a monthly premium and prescription drug (Part D) premium. There are no additional deductibles or copayments for any service or level of care.

The marketing messages from Medicare Advantage are pulling PACE eligible members into dual MA and Medicaid plans, which significantly reduce the level of care, access to care, and continuity of care. The MA/Medicaid programs also have higher out-of-pocket costs to members, despite having no monthly premium. Research shows that Medicare Advantage is targeting healthier individuals who will use the provided benefits less often and that when Medicare Advantage patients become sicker, they switch back to traditional Medicare plans if they can.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

The financial and health implications of uninformed disenrollment from PACE to conventional MA plans are significant. The needs of PACE beneficiaries, most of whom have multiple complex medical conditions, cognitive or functional impairments – or all three – are not comprehensively addressed by MA plans. The loss of PACE services is harmful and, in some cases, can be life-threatening.

The financial and health implications of uninformed disenrollment from PACE to conventional MA plans are significant. The needs of PACE beneficiaries, most of whom have multiple complex medical conditions, cognitive or functional impairments – or all three – are not comprehensively addressed by MA plans. The loss of PACE services is harmful and, in some cases, can be life-threatening.

president and CEO, LeadingAge

In their letter to CMS, NPA and LeadingAge called for the following changes to be made:

- Require MA plans to explain, clearly and without embellishment, all out-of-pocket costs and network/coverage limitations. using easy to understand terms

- When a member disenrolls from a PACE program, additional steps should be taken to ensure the disenrollment is voluntary and that the member is fully informed of the differences in coverage before leaving the PACE program.

- Increased leniency in re-enrolling in PACE programs after leaving a Medicare Advantage program by allowing re-enrollment mid-month.

- Require MA brokers, when providing comparative benefit information of their current coverage (e.g., PACE) to an alternate MA plan, to also inform them, in plain language, if the new plan does not cover or coordinate their Medicaid benefits; and any benefits the individual would “lose” under the new plan (e.g., transportation to groceries).

We share CMS’ stated desire that people have access to accurate and complete information when they make health care choices. We have numerous examples of vulnerable seniors being induced to enroll in MA plans without being fully-informed of what they are giving up when they enroll.

We share CMS’ stated desire that people have access to accurate and complete information when they make health care choices. We have numerous examples of vulnerable seniors being induced to enroll in MA plans without being fully-informed of what they are giving up when they enroll.

president and CEO, National PACE Association

The Rowan Report reached out to LeadingAge to see if CMS has responded to their letter.

Updates will be provided when we have them.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Kristin Rowan | Aug 1, 2024 | CMS, Hospice, Regulatory

2025 Hospice Final Rule Update

On July 30, 2024, CMS issued its final rule for the 2025 Hospice Final Rule Update (CMS-1810-F), with updates to HQRP and HOPE. The rule also finalizes a proposal to change the statistical area delineations. This will impact the hospice wage index. The rule includes clarifications on the hospice election statement and notice of election as well as clarifying language around hospice admission and certification of terminal illness.

Wage Decrease for Some Hospices Assigned to a New Area

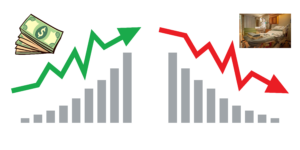

The change in area delineations will have a negative impact on some hospices. They will see a decrease in payments based on their new area. However, CMS emphasizes that, regardless of the area change, the maximum change is a 5% decrease from the 2024 wage index, as there is a 5% cap on any decrease to the wage index.

2025 Hospice Final Rule Routine Annual Rate Setting Changes

Just one month after proposing additional deduction to the home health payment rate, the 2025 hospice final rule increases the base rate by 2.9%. This is an aggregate of a 3.4% inpatient hospital increase and a 0.5% productivity decrease. The quality data reporting requirement remains. Hospices that do not submit quality data would still see a 4% decrease in payment rates, yielding an aggregate 1.1% decrease. The payment update also includes an aggregate cap of $34,465.34 per individual per year.

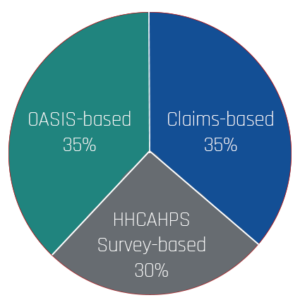

Hospice Quality Reporting Program (HQRP)

The new rule includes two new process measures to HQRP:

-

- Timely Follow-up for Pain Impact

- Timely Follow-up for Non-Pain Symptom Impact

These two measures are expected to begin in 2028 and address hopsice care delivery documentation on whether a follow-up visit occurred with 48 hours of the first assessment. The measures include visits where there was an impact of moderate to severe symptoms, both with and without pain.

Adoption and Implementation of HOPE

Hospice Outcomes and Patient Evaluation (HOPE) will replace the current Hospice Item Set (HIS) structure. The gradual roll-out will begin in FY 2025 and will collect data at different time points throughout a hospice stay. In contrast, HIS only collected data at admission and discharge.

New or expanded categories of HOPE relative to HIS include:

CMS conducted an experiment in 2021 surrounding the Hospice CAHPS Survey. Based on those results, the final rule will implement these change to the survey:

-

- The addition of a web-mail mode (email invitation to a web survey, with mail follow-up to non-responders).

- A shortened and simplified survey.

- Modifications to survey administration protocols to include a pre-notification letter and extension of the field period from 42 to 49 days.

- The addition of a new, two-item Care Preferences measure.

- Revisions to the existing Hospice Team Communication measure and the existing Getting Hospice Care Training measure.

- The removal of three nursing home items and additional survey items impacted by other proposed changes in this rule.

Hospice Special Focus Program (SFP)

The SFP allows CMS to monitor those hospices that are identified as poor performers based on quality indicators from the CAHPS surveys. Additional oversight from CMS will “enable continuous improvement” for those hospices identified. The four measures used to determine poor performance are Help for Pain and Symptoms, Getting Timely Help, Willingness to Recommend this Hospice, and Overall Rating of this Hospice.

According to CMS, the final rule includes changes to the Overall Rating of this Hospice measure. CMS states that these changes are not substantive and will not impact the SFP algorithm. “CMS adjusts measure scores for mode of survey administrations, so the introduction of a new mode should not impact measure scores.”

NAHC previously submitted comments to CMS stating that some aspects of the Hospice Special Focus Program are flawed and need to be adjusted for accuracy and fairness. NAHC/NHPCO has created a research project to understand the impact and validity of the Hospice Special Focus Program.

2025 Hospice Final Rule Conditions of Participation and Payment Requirements

There are language discrepancies in existing hospice requirements for medical director and physician designee, physician member, and payment requirements for the certification of the terminal illness and admission to hospice care. Therefore, CMS is making technical changes to the CoPs by adding the physician mmever of the hospice IDG as someone who can review technical information and provide certification of life expectancy.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Elizabeth E. Hogue, Esq. | Aug 1, 2024 | Clinical

by Elizabeth E. Hogue, Esq.

What do Managed Care Plans Really Want from Providers of Services to Patients in Their Homes?

Medicare Managed Care Plans have a long history of disinterest in provision of services to patients in their homes. Despite the fact that they are mandated to provide the same services that enrollees in Medicare fee-for-services receive, they just haven’t done it. Common practices among Plans of draconian, untimely preauthorization processes and doling out authorizations for visits a few at a time make it clear that Plans have seen no real value in services to patients at home.

Plans, of course, should have been very interested in services at home. These services save money and keep patients at home where they want to be. Services at home are just generally a beautiful thing!

At the same time, it’s fair to say that the Office of Inspector General (OIG) of the U.S. Department of Health and Human Services (HHS), the primary enforcer of fraud and abuse prohibitions, has Medicare Managed Care Plans in its crosshairs. A key area of concern for the OIG is that Medicare Managed Care Plans make visits to patients in their homes looking for additional diagnoses so that the Plans will receive more money per patient. The OIG is especially critical of this practice because review of medical records of patients who received visits at homes and whose acuity increased as a result never received any care for these new diagnoses.

Managed Care Plans in the News

The Wall Street Journal recently reported that between 2018 and 2021 Plans received $50 billion for diagnoses added to members’ charts, at least some of which resulted from visits to patients in their homes.

After years of disinterest, Plans are now quite interested in at home services. Is it possible that Plans’ newfound interest is related to a desire to increase revenue through home visits? It appears so. Take, for example, comments by the CEO of UnitedHealth Group, Andrew Witty, during an investment call on July 16, 2024.

Managed Care Plan Responds

UnitedHealth Group CEO Andrew Witty

Mr. Witty reported to investors that staff made more than 2.5 million home health visits to Plan members in 2023. “As a direct result, our clinicians identified 300,000 seniors with emergent health needs that may have otherwise gone undiagnosed,” Mr. Witty said. “They connected more than 500,000 seniors to essential resources to help them with unaddressed needs.”

Former UnitedHealth employees told The Wall Street Journal that home visits were used to add diagnoses to patients’ records. They said that clinicians used software during visits that offered suggestions about what illnesses patients might have.

It now looks like it’s possible that at-home care is being hijacked by Medicare Advantage Plans to help Plans engage in practices that the OIG views as questionable.

Elizabeth Hogue is an attorney in private practice with extensive experience in health care. She represents clients across the U.S., including professional associations, managed care providers, hospitals, long-term care facilities, home health agencies, durable medical equipment companies, and hospices.

©2024 Elizabeth E. Hogue, Esq. All rights reserved.

No portion of this material may be reproduced in any form without the advance written permission of the author.

by Tim Rowan | Jul 26, 2024 | CMS, Editorial, Medicare Advantage, Regulatory

by Tim Rowan, Editor Emeritus

For at least the last five years, every Home Health conference this reporter has attended has featured at least one keynote speaker or expert panelist complaining about sparse and shrinking payments from Medicare Advantage plans. As thousands of seasonal TV ads convince more and more Medicare beneficiaries to enroll in what insurance company executive-turned-whistleblower Wendell Potter called “neither Medicare nor an advantage,” the calls from Home Health executives to turn away MA members, following the lead of many hospitals, have grown louder and more frequent.

Originally designed to extend the lifespan of the Medicare Trust Fund by bringing managed care practices to the federal healthcare program for seniors and disabled, Medicare Advantage has failed to do so. As long ago as 2021, an exposé by Fred Schulte in Kaiser Family Foundation Health News found that MA costs to taxpayers began to explode in 2018 and today equal 119 percent of what traditional Medicare should cost. We looked at more recent studies and found similar reports.

Referencing a study by Richard Kronick, a former federal health policy researcher and a professor at the University of California-San Diego, Schulte said, “his analysis of newly released Medicare Advantage billing data estimates that Medicare overpaid the private health plans by more than $106 billion from 2010 through 2019 because of the way the private plans charge for sicker patients. A third of that overpayment occurred in 2018 and 2019.”

Since Kronick’s 2021 report, more beneficiaries have opted in to Medicare Advantage. So far, just over half have switched from straight Medicare, with or without a supplement, and that number may reach 100 percent if those who profit most from the option have their way.

In recent months, we have investigated and reported on the insurance industry’s practice of

exaggerating MA member health conditions and denying care that traditional Medicare would have covered, collecting from both ends of the CMS trough. We have also mentioned several federal and state lawsuits piling up against insurance companies for both of those practices. One of our sources, The Center for Economic and Policy Research, said this in the Executive Summary of its detailed, September 2023

study:

Profiting at the Expense of Seniors: The Financialization of Home Health Care

“The nonpartisan Medicare Payment Advisory Commission (MedPAC) estimates that upcoding by MA plans that make enrollees appear to be sicker than they are costs CMS 106 percent of what traditional Medicare costs; adding in the quality bonus payments brings it to 108 percent. MA plans also enroll healthier Medicare beneficiaries, increasing their operating surplus by another 11 percent, making the payments to MA plans 19 percent higher than the payments to traditional Medicare.

CMS’s announced goal for traditional Medicare beneficiaries is to move all of them to Accountable Care Organizations, which use the valued-based payment model, or other similar care arrangements, by 2030. CMS’s leading model to accomplish this shift is ACO REACH — a gentler, kinder version of the Trump administration’s backdoor enrollment of traditional Medicare beneficiaries in a capitated payment model.”

The Center for Economic Policy Research

Depending on results in the unpredictable world of politics later this year, CMS may or may not see its shift to value-based ACO models come to fruition. Kaiser News‘ Schulte examined the Heritage Foundation’s “Project 2025,” the conservative think tank’s blueprint for any possible future Republican administration, and found an entire section on the Department of Health and Human Services.

Within its “Mandate for Leadership,” the authors identify Medicare and Medicaid as “the principal drivers of our $31 trillion national debt.” While admitting that Medicare and Medicaid “help many,” the authors assert that the programs “operate as runaway entitlements that stifle medical innovation, encourage fraud, and impede cost containment, in addition to which their fiscal future is in peril.”

Commenting on the Heritage Foundation’s claim, researcher Sonali Kolhatkar, writing for “OtherWords.org,” counters that this opinion is often used to justify ending social programs, but actual CMS data indicates that per person Medicare spending has plateaued for more than a decade and represents one of the greatest reductions to the federal debt. Even with 10,000 to 11,000 Boomers reaching Medicare eligibility every day, total per beneficiary expenditures have stopped climbing, hovering around $12,000 per year since 2010. Before reaching that 2010 plateau, per beneficiary spending had steadily risen from $2,000 at the program’s 1965 inception.

Medicare Advantage for All

Project 2025 proposes making Medicare Advantage the default enrollment option rather than a choice beneficiaries can opt into. With 100 percent of seniors on MA plans, already historic insurance profits will skyrocket further. But will Medicare beneficiaries benefit as well?

The Center for Economic and Policy Research cites multiple lawsuits that have proven eight of the ten largest MA plans routinely add chronic conditions – some non-existent – to patient assessments at enrollment…or later. We reported recently that UnitedHealth Group, operator of the largest MA plan, recently began sending nurses into homes to search for additional health conditions that would raise company payments from the trust fund. The report we quoted included evidence that these home visit upcodes do not lead to any treatments. The Center added that MA’s “heavily restricted networks damage one’s choice of provider along with introducing dangerous delays and denials of necessary care.”

As we have mentioned before, Medicare Advantage is neither Medicare nor an Advantage.

Project 2025 also proposes restrictions on Medicaid eligibility by imposing work requirements. The blueprint sees the program for low-income Americans as a “cumbersome, complicated, and unaffordable burden on nearly every state.” Their plan includes bringing private insurance companies in to “manage” care.

A June, 2024 report by the Center on Budget and Policy Priorities concluded that the ACA’s expansion of Medicaid helped millions of Americans who would otherwise be uninsured, and that its enabling and encouragement of preventive care actually saved money in state budgets. Last month’s report asserted “the people who gained coverage have grown healthier and more financially secure, while long-standing racial inequities in health outcomes, coverage, and access to care have shrunk.”

Project 2025 authors make no mention of a KFF News report from April 2023 that said most Medicaid-eligible people are already working. Nor does it take into account a Government Accountability Office report to Congress October 2020 and again in 2023 that determined that hourly wages in many large companies are low enough to keep even full-time workers eligible for Medicaid and SNAP. Walmart and McDonalds, to name two, land in the top five in almost every state for having Medicaid-eligible workers.

EVEN THE WALL STREET JOURNAL IS CRITICAL

Under the front page Headline “Medicare paid $50 billion to insurers for untreated ills,” a detailed WSJ investigation highlighted a number of findings, including:

- “The questionable diagnoses included some for potentially deadly illnesses, such as AIDS, for which patients received no subsequent care, and for conditions people couldn’t possibly have, the analysis showed. Often, neither the patients nor their doctors had any idea.”

- “Instead of saving taxpayers money, Medicare Advantage has added tens of billions of dollars in costs, researchers and some government officials have said.”

- “Medicare Advantage has cost the government an extra $591 billion over the past 18 years, compared with what Medicare would have cost without the help of the private plans, according to a March report of the Medicare Payment Advisory Commission, or MedPAC, a nonpartisan agency that advises Congress. Adjusted for inflation, that amounts to $4,300 per U.S. tax filer.”

- “The Journal reviewed the Medicare data under an agreement with the federal government. The data doesn’t include patients’ names, but covers details of doctor visits, hospital stays, prescriptions and other care.”

Now it is in the Hands of Voters

Home Health, Hospice, and Home Care owners, management, and workers will be voting in November. Consideration of what four years under a Project 2025-friendly administration will mean to businesses dependent on Medicare and Medicare will weigh heavily on their minds as they enter their polling booths.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Tim Rowan | Jul 19, 2024 | Admin, Editorial, Medicare Advantage

by Tim Rowan, Editor Emeritus

UnitedHealth Making Home Health Visits

Payer or Competitor…that is the question. According to a report in the Wall Street Journal, and questioned by the insurance industry’s lobbying arm, AHIP, UnitedHealth Group has increased its revenue from the Medicare Trust Fund by $50 billion by “finding” additional health issues during home visits to its MA customers.

In a July 16 investor call, CEO Andrew Witty said UnitedHealth clinicians made more than 2.5 million home health visits to UnitedHealthcare MA members in 2023. Following these visits to more than 500,000 seniors, UnitedHealth upgraded over 300,000 of them to higher payment levels by uncovering health conditions the individual seniors did not know they had.

The WSJ investigation found that between 2018 and 2021, insurers received $50 billion for diagnoses they added to members’ charts. Many of these diagnoses were “questionable,” according to that investigation.

Though a UnitedHealth spokesperson called the analysis “inaccurate and biased,” former UnitedHealth employees told the Journal home visits are often used to add diagnoses. Clinicians say they use software during visits that offer suggestions as to what illnesses a patient might have.

CEO Witty maintained in the investor call that the practice is good for seniors. “UnitedHealth clinicians discovered more than 3 million gaps in care through home visits in 2023,” he reported, “and 75% of patients receive follow-up care in a clinic within 90 days of a home visit.”

He added that the United home visit program “helps patients live healthier lives and saves taxpayers money,” concluding. “…Medicare Advantage makes programs and results like this possible.”

The Journal concluded with the finding that few of these upgraded seniors are ever seen by a physician for their newly discovered health conditions.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Kristin Rowan | Jul 12, 2024 | Advocacy, CMS, Regulatory

“A government agency must conform to any clear legislative statements when interpreting and applying a law, but courts will give the agency deference in ambiguous situations as long as its interpretation is reasonable.”

This statement followed the unanimous (minus the three who did not take part in the decision) U.S. Supreme Court decision in the Chevron U.S.A., Inc. v. National Resources Defense Council. The case is known for establishing the extent to which a federal court should defer to a government agency’s interpretation of an ambiguous statement when constructing statutes.

Breaking Down Chevron Deference

For those of you who don’t have a law degree, here’s what that means:

- When a statutory term (required by law) is not explicitly defined and explained by Congress, there is room for interpretation

- When a government agency interprets that statutory term, the interpretation may come under question

- As long as the interpretation is not arbitrary (random), capricious (impulsive or unpredictable), or contrary to the statute (opposite the intent when put into practice), federal courts should give more weight to the government agency’s interpretation than to any other interpretation

At the time, the Supreme Court argued that if Congress leaves a term open to interpretation, it is either stated openness to interpretation, or an implied openness to interpretation. If a statute is implicity open, the intent of Congress is to allow a government agency to create provisions and regulations from that statute as they see fit.

No one foresaw the impact this ruling would have on commerce and regulation in the U.S. To date, the Chevron Doctrine has been cited nearly 18,000 times in federal court decisions. The application of a statute based on agency interpretation could no longer be questioned or changed by judicial review.

Chevron Deference in Home Health

Since the advent of the PDGM model, CMS has calculated payment rates based on its interpretation of budget neutrality. The National Association for Home Care and Hospice has disputed the validity of both the interpretation of budget neutrality and the formulas used to calculate it.

Last year’s 2024 CMS Proposed Rule cut payment rates even further with a 2.890% Budget Neutrality permanent payment rate adjustment and a temporary rate adjustment to account for alleged overpayments from 2020-2022.

The lawsuit filed against CMS in response to the 2024 Final Rule was dismissed. NAHC began pursuing an administrative review with CMS. However, CMS has already stated that their final position is that budget neutrality has been calculated within the law.

“That proposal also fails logically in that it puts care access in severe jeopardy in applying a budget neutrality reconciliation methodology that takes PDGM-induced behavior changes to assess what otherwise would have been expended by Medicare in the absence of PDGM. In doing so, CMS fully fails to meet its obligation to ensure that the transition to a new payment model is budget neutral.”

- NAHC Comment Source

Chevron Deference Repealed

In a landmark ruling on Friday, June 28. 2024, the Supreme Court removed the power of federal agencies to interpret laws and ruled that the courts should rely on their own intrepretation of ambiguous laws. Justice Elena Kagan, who dissented the ruling, predicts this change “will cause a massive shock to the legal system.”

Chief Justice John Roberts explained in his opinion that the Chevron Deference is inconsistent with the Administrative Procedure Act (APA). The APA is a federal law which contains instructions for courts to review actions by federal agencies. According to Roberts, the APA directs courts to decide legal questions using their own judgment. Therefore, he noted, agency interpretations of statutes are not entitled to deference. “…it remains the responsibility of the court to decide whether the law means what the agency says,” concluded Roberts.

NAHC to Refile Lawsuit after Chevron Deference Repeal

In April, 2024, the lawsuit filed against CMS regarding the methodology for calculating budget neutrality was dismissed. Now, NAHC can refile the lawsuit and force CMS to justify its decision to enact repeated reimbursement cuts for home health.

In an interview on Wednesday, Bill Dombi told The Rowan Report, “This improves the chances of success for our lawsuit. CMS is going to have to support their regulatory interpretations going forward. Congress is going to have to offer more detail in its legislative language, leaving less to being open to interpretation.” Regarding the PDGM lawsuit, CMS argued that the law was clear and the agency’s interpretation was valid. The overturning of Chevron Deference allows the possibility of arguing that CMS’s interpretation of the law is flawed.

Dombi also explained that the Ensuring Access to Medicaid Services rule, also known as the 80/20 rule, was “drawn out of a whole cloth.” Previously, there were limited avenues available to challenge this rule. The repeal of Chevron Deference significantly improves the ability to challenge the 80/20 rule. The argument now, Dombi told The Rowan Report, is “Does CMS even have the authority to do this?”

The Rowan Report anticipates more news coming out of Washington D.C. and the NAHC office regarding the 2024 pay cuts and the 80/20 rule. We will provide ongoing updates and information as it becomes available.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Tim Rowan | Jun 27, 2024 | CMS, Medicare Advantage

by Tim Rowan, Editor Emeritus

We have been keeping an eye on the Medicare Advantage business as the number of beneficiaries who switch exceeds fifty percent. In past reports, we have described the federal lawsuits that accuse MA insurance companies of illicitly padding revenues while illegally denying treatments that straight Medicare would have covered. (See MedPAC Exposes More Medicare Advantage Crimes – 3/20/24)

Until now, we haven’t gone into detail about those independent brokers with the continuous TV commercials every November. It turns out, they may be even more dishonest than the insurance companies themselves.

Perhaps the most famous of these brokers is the one that put Broadway Joe Namath in our living rooms a hundred times a day. The company started life as Health Insurance Innovations, owned by Chicago-based private equity firm Madison Dearborn Partners. After accusations of fraud, the company folded and re-emerged as Benefytt. When the same accusations returned, the owners shut that company down and came back as Blue Lantern Health.

According to Healthcare Uncovered, the firm filed for a state-level bankruptcy equivalent in Delaware last April, called “assignment for the benefit of creditors.” Blue Lantern’s website is down, as are MedicareCoverageHelpline.com and HealthInsurance.com, their signature assets. Nobody answers the 800 number Namath hocked for years.

The bankruptcy litigation revealed a database of 7 million seniors who had been bombarded by 17 million phone calls. The bankruptcy was apparently precipitated by the Federal Trade Commission, which forced Benefytt to pay $100 million to the people it had scammed by selling sham Obamacare plans, with checks distributed to victims in March. The Securities and Exchange Commission forced Health Insurance Innovations and the company’s co-founder Gavin Southwell to pay a $12 million settlement. Another close associate of the company, Steven Dorfman, was convicted of wire fraud in February.

Tolerance for the firm’s deceptive advertising scheme ended with changes to the Medicare Advantage rule in 2023 that took effect in 2024. Blue Lantern stated after the fines were imposed that the new rule was critical to the company’s downfall,

Previously, former HHS Security Alex Azar characterized the Namath ads as “real savings, real options” in Medicare Advantage, ignoring the studies showing that the MA program costs the Trust Fund not less but $140 billion more than original Medicare.

Healthcare Uncovered concluded with this observation, “Further rules imposed since then by the Biden administration are putting even more pressure on Medicare Advantage lead generators, also called ‘third-party marketing organizations.’ (TPMOs) Beginning October 1 of this year, CMS will require that TPMOs get express consent from individuals before selling contact information to other marketers and brokers — a key loophole that enabled the growth of Blue Lantern and its predecessors.”

Don’t worry about Joe Namath’s retirement income though.

He has already landed a gig hawking hearing aids.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Rowan Report | Apr 26, 2024 | Admin, Clinical, CMS, Regulatory

by Johnathan Eaves, Senior Director of Communications, Axxess

Treating Medicare patients comes with a level of nuance that is important to understand to ensure that organizations remain compliant and patients receive appropriate care. Standards for quality care and payment can sometimes be dictated by Medicare’s payment policies and at other times be decided by the Conditions of Participation. There is an important difference between these two governing principles that providers should understand to ensure compliance.

Care at home industry veteran and Axxess Senior Vice President of Clinical Services Arlene Maxim RN, HCS-C, offered insights into the differences between Medicare’s policy and its Conditions of Participation during a recent webinar.

Explaining the Difference

Maxim pointed out that the differences between policy and the conditional requirements comes down to what can be billed and what are the quality standards for the services provided.

“The Conditions of Participation are dealing primarily with quality, whereas Medicare policy is related to payment,” said Maxim. And while there is a difference, that doesn’t mean both aren’t important and must always be followed.

“If Medicare policies are not followed, you are audited and if you do not have documentation to support those policies, you’re not going to get paid,” said Maxim “Oftentimes, with PDGM, staff members are not getting past that first 30 days. They’re not understanding what they need to do to keep that patient who continues to qualify for services on for longer.”

Maxim says that the problem is often that clinicians do not understand Medicare policy. “Every piece of documentation we submit to the Medicare program for review [needs to be] as pristine as we can possibly get it,” she said.

Assessment and Documentation

Proper assessment and documentation is something Maxim feels is critical in ensuring quality care, meeting Medicare requirements, and receiving payment for services.

“Complete and detailed documentation is going to be the key for agency payment by the Medicare program,” Maxim said.

Maxim pointed out certain services covered under Medicare policy may include observation and assessment, management and evaluation of a care plan, maintenance therapy, teaching and training activities, administration of medications, wound care, ostomy care, rehab nursing, venipuncture, skilled nursing visits, and more.

She also cautioned that agencies need to be prudent with the funds they receive from Medicare, viewing them as a potential “short-term, interest-free loan” until undergoing any audit. Until their documentation is reviewed and approved, there are no guarantees.

“Medicare is an insurance and it’s not free,” said Maxim. “Medicare policy provides us with a list of covered items. If experiencing an audit, and if the documentation is not there to cover the covered service, you’re not in compliance with that Medicare policy and you will not be paid for the services.”

Communicating With Physicians

Maxim further emphasized the importance of frequent contact with physicians, adherence to care plans, and ensuring that care plans are simple with individualized plans and goals that are achievable.

“You want to make sure that you have orders that physicians are actually going to read and to determine that they make sense and they’re going to sign off on them,” said Maxim.

“Keep your plan of care simple.”

# # #

Axxess Home Health, a cloud-based home health software, streamlines operations for every department while improving patient outcomes.

© 2024 Axxess. For reprint permission, please contact The Rowan Report: kristin@therowanreport.com

by Rowan Report | Apr 26, 2024 | CMS, Medicare Advantage, Regulatory

By Beth Noyce, RN, BSJMC, BCHH-C, COQS

CHAP-certified home health & hospice consultant

This is part 3 of the 3 in the series, outlining the discussions and implications in adopting new outcome and process measures for Hospice care. The final segment addresses future process and outcome measures that the board discussed, but did not yet implement. Read Part 1 on Outcome Measures and Part 2 on Process Measures.

The TEP discussed potential future process and outcome measure concepts that Abt Associates presented to the panel as well.

The process measures included:

- Education for Medication Management

- Wound Management Addressed in Plan of Care

- Transfer of Health Information to Subsequent Provider

- Transfer of Health Information to Patient/Family Caregiver

Hope-based outcome measures were:

- Patient Preferences Followed throughout Hospice Stay

- Hospitalization of Persons with Do-Not-Hospitalize Order

Developing education for medication management as a process measure was a popular concept, and the top priority of the recommended measures with the TEP as they “broadly agreed that CMS should develop this measure,” the report says, citing “a significant need for training in medication management for patients and their caregivers.” They recommended that the measure weigh more heavily when care is provided in a home setting than in a facility setting because hospices are unable to control facility training and hiring practices. One panelist commented that including the phrase “during today’s visit” in the measure is important.

Whether CMS should further develop the process measure addressing wound management in the plan of care was less straight-forward, as panelists provided varied feedback. They generally agreed that this measure is important, as having a record of wound management addressed in the plan of care can hold the staff accountable for treating the wounds. But some members recommended measuring wound management with outcome measures rather than process measures. One panelist cited potential problems from patients’ deterioration over time and another noted that the time frame of this measure is important, and encouraged recording the process of getting care in place once a wound is identified. The panel agreed CMS should carefully define the measure’s specifications.

Because standard practice for most agencies is, when a patient is discharged live, to transfer health information to the subsequent provider and to the patient and family or caregiver, TEP members expressed that the two measures were likely to “top out,” meaning they would almost always be marked “Yes,” making them of no value in differentiating between hospice providers. The group generally discouraged developing these process measures.

The group strongly rejected any merit in developing two outcome measures concerning Patient Preferences Followed Throughout Hospice Stay and Hospitalization of Persons with Do-Not-

Hospitalize Order. The report says “Multiple TEP members described situations in which patients who had preferred not to be hospitalized changed their minds when a crisis occurred. Patients’ preferences and unexpected crises are usually out of the hospice’s control. Although it is still important for hospices to ask patients about their preferences as part of patient-centered care, the TEP did not believe these two items would be practical measures of a hospice’s care quality.”

Dr. McNally expects that Abt. Associates will apply the HQEP TEP’s suggestions to the HOPE tool.

“Oh yeah, they did it,” he says. “Abt would come to a specific meeting with information, data, suggestions, and specific information about how these things would be measured. We’d give feedback. Then they’d come back to the next meeting having incorporated our suggestions,” he explains. “All of us felt very much heard and responded to. It didn’t feel in the least bit perfunctory.”

Whatever specific measures are eventually included in the HOPE tool, Lund Person sees value in its implementation. “Hospice providers have had a woeful lack of outcome measures for hospice patients, which has made the evaluation of quality hospice care based only on process measures and the family’s evaluation of hospice care in the CAHPS® Hospice Survey, she explains. “Implementing HOPE will begin to identify outcome measures that can be compared between providers.”

Lund Person warns of potential challenges as well. “The selection of risk adjustment and stratification must be carefully done to minimize bias and maximize effectiveness of measures,” she says. “In addition, hospice providers have been awaiting the release of the HOPE tool with significant anxiety about content and administrative burden.”

Dr. McNally is confident the HOPE tool will be a healthy change for hospices.

“A lot of my role as a medical director and hospice physician is supporting our nurses,” he says. “They do 95% of the work. I really would like to see this not be burdensome for our hospice nurses. I’m looking forward to seeing what the [HOPE tool] beta testing translates to in our own hospice world.” He added “What I would hope to see is that the tool feels user-friendly to the hospice team, the people who have to use it, and that it also provides useful information to patients and families.”

NAHC’s Wehri says that standardizing processes through the HOPE tool is the key foundational element for the hospice industry. “High quality care is driven by reducing variance through standardized processes, Wehri writes. “Also, CMS will have a better idea of how the type of population a hospice serves impacts some of the clinical care.” This small glimpse into hospice variances that CMS does not currently have could be very helpful in future policy and payment decisions, according to Wehri. “What CMS finds in terms of differences between hospices and their care for patients may be a bit of a surprise to CMS,” she says. “I hope they are pleasantly surprised with the overall quality of care that is revealed.”

# # #

Beth Noyce provides education, consulting, mentoring, compliance assessments and auditing services to home health and hospice agencies and their clinicians in several states. She also now provides patient and family guidance concerning hospice and home health services. Beth loves teaching and helping others succeed. She also makes available recordings of much of her education for her clients’ convenience.

Beth Noyce provides education, consulting, mentoring, compliance assessments and auditing services to home health and hospice agencies and their clinicians in several states. She also now provides patient and family guidance concerning hospice and home health services. Beth loves teaching and helping others succeed. She also makes available recordings of much of her education for her clients’ convenience.

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

The financial and health implications of uninformed disenrollment from PACE to conventional MA plans are significant. The needs of PACE beneficiaries, most of whom have multiple complex medical conditions, cognitive or functional impairments – or all three – are not comprehensively addressed by MA plans. The loss of PACE services is harmful and, in some cases, can be life-threatening.

The financial and health implications of uninformed disenrollment from PACE to conventional MA plans are significant. The needs of PACE beneficiaries, most of whom have multiple complex medical conditions, cognitive or functional impairments – or all three – are not comprehensively addressed by MA plans. The loss of PACE services is harmful and, in some cases, can be life-threatening. We share CMS’ stated desire that people have access to accurate and complete information when they make health care choices. We have numerous examples of vulnerable seniors being induced to enroll in MA plans without being fully-informed of what they are giving up when they enroll.

We share CMS’ stated desire that people have access to accurate and complete information when they make health care choices. We have numerous examples of vulnerable seniors being induced to enroll in MA plans without being fully-informed of what they are giving up when they enroll.

Beth Noyce provides education, consulting, mentoring, compliance assessments and auditing services to home health and hospice agencies and their clinicians in several states. She also now provides patient and family guidance concerning hospice and home health services. Beth loves teaching and helping others succeed. She also makes available recordings of much of her education for her clients’ convenience.

Beth Noyce provides education, consulting, mentoring, compliance assessments and auditing services to home health and hospice agencies and their clinicians in several states. She also now provides patient and family guidance concerning hospice and home health services. Beth loves teaching and helping others succeed. She also makes available recordings of much of her education for her clients’ convenience.