by Tim Rowan | Mar 20, 2024 | CMS, Editorial

by Tim Rowan, Editor Emeritus

This week, we look at the state of the healthcare industry, vis a vis payers that do not pay.

While Home Health and Hospice leaders talk at every gathering about refusing to accept Medicare Advantage clients, some large Integrated Healthcare Systems are actually doing it. Other hospitals are responding to difficult payers by laying off staff, or even closing. The HHS Office of Inspector General repeatedly fines insurance companies for upcoding to gain inflated, unjustified monthly payments. Meanwhile, insurance companies report record profits, with their MA divisions leading the way. The fines go into the “cost of doing business” column.

March, 2024, Becker’s Hospital Review: Bristol (Conn.) Health will eliminate 60 positions, 21 of which are currently occupied and will result in layoffs at Bristol Hospital. The hospital’s CEO, Kurt Barwis, told a local newspaper a lack of reimbursement from insurers left the hospital without a choice but to cut staff.

October, 2023, NPR: Since 2010, 150 rural hospitals have closed. Under CMS’s “Critical Access” designation, Medicare pays extra to those hospitals to compensate for low patient volumes. MA plans do not. Instead, they offer negotiated rates that are lower than what traditional Medicare would pay.

December, 2023, Becker’s Financial Management: 13 additional hospital systems cut ties with Medicare Advantage plans since October.

What is going on?

The Medicare Payment Advisory Commission, MedPAC, believes it has learned the answer. In its March 15, 2024 report to Congress, the Commission called for a “major overhaul” of Medicare Advantage policies. It says it found that the program, designed to lower costs and extend the lifespan of the Medicare trust fund, does not save money but costs the fund more than if all beneficiaries were on traditional Medicare, $83 billion more in 2024.

Calling it, too politely, “coding intensity,” MedPAC concurs with the OIG that MA plans routinely exaggerate patient conditions. The report claims it will amount to MA clients appearing to need 20% more healthcare than fee-for-service beneficiaries, when they do not. Padded coding, MedPAC says, will increase Medicare premiums by $13 billion in 2024.

“A major overhaul of MA policies is urgently needed for several reasons,” the commission wrote in its report. MedPAC cited several problems that need to be addressed, including the disparity in costs between beneficiaries in fee-for-service Medicare and MA, a lack of information on the use and value of supplemental benefits, and challenges setting benchmark payment rates.

A proposal currently making its way through Congress would reduce supplemental payments to insurers, who threaten to raise premiums and cut benefits if their inflated benchmark payments are lowered.

“If payments to MA plans were lowered, plans might reduce the supplemental benefits they offer,” MedPAC wrote in its report. “However, because plans use these benefits to attract enrollees, they might respond instead by modifying other aspects of their bids.” The barrage of TV ads, featuring aging celebrities, have been found to be deceptive and too often backed by shady front companies representing brokers, not insurance companies. The brokerage company behind the Joe Namath ads, for example, has reorganized and changed its name three times.

Pushback from AHIP, the insurance industry lobbying organization, has been as expected. “MedPAC’s estimates are based on ‘speculative assumptions’ and ‘overlook basic facts about who Medicare Advantage serves and the value the program provides.'”

MedPAC asserts that its estimates are based on history, not speculation.

Healthcare Providers Beg to Differ

A lack of payments from Medicare Advantage plans is one reason the Connecticut hospital is laying off staff, the Hartford Courant reported March 14. CEO Kurt Barwis told the newspaper Medicare Advantage plans have been denying claims more frequently while delaying payments for the claims they do approve. “Our primary care is to take care of patients, their single focus is shareholder value and profits,” Mr. Barwis told the Courant. “The Medicare Advantage abuse is outrageous.”

The strategy insurance companies deploy to avoid providing care, Barwis continued, is excessive prior authorizations, coupled with delayed payments. This obstacle to care is directly in opposition to CMS policy. MA divisions of large insurers respond that they are private insurance and allowed to impose their own treatment approval policies. MedPAC says this claim is incorrect.

Richard Kronick, a former federal health policy researcher and a professor at the University of California-San Diego, said his analysis of newly released Medicare Advantage billing data estimates that Medicare overpaid the private health plans by more than $106 billion from 2010 through 2019 because of the way the private plans charge for sicker patients. Kronick added that there is “little evidence” that MA enrollees are sicker than the average senior, though risk scores in 2019 were 19 percent higher in MA plans than in original Medicare. That gap continues to widen.

Where does this excess taxpayer money go?

2023 Medicare Advantage business division profits and 2022 CEO compensation reported by publicly traded companies:

UnitedHealth Group: $22.4 B (Andrew Witty $20,865,106)

Aetna (CVS): $8.3 B (Karen Lynch $21,317,055)

Elevance Health (Anthem): $6 B (Gail Boudreaux $20,931,081)

Cigna: $5.1 B (David Cordani $20,965,504)

Centene: $2.7 B (Sarah London $13,246,447)

Humana: $2.5 B (Bruce Broussard $17,198,844)

We found one curious outlier. Molina Health, with annual revenue 10 percent of UnitedHealth Group’s income and 2.16 percent of the market, paid its CEO $22,131,256 in 2022.

Download the entire MedPAC 2024 report here. Chapter 7 is the Home Health section. A summary of MedPACs recommendations begins the chapter thus, “For calendar year 2025, the Congress should reduce the 2024 Medicare base payment rates for home health agencies by 7 percent.”

# # #

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Feb 7, 2024 | Admin, Marketing, Regulatory

by Kristin Rowan, Editor

Medicare Advantage has multiple measures of success for payment bumps and bonuses. Rehospitalization rates has long been the most important measure of how well a care at home agency is performing, but there are additional measures that can help or hurt your agency. One that is gaining a lot of traction with MA and can impact your agency’s ability to survive is the overall patient experience. Measuring the patient experience can be subjective, but a great marketing tool to use is the Net Promoter Score (NPS). NPS is a calculation of patient responses regarding their likelihood to recommend you to others. A NPS score of “0” means that, overall, your clients are not going to speak positively or negatively about you; there just isn’t anything outstanding enough to bother saying anything. Anything above zero is better than nothing, but 30 and above is ideal.

During January’s HomeCare 100 Winter Conference, Tim Craig moderated the panel, “The MA Member Experience and Why it Matters” with a panel of experts. He posed this question to the audience:

“How well do home care providers perform when it comes to delivering on patient experience?”

Rating care provider performance on a scale of 1-5, the responses during the panel were somewhat surprising

- 47% of those who responded rated the delivery on patient experience 3

- 43% said 4

- 6% responded 2

- A mere 4% responded 5

- There were no responses of 1

If we turn these answers into a Net Promoter Score, we get -6. If caregivers, administrators, and providers don’t believe we’re doing a good job, how can we expect our clients, patients, and families to be happy with the care they receive?

Statistics

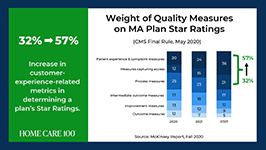

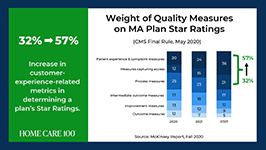

- Patient experience and complaint measures count higher toward star rating than they have before

- CAHPS Scores have changed weight from 1.5 to 4 since 2021

- Star Ratings Determine Bonus Eligibility and Amount – starts at 4 stars and above

- Number of plans that have a 4.0 or higher star rating dropped from 64% to 43%

- Disenrollment is on the rise from 10% in 2017 to 17% in 2021

Net Promoter Score

Glen Moller, CEO of Upward Health, whose net promoter score is a whopping 86, said:

“The Member Experience has always been important. What has changed is the way we manage it, given the implication of the CAHPS rating, you can’t be a 4 star without high CAHPS scores.” Moller improved his patient experience with internal surveys to get actionable intel and asking open-ended questions. Look at change and innovation and how that could be disruptive to members. Member experience is at the center of all the other measures. No matter what benefits you’re offering, embed member experience measures at every step of the process.

Because your star rating directly impacts your ability to receive bonuses and because experience-related metrics are increasingly weighted in determining star ratings, you should be looking at the member experience more closely in all of your process. You should also be measuring the member experience and looking at ways to improve it.

Ways to measure ME

• HHCAHPS

• Quality of Patient Care Ratings

• Word of Mouth

• Net Promoter Score

• Glassdoor

• YelpCalculating a Net Promoter Score can be challenging, especially when trying to get older or infirmed patients to answer a survey. For the most accurate NPS, send a single question survey to all of your current and past customers asking them to rate, on a scale of 1 to 10, “How likely are you to recommend us to a friend or family member.” If you aren’t able to do this, you can still calculate a rough NPS using your other measures. You can use your Google and Yelp reviews with a simple formula: % of promoters – % of detractors = NPS. Three stars and below are detractors; four and five stars are promoters.The NPS score is more about comparative to the usual experience rather then the actual experience. A high score from a customer doesn’t necessarily meant it’s “great”, only that it’s much better than what they’re used to or what they expected.

The NPS is not the only measure of customer experience. To get the whole picture, use all the data you have to find out what interventions should be done and implement them. Whether the change is in training your staff, updating your scheduling process, using AI to help communicate directly with patients and families, or simply streamlining your website for a better user experience, you can improve your chances for higher ratings and bigger bonuses in a few easy steps.

I won’t often insert a shameless plug into an article, but if increasing patient satisfaction and member experience can help your agency survive the CMS pay cuts, and you need help with getting a NPS, understanding how to measure your patient experience, or getting online reviews, please contact me for more information. My marketing agency is happy to help get you started.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Feb 7, 2024 | Regulatory

by Kristin Rowan, Editor,

On Wednesday, January 31, Cigna and HCSC signed an agreement to sell all of Cigna’s Medicare business — including traditional Medicare, supplemental benefits, Medicare Part D offerings, and CareAllies, a value-based care management subsidiary. — to HCSC, a Blue Cross / Blue Shield partner with operations in Illinois, Texas, New Mexico, Oklahoma and Montana. The $3.3 billion deal will quadruple the size of HCSC’s Medicare Advantage population, which numbered 217,623 as of this month.

Medicare Advantage had not been a significant business for Cigna. CEO David Cordani explained that it required resources disproportionate to its size in the company. With 19 million insurance customers, Cigna had a little over a half million in its MA business, a little under a half million Medicare supplement members, and 2.5 million in Part D.

It had previously been reported that Cigna believed divesting its Medicare business would make its merger with Humana more acceptable to regulators. The company completed its HCSC deal even though negotiations with Humana had already broken down. Though inked today, the deal is not expected to close until the first quarter of 2025.

# # #

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Tim Rowan | Jan 24, 2024 | Regulatory

Untitled Document

Analysis by Tim Rowan, Editor Emeritus

P

erennial Home Health enemy MedPAC angered a different group last week by releasing a status report on insurance companies participating in the Medicare Advantage program.1

The report details the way in which giant, for-profit, health insurance companies improperly increase per-customer payments by upcoding their health assessment at enrollment, and then slash costs by denying coverage for healthcare services that traditional Medicare would have honored. MedPAC was also critical of the practice of requiring prior authorizations, backed up by utilization review algorithms that are supposedly intended to “minimize furnishing unnecessary services” but which effectively increase denials for necessary care.

According to the report, MedPAC expects CMS to pay MA plans $88 billion in 2024.

On January 12, a meeting to discuss the report ended in what one reporter politely described as “a kerfuffle.” Other witnesses to the meeting chose to describe it as a shouting match.

“One member, Brian Miller, MD, MPH, of Johns Hopkins University in Baltimore, accused panel leadership of issuing a negative status report on MA plans’ market dominance, saying it had been ‘hijacked for partisan political aims to justify a rate cut to Medicare Advantage plans.’

“Miller said the analysis … ‘appears to be slanted to arrive at a foregone conclusion in order to set up and provide political cover’ just before the Centers for Medicare & Medicaid Services prepares its annual rate notice for MA plans, expected in coming weeks. ‘The chapter reads like attack journalism as opposed to balanced and thoughtful policy research.'”2

Report authors fired back, citing numerous ways MA plans generate higher revenue, including enrolling people who are relatively healthy, known as favorable selection. They then vigorously scan patients’ medical histories and charts to code for health factors that generate higher per-capita payments, known as coding intensity, often spending less on services. Coding intensity is also the difference between a risk score that a beneficiary would receive in an MA plan versus in fee-for-service. Though MA plans skew toward healthier enrollees, MedPAC found that MA risk scores are about 20.1% higher than scores would be for the same beneficiaries had they enrolled in Fee For Service Medicare.

Namath, Walker, Shatner and Brokers

Criticism of MA plan behavior did not only come from MedPAC commissioners and report authors. For example, Lynn Barr, MPH, founder of Caravan Health, which was acquired by CVS Health through its acquisition of Signify Health, exposed what the annual TV ads do not make clear, that their 800 numbers go to brokers, not to any one plan.

“This is not the big, lovely, glowing success that everybody says it is. And we continue to create policies that drive people into these plans. Medicare allows money paid to MA plans to be used for broker commissions as high as “$600 to recruit them, plus $300 a year every year that they stay in the MA plan.

“We have allowed MA to buy the market, and that is why MA is growing. It’s not because the quality’s so great. People don’t love the prior auth, people are leaving their plans a lot. Aside from Medicaid, Medicare is the least profitable payer for doctors. And at the same time, we give all this money to the plans. It’s unconscionable.”

Adding to the “kerfuffle” with a powerful anecdote, Stacie Dusetzina, PhD, of Vanderbilt University Medical Center in Nashville, Tennessee, noted that even cancer patients often have trouble getting necessary care because of the plans’ limited networks. She referenced a January 7 NPR story3 about an MA enrollee who could not get the cancer care he needed from his MA plan, and could not get out of the plan without facing 20% in expensive copays. In all but four states, supplemental plans that could pick up the difference can reject patients with costly conditions.

“When you are 65 and aging into the program,” Dr. Dusetzina summarized, “you are healthy at that time and may not be thinking about your long-term needs. [If you did], it would push you to think harder about the specialty networks that you may or may not have access to when the MA plan is making your healthcare decisions.”

1 A 30-page slide presentation is available to the public at medpac.gov/wp-content/uploads/2023/10/MedPAC-MA-status-report-Jan-2024.pdf. The complete report is available only to MedPAC commissioners. The charts on slides 26 and 27 show how MA plans learned to pad profits in 2018 and increased the practices exponentially since then.

2 Cheryl Clark, MedPage Today January 16, 2024 medpagetoday.com/special-reports/features/108275

3 npr.org/2024/01/07/1223353604/older-americans-say-they-feel-trapped-in-medicare-advantage-plans

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. RowanResources.com; Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Tim Rowan | Dec 6, 2023 | CMS, Regulatory

by Tim Rowan, Editor Emeritus

MA Plans Continue to Exaggerate Patient Conditions for Profit

As we reported in October (More MA Plans Caught Inflating Patient Assessments, 10/11/23), insurance companies operating Medicare Advantage plans routinely pad the patient assessments that set their monthly revenue from the Medicare Trust Fund. Worse, CMS bowed to industry pressure earlier this year and agreed not to extrapolate the amount of the fraudulent payments, as it does with Home Health and Hospice overpayments (Government Lets Health Plans That Ripped Off Medicare Keep the Money, 2/22/23).

Now, we hear that the HHS OIG has totaled its 2023 audits and announced it found over $213 million in padded Medicare Advantage overpayments so far this year. In its latest semiannual report, covering fraudulent patient assessments between April and September, the OIG said it recovered $82.7 million. Total recoveries would have been higher except for that CMS ruling that prevents the agency from extrapolating payments before contract year 2018.

Will SEC Allow Cigna/Humana Marriage?

Early last month, Bloomberg broke the news that Cigna was in talks to sell its Medicare Advantage business to Health Care Service Corporation, the parent company of BCBS in Illinois, Texas, New Mexico, Montana and Oklahoma. Should that sale be approved, it would remove an obstacle to Cigna’s rumored desire to merge with Humana.

Though approval is uncertain — the SEC has squashed more than one similar attempt under both the current and former Presidents — it would create what Axios called “another Titan” that would rival UnitedHealth Group and CVS Health in size. CVS acquired Aetna in 2018. It would also combine two Pharmacy Benefit Managers, giving the new entity control of a third of the market, which would be equal to the market share owned today by CVS.

In 2017, a proposed merger between Cigna and Elevance Health, formerly Anthem, was struck down in court. A proposed merger between Humana and Aetna was also canceled in a federal court the same year. Large, powerful insurers, and the PBMs they own, have come under increased scrutiny from federal regulators.

The Biden administration has already launched a warning shot, indicating it will be scrutinizing private equity acquisitions in health care. In September, the Federal Trade Commission sued private equity firm Welsh, Carson, Anderson & Stowe after it bought up nearly all of the anesthesiology practices in Texas and then, with competition removed, began to jack up prices. FTC chair Lina Khan made it clear the suit was intended to send a message to all consolidation attempts that might harm patients.

United to Change Prior Authorization Policy

According to a November 27 policy update from UnitedHealthcare (UHC), the payer is updating its Home Health prior authorization and concurrent review process for services that are delegated to Home & Community Care, the payer’s home care division.

The updated policy, which are set to take effect January 1, will affect United’s Medicare Advantage and Dual Special Needs plans in 37 states, a UnitedHealthcare news release stated.

In Summary

- Start of care visits still do not require prior authorization.

- Providers must notify Home & Community Care of the initiation of home care services. UHC encourages providing notice within five days after the start of a care visit to help avoid potential payment delays.

- Before the 30th day, providers must request prior authorization for days 30 to 60, by discipline, and provide documentation to Home & Community Care.

- For each subsequent 60-day period, providers must request prior authorization, by discipline, and provide documentation to Home & Community Care during the 56- to 60-day recertification window.

UHC says it will respond to questions about the prior authorization approval process at HHinfo@optum.com

In related news, in its annual investor conference call, the company projected “revenues of $400 billion to $403 billion, net earnings of $26.20 to $26.70 per share and adjusted net earnings of $27.50 to $28.00 per share” for 2024. Cash flows from operations are expected to range from $30 billion to $31 billion.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2023 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Kristin Rowan | Sep 13, 2023 | Editorial, M&A, Regulatory

UnitedHealth Group Makes Bid to Buy Amedisys after Acquiring LHC Group

Amedisys is one of the leading providers of home health, hospice, and other healthcare at home services. It operates more than 500 locations in 37 states and the District of Columbia. After acquiring Contessa Health in 2021 for $250 million, Amedisys added hospital-at-home, SNF-at-home, and palliative care to its list of services.

Optum Outbids Option Care Health

In May of this year, Option Care Health and Amedisys issued joint statements announcing a merger of the two companies in an all stock-option bid. Option Care Health provides home and alternate site infusion services, while Amedisys provides home health, hospice, and high-acuity care. The merger was valued at $3.6 billion. It would have increased stockholder value, increased access to care across the United States, and created a network of more than 16,000 health care professionals, according to the joint statement.1

By June 26th, Option Care Health confirmed the termination of the merger and a $106 million termination payment from Amedisys, after Amedisys accepted an all-cash bid from UnitedHealth Group.2

UnitedHealth Expanding Service Options

UnitedHealth Group acquired LHC Group earlier this year for $5.4 billion.3 That acquisition folded LHC Group into UnitedHealth Group’s Optum. The acquisition came after increased demands for home care services. UnitedHealth Group considered this a move toward value-based care. The Federal Trade Commission stalled the merger with requests for additional details in mid-2022. Despite the FTC probe and a shareholder lawsuit, the deal was ultimately approved and the LHC Group delisted its stock on February 22.4

New Merger Faces Federal Scrutiny

Optum and Amedysis expected concerns over anti-trust issues surrounding the merger, according to a joint statement from the two groups. The Department of Justice recently asked for more information.5 The request will push back the timeline for the merger. Amedisys believes there is little geographic overlap between Amedisys and LHC Group and that the scrutiny is a result of other UnitedHealth Group acquisitions.

In a press release about the merger, Optum CEO Patrick Conway, M.D. said, “Amedisys’ commitment to quality and care innovation within the home, and the patient-first culture of its people, combined with Optum’s deep value-based care expertise can drive meaningful improvement in the health outcomes and experiences of more patients at lower costs, leading to continued growth.”6

Even with the recent acquisitions and mergers, if this deal with Amedisys proceeds, Optum will have only a 10% market share across the U.S. For this reason, as well as the demand for home care far exceeding the supply, Optum believes this merger will be approved.

Should a company that brokers health insurance also be allowed to be the provider of care? In this author’s experience, job-based healthcare insurance does not come with many options. There may be different levels of care to fit your budget, but the insurance company is already chosen by the employer. This means that employees and their families choose to have health insurance or not but cannot choose the insurance company.

Home Care, Hospice, Post-Acute Care, Palliative Care, and other in-home services are very personal. The company you choose and the care provider you get have to fit your needs and personality and there is a high level of trust needed to allow a stranger into your home when you are in a vulnerable state. If the insurance company is also providing the care, the option to find a care provider that suits the level of trust needed almost disappears.

In 2021, President Joe Biden signed an executive order for more vigorous oversight of the healthcare market. Mergers and acquisitions are being scrutinized more heavily to preclude monopolies of care. The FTC and DOJ, in response to this executive order, have proposed updates to antitrust guidelines that will make healthcare mergers and acquisitions more difficult.7

Medicare beneficiaries enrolled in Medicare Advantage has now reached 50%, making insurance companies more involved in senior care than ever before.8 Insurance companies only recently increased the percentage of revenue spent on patient care to 80%, up from as low as 50% before 2010.9 Given these facts, it may be worth questioning whether the insurance companies have too much control over care now, and if the acquisition of care providers by insurance providers should be eliminated completely to avoid a complete takeover of healthcare by insurance companies that already focus more on profit than people.

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

by Tim Rowan | Aug 9, 2023 | Editorial

analysis by Tim Rowan, Editor

It is good to occasionally remind ourselves that 2023 is the year enrollment in Medicare Advantage reached a full half of Medicare beneficiaries. Originally conceived as a plan to control spending, MA does seem to be achieving that goal.

At what cost, however?

The Medicare trust fund pays insurance companies participating in the MA program a per-patient-per-month fee based on the company’s own declaration of each customer’s health and likely future needs. With those monthly payments, MA companies provide care as needed. Or at least they are supposed to.

Frequently, since the program began, whistleblowers have told the government that employees are rewarded for increasing a patient’s risk-adjustment, the clinical assessment that is supposed to be scored by a physician but is often instead scored through data mining. That practice involves employees searching through patient records, looking for signs of health conditions that would raise their assessment, and thus their value to the insurer. In other words, a class of crime that would earn an HHA a hefty fine if they did it with their OASIS assessments.

Evidence has been mounting lately that these insurance companies not only fudge the numbers to gather more than they should from Medicare, but they also provide as little care as they can get away with. Our industry is familiar with the penny-pinching MA companies practice when authorizing in-home care. The problem is larger than that.

String of Recent Accusations

- The HHS Office of Inspector General issued a report revealing how Elevance, the company formerly known as Anthem, made $5.5 billion in profits in the first six months of this year, a 14.4% jump from the $4.8 billion in profits it made during the same period of 2022. The profits, OIG said, came mostly from denying care to Medicaid beneficiaries, care that their physicians had recommended.

- The largest insurer, with 27 percent of the market, UnitedHealth’s investors were distraught in June when it appeared the company was spending too much on patient care. Their fears were calmed, however, when United reported revenue of $56.3 billion for 2Q 2023, compared to $45.1 billion in the same quarter of 2022.

- Cigna is the target of a class action suit in California, in which it is accused of using an algorithm to deny care, overriding and sometimes ignoring physician recommendations.1

Last October, the New York Times summarized the problem with a list of recent government findings and accusations:

“Kaiser Permanente called doctors in during lunch and after work and urged them to add additional illnesses to the medical records of patients they hadn’t seen in weeks. Doctors who found enough new diagnoses could earn bottles of champagne, or a bonus in their paycheck.

“Elevance Health paid more to doctors who said their patients were sicker. And executives at UnitedHealth Group, the country’s largest insurer, told their workers to mine old medical records for more illnesses — and when they couldn’t find enough, sent them back to try again.

“Each of the strategies — which were described by the Justice Department in lawsuits against the companies — led to diagnoses of serious diseases that might have never existed. But the diagnoses had a lucrative side effect: They let the insurers collect more money from the federal government’s Medicare Advantage program.”

Comparison to Home Health and Hospice

Naturally, these examples reach into the hundreds of billions because MA covers hospital and physician claims, but the comparison to our sector is nevertheless valid.

Since payments to HHAs were first attached to patient assessments a quarter century ago, clinicians have gotten better and better at the task. OASIS assessments are more accurate and thorough than they used to be. Professional coders are more adept at identifying and sequencing appropriate diagnosis codes. AI-assisted tools entering the fray promise an enhanced level of accuracy. (See our product review of the most promising of these tools.)

From the beginning, more accurate assessments have always meant a 10 to 15 percent increase in an agency’s episodic payment over less accurate OASIS scores. Wary of being accused of upcoding, nurses have always been unnecessarily cautious with their intake assessments.

Upcoding Accusations

CMS has always responded to increasing accuracy with accusations of upcoding, even though the Medicare trust fund more often benefits from the above described undercoding habit. Regulatory adaptations have enshrined the fear of upcoding into an assumption that it will happen, with payments slashed in advance just in case it does.

When errors in assessments and claims are discovered by CMS contractors through sampling, the overpayment amount found in the sample is extrapolated to an agency’s entire patient census. The result has at times crossed the line into seven figures, with a payback demand that occasionally cripples the HHA.

Compare this practice to the gift given to MA companies that we revealed in these pages last February: “Government Lets Health Plans That Ripped Off Medicare Keep the Money” In researching that story, we found that CMS typically postpones its duty to audit the risk adjustment figures that MA plans submit annually. After getting more than a decade behind, they decided to write off overpayments to MA plans prior to 2018 and start auditing from that year forward.

As an additional gift they said they would demand repayments only on the amounts turned up in their sample dataset, without extrapolating to each MA’s total patient population as they do with HHAs.

What can one conclude from this comparison? Possibly that CMS is very good at policing millions of dollars but gets overwhelmed and gives up with amounts in the billions.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

1 https://sharylattkisson.com/2023/08/class-action-suit-filed-against-cigna-over-alleged-use-of-algorithm-to-review-reject-patient-claims/

by Rowan Report | Feb 1, 2023 | Admin

by Wendell Potter

Medicare Advantage is a money-making scam. I should know. I helped to sell it.

Right now, well-funded lobbyists from big health insurance companies are leading a campaign on Capitol Hill to get Members of Congress and Senators of both parties to sign on to a letter designed to put them on the record “expressing strong support” for the scam that is Medicare Advantage.

But here is the truth: Medicare Advantage is neither Medicare nor an advantage.

And I should know. I am a former health-care executive who helped develop PR and marketing schemes to sell these private insurance plans.

During my two decades in the industry, I was part of an annual collaborative effort to persuade lawmakers that Medicare Advantage was far superior to traditional Medicare — real Medicare. We knew that having Congressional support for Medicare Advantage was essential to ensuring ever-growing profits — at the expense of seniors and taxpayers. We even organized what we insiders derisively called “granny fly-ins.” We brought seniors enrolled in our Medicare replacement plans to Washington, equipped them with talking points, and had them fan out across Capitol Hill.

Instead of joining with the corporate lobbyists in extolling the benefits of Medicare Advantage while obscuring the program’s numerous problems… Congress should work to lower the cost of health care.

Apology and Accusation

I regret my participation in those efforts. Over the 20 years since Congress passed the Medicare Modernization Act, the Medicare Advantage program has become an enormous cash cow for insurers, in large part because of the way they have rigged the risk-scoring system to maximize profits. As Kaiser Health News reported last month, the Center for Medicare and Medicaid Services estimated “net overpayments to Medicare Advantage plans by unconfirmed medical diagnoses at $11.4 billion for 2022.” That was for just one year. Imagine what the cumulative historical total would be.

The Medicare and Medicaid programs have become so lucrative and profitable for insurers that UnitedHealth Group, the nation’s largest health insurer and the biggest in terms of Medicare Advantage enrollment, got 72 percent of its health plan revenues in 2021 from taxpayers and seniors. In fact, all of UnitedHealth’s enrollment growth since 2012 has been in government programs. Enrollment in the company’s employer and individual health plans shrank by 370,000 between September 30, 2012, and September 30, 2022. Much of the $81 billion UnitedHealth collected in revenues in the third quarter of last year was subsidized by American tax dollars.

Members of Congress on both sides of the political aisle – and both sides of the Capitol – are at long last calling for more scrutiny of the Medicare Advantage program. Sen. Chuck Grassley has called for aggressive oversight of Medicare Advantage plans to recoup overcharges and was quoted in the Kaiser Health News story. As was Sen. Sherrod Brown, who said that fixing Medicare Advantage is not a partisan issue. As Rep. Katie Porter commented, “When big insurance bills taxpayers for care it never intends to deliver, it is stealing our tax dollars.”

I know that Democrats and Republicans alike care about the financial stability of the Medicare program. Instead of joining with the corporate lobbyists in extolling the benefits of Medicare Advantage while obscuring the program’s numerous problems, and in the process helping Big Insurance make massive profits, Congress should work to lower the cost of health care.

Medicare Advantage is a money-making scam. I should know. I helped to sell it. And I am going to continue working alongside patients, caregivers, and elected officials to address the problems.

Wendell Potter is the former vice president for corporate communications at Cigna. He is now president of “Business for Medicare for All” and author of bestselling books Deadly Spin and Nation on the Take.

commondreams.org/author/wendell-potter

©2023 by Rowan Consulting Associates, Inc., Colorado Springs, CO. All rights reserved. This article originally appeared in Common Dreams.org. Reprinted by permission in Home Care Technology: The Rowan Report. homecaretechreport.com One copy may be printed for personal use; further reproduction by permission only. editor@homecaretechreport.com

by Tim Rowan | Sep 16, 2020 | CMS, Editorial

Insurance Industry Insider Instructs Providers

September 16, 2020

by Wendell Potter

(Adapted with permission from an article posted on the author’s Twitter feed. –Editor)

My former colleagues in the health insurance industry claim they are waiving all costs of testing and treatment for COVID-19. This is a lie.

My former colleagues in the health insurance industry claim they are waiving all costs of testing and treatment for COVID-19. This is a lie.

I will explain the reality that this promise does not apply to everyone, in fact to a fraction of covered lives, and there is no enforcement mechanism to ensure that it will. Here is the truth: When insurers and the Trump administration say insurers are “doing their part” to end the pandemic, they are counting on Americans to be fooled by industry lingo, to believe that COVID-19 health expenses are covered. When I worked as VP of PR for Cigna, I would have gotten a bonus for achieving this deception.

In reality, this is world-class propaganda on display. To see how the industry is pulling the wool over our eyes, go to the website of its trade group, AHIP (America’s Health Insurance Plans). It is, intentionally, close to impossible to follow what each insurance company is actually doing.

A secret: The main purpose of insurers’ web sites and documents is to provide a space to crow about their “charitable” donations, which are a tiny percentage of their revenues. I know firsthand! One of my roles at Cigna was to head the company’s meagerly-endowed foundation.

An example: To see how they mislead regarding actual COVID-19 costs, let’s examine the hidden caveat in one company’s claim. Aetna says it

“will waive co-pays for all diagnostic testing related to COVID-19… That includes all member costs associated with diagnostic testing for Commercial, Medicare, and Medicaid lines of business. Self-insured plan sponsors will be able to opt-out at their discretion. Aetna is also offering zero co-pay telemedicine visits for any reason, and extending [additional benefits] to all fully insured members.” 1

Notice the catch? They mention “self-insured” plan sponsors. Nearly 80% of Aetna’s health plan members are in these types of plans. If you get your coverage through your employer, you likely are one of them. Aetna does not consider these people “fully insured.” Therefore, their promises may only apply to 20 percent of their members.

Of course, most folks probably have no idea whether they are in a “fully insured” or “self-insured” plan, but it makes a world of difference, especially during this pandemic. And believe me, these companies are thrilled by your confusion. It could save them millions.

Maybe we should expect private insurers to be dishonest by now, or rely on government watchdogs to take care of us. That is the other problem. There is no watchdog at any level of government monitoring this deceptive practice. In other words, there are no consequences to insurer deceit. And they know it. Again, I know it because I used to be one of them.

The answer? All insurers should be required to state exactly what percentage of their members actually benefit from their “promise” to fully cover COVID-19 testing and treatment. And Congress should look into this ASAP. It would be a great chance for Representative Katie Porter (D-CA) to embarrass the insurers yet again.2

Wendell Potter is a former insurance industry PR executive and the author of “Deadly Spin: An Insurance Company Insider Speaks Out on How Corporate PR Is Killing Health Care and Deceiving Americans” and “Nation on the Take: How Big Money Corrupts Our Democracy and What We Can Do About It,” both published by Bloomsbury Press. He is the founder of Tarbell™ a non-partisan news publication of To Be Fair, Inc., an IRS-approved 501(c)3 non-profit organization. He also serves as senior analyst at the Center for Public Integrity, one of the nation’s oldest non-partisan, nonprofit investigative news organizations, and is a contributor to The Huffington Post and healthinsurance.org. His work has also appeared in Newsweek, The Nation and The Guardian.

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

• HHCAHPS

• HHCAHPS

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or

Kristin Rowan has been working at Healthcare at Home: The Rowan Report since 2008. She has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in event planning, sales, and marketing strategy. She has recently taken on the role of Editor of The Rowan Report and will add her voice to current Home Care topics as well as marketing tips for home care agencies. Connect with Kristin directly kristin@girardmarketinggroup.com or

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information:

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information:

My former colleagues in the health insurance industry claim they are waiving all costs of testing and treatment for COVID-19. This is a lie.

My former colleagues in the health insurance industry claim they are waiving all costs of testing and treatment for COVID-19. This is a lie.