Perfect Storm

by Hannah Vale, CMO HealthRev Partners

Care at Home Industry Faces Perfect Storm

Industry Challenges in 2025

The care at home industry is grappling with an unprecedented crisis as staffing shortages, technological hurdles, and complex reimbursement models converge to create significant operational challenges. Industry experts warn that without immediate intervention, patient care could be severely impacted.

Staffing Crisis Reaches Critical Levels

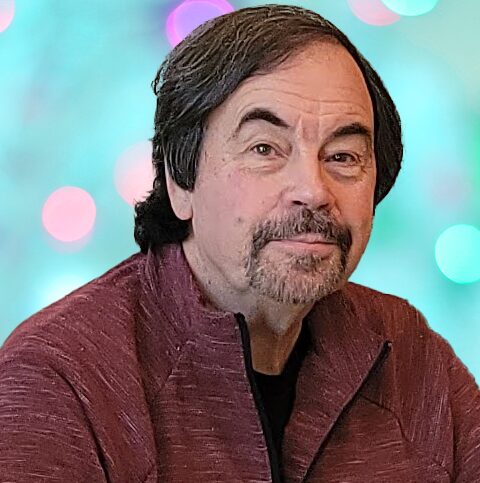

The staffing shortage in home health care has intensified dramatically since the COVID-19 pandemic. Carole Carlson, Registered Nurse (RN), Administrator at Avant Home Care, is a veteran with 36 years of experience in the field. She reports unprecedented difficulty in recruiting registered nurses.

“We’re seeing a mass exodus of healthcare workers who have found remote work alternatives. This exodus has also led to a significant caregiver shortage, causing a decline in non-skilled care services.”

RN Shortage

“The other issue is the RN shortage. This is our first time ever experiencing an RN shortage. We are not even getting applicants, whereas in the past we have always had nurses apply and were able to hire within a relatively short period of time,” Carlson added.

Michael Greenlee, Founder and CEO of HealthRev Partners, notes that the shortage is systemic, with insufficient new workers entering the field to meet growing demand. The situation is particularly dire in rural areas, where agencies face additional challenges in attracting and retaining staff.

Connectivity Issues on Top of Documentation Burden

- Many patients still rely solely on landlines

- Large areas lack cell coverage

- Limited or no WiFi access is common

These issues often force nurses to complete documentation after hours, significantly impacting their work-life balance. Greenlee suggests that emerging satellite connectivity solutions could potentially address these issues in the future.

EMR Limitations

Electronic Medical Record (EMR) systems, while essential, present their own set of challenges. Agencies find that basic systems require multiple costly add-ons for full functionality.

Carlson identifies several gaps in current EMR systems:

- Lack of built-in HIPAA-compliant dictation capabilities

- Limited care plan template libraries requiring extensive manual input

- Need for multiple add-ons to achieve full functionality

These limitations are forcing agencies to invest in additional software solutions, further straining already tight budgets.

Medicare Advantage Complicates Operations

The growing prevalence of Medicare Advantage plans is adding another layer of complexity to home health care operations. In one agency’s case, Medicare Advantage patients now represent 30% of their 160-patient census, equal to traditional Medicare patients. Each Medicare Advantage plan comes with different requirements, creating a significant administrative burden for agencies.

“Keeping up with the varying billing requirements across plans is a constant challenge for our small staff,” Carlson notes. “The need to maintain efficient workflows with clearinghouse and software updates for different payers is putting additional strain on already stretched resources”

Final Thoughts

As the care at home industry navigates these multifaceted challenges, experts stress the urgent need for comprehensive solutions to ensure the continued delivery of quality care to an aging population increasingly preferring to receive treatment at home.

# # #

Hannah Vale, M.Ed. is a dynamic leader bringing a wealth of experience and marketing innovation to her role at HealthRev Partners. Hannah is dedicated to helping post acute agencies streamline processes, optimize reimbursement, and embrace tech-driven solutions. She is recognized as an advocate for empowering agencies with the tools and knowledge they need to drive successful growth. A lifelong learner and former educator turned entrepreneur with a proven track record in launching and scaling businesses, passionate about creating impactful strategies that unite purpose and business. Hannah is also the co-host of the Home Health Revealed podcast, where she discusses industry insights and shares stories from experts in all things pertaining to home health, hospice, and palliative care. Hannah holds a Bachelors Degree in Education from Cleveland State University and a Masters in Educational Leadership from Evangel University.

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com