MA Past, Present, and Possible Future: Nothing Good to Report

CMSby Tim Rowan, Editor Emeritus

Past

For at least the last five years, every Home Health conference this reporter has attended has featured at least one keynote speaker or expert panelist complaining about sparse and shrinking payments from Medicare Advantage plans. As thousands of seasonal TV ads convince more and more Medicare beneficiaries to enroll in what insurance company executive-turned-whistleblower Wendell Potter called “neither Medicare nor an advantage,” the calls from Home Health executives to turn away MA members, following the lead of many hospitals, have grown louder and more frequent.

Originally designed to extend the lifespan of the Medicare Trust Fund by bringing managed care practices to the federal healthcare program for seniors and disabled, Medicare Advantage has failed to do so. As long ago as 2021, an exposé by Fred Schulte in Kaiser Family Foundation Health News found that MA costs to taxpayers began to explode in 2018 and today equal 119 percent of what traditional Medicare should cost. We looked at more recent studies and found similar reports.

From the Experts

Referencing a study by Richard Kronick, a former federal health policy researcher and a professor at the University of California-San Diego, Schulte said, “his analysis of newly released Medicare Advantage billing data estimates that Medicare overpaid the private health plans by more than $106 billion from 2010 through 2019 because of the way the private plans charge for sicker patients. A third of that overpayment occurred in 2018 and 2019.”

Since Kronick’s 2021 report, more beneficiaries have opted in to Medicare Advantage. So far, just over half have switched from straight Medicare, with or without a supplement, and that number may reach 100 percent if those who profit most from the option have their way.

Present

Profiting at the Expense of Seniors: The Financialization of Home Health Care

“The nonpartisan Medicare Payment Advisory Commission (MedPAC) estimates that upcoding by MA plans that make enrollees appear to be sicker than they are costs CMS 106 percent of what traditional Medicare costs; adding in the quality bonus payments brings it to 108 percent. MA plans also enroll healthier Medicare beneficiaries, increasing their operating surplus by another 11 percent, making the payments to MA plans 19 percent higher than the payments to traditional Medicare.

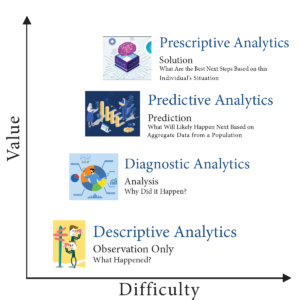

CMS’s announced goal for traditional Medicare beneficiaries is to move all of them to Accountable Care Organizations, which use the valued-based payment model, or other similar care arrangements, by 2030. CMS’s leading model to accomplish this shift is ACO REACH — a gentler, kinder version of the Trump administration’s backdoor enrollment of traditional Medicare beneficiaries in a capitated payment model.”

The Center for Economic Policy Research

Future

Depending on results in the unpredictable world of politics later this year, CMS may or may not see its shift to value-based ACO models come to fruition. Kaiser News‘ Schulte examined the Heritage Foundation’s “Project 2025,” the conservative think tank’s blueprint for any possible future Republican administration, and found an entire section on the Department of Health and Human Services.

Within its “Mandate for Leadership,” the authors identify Medicare and Medicaid as “the principal drivers of our $31 trillion national debt.” While admitting that Medicare and Medicaid “help many,” the authors assert that the programs “operate as runaway entitlements that stifle medical innovation, encourage fraud, and impede cost containment, in addition to which their fiscal future is in peril.”

Rebuttal

Commenting on the Heritage Foundation’s claim, researcher Sonali Kolhatkar, writing for “OtherWords.org,” counters that this opinion is often used to justify ending social programs, but actual CMS data indicates that per person Medicare spending has plateaued for more than a decade and represents one of the greatest reductions to the federal debt. Even with 10,000 to 11,000 Boomers reaching Medicare eligibility every day, total per beneficiary expenditures have stopped climbing, hovering around $12,000 per year since 2010. Before reaching that 2010 plateau, per beneficiary spending had steadily risen from $2,000 at the program’s 1965 inception.

Medicare Advantage for All

Project 2025 proposes making Medicare Advantage the default enrollment option rather than a choice beneficiaries can opt into. With 100 percent of seniors on MA plans, already historic insurance profits will skyrocket further. But will Medicare beneficiaries benefit as well?

The Center for Economic and Policy Research cites multiple lawsuits that have proven eight of the ten largest MA plans routinely add chronic conditions – some non-existent – to patient assessments at enrollment…or later. We reported recently that UnitedHealth Group, operator of the largest MA plan, recently began sending nurses into homes to search for additional health conditions that would raise company payments from the trust fund. The report we quoted included evidence that these home visit upcodes do not lead to any treatments. The Center added that MA’s “heavily restricted networks damage one’s choice of provider along with introducing dangerous delays and denials of necessary care.”

As we have mentioned before, Medicare Advantage is neither Medicare nor an Advantage.

Medicaid also Attacked

Project 2025 also proposes restrictions on Medicaid eligibility by imposing work requirements. The blueprint sees the program for low-income Americans as a “cumbersome, complicated, and unaffordable burden on nearly every state.” Their plan includes bringing private insurance companies in to “manage” care.

A June, 2024 report by the Center on Budget and Policy Priorities concluded that the ACA’s expansion of Medicaid helped millions of Americans who would otherwise be uninsured, and that its enabling and encouragement of preventive care actually saved money in state budgets. Last month’s report asserted “the people who gained coverage have grown healthier and more financially secure, while long-standing racial inequities in health outcomes, coverage, and access to care have shrunk.”

Project 2025 authors make no mention of a KFF News report from April 2023 that said most Medicaid-eligible people are already working. Nor does it take into account a Government Accountability Office report to Congress October 2020 and again in 2023 that determined that hourly wages in many large companies are low enough to keep even full-time workers eligible for Medicaid and SNAP. Walmart and McDonalds, to name two, land in the top five in almost every state for having Medicaid-eligible workers.

EVEN THE WALL STREET JOURNAL IS CRITICAL

Under the front page Headline “Medicare paid $50 billion to insurers for untreated ills,” a detailed WSJ investigation highlighted a number of findings, including:

- “The questionable diagnoses included some for potentially deadly illnesses, such as AIDS, for which patients received no subsequent care, and for conditions people couldn’t possibly have, the analysis showed. Often, neither the patients nor their doctors had any idea.”

- “Instead of saving taxpayers money, Medicare Advantage has added tens of billions of dollars in costs, researchers and some government officials have said.”

- “Medicare Advantage has cost the government an extra $591 billion over the past 18 years, compared with what Medicare would have cost without the help of the private plans, according to a March report of the Medicare Payment Advisory Commission, or MedPAC, a nonpartisan agency that advises Congress. Adjusted for inflation, that amounts to $4,300 per U.S. tax filer.”

- “The Journal reviewed the Medicare data under an agreement with the federal government. The data doesn’t include patients’ names, but covers details of doctor visits, hospital stays, prescriptions and other care.”

Now it is in the Hands of Voters

Home Health, Hospice, and Home Care owners, management, and workers will be voting in November. Consideration of what four years under a Project 2025-friendly administration will mean to businesses dependent on Medicare and Medicare will weigh heavily on their minds as they enter their polling booths.

# # #

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

Beth Noyce provides education, consulting, mentoring, compliance assessments and auditing services to home health and hospice agencies and their clinicians in several states. She also now provides patient and family guidance concerning hospice and home health services. Beth loves teaching and helping others succeed. She also makes available recordings of much of her education for her clients’ convenience.

Beth Noyce provides education, consulting, mentoring, compliance assessments and auditing services to home health and hospice agencies and their clinicians in several states. She also now provides patient and family guidance concerning hospice and home health services. Beth loves teaching and helping others succeed. She also makes available recordings of much of her education for her clients’ convenience.