by Tim Rowan | May 2, 2024 | Admin, Privacy and Security, Regulatory, Telehealth

by Tim Rowan, Editor Emeritus

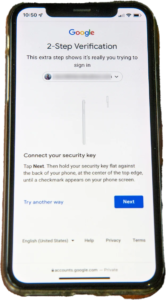

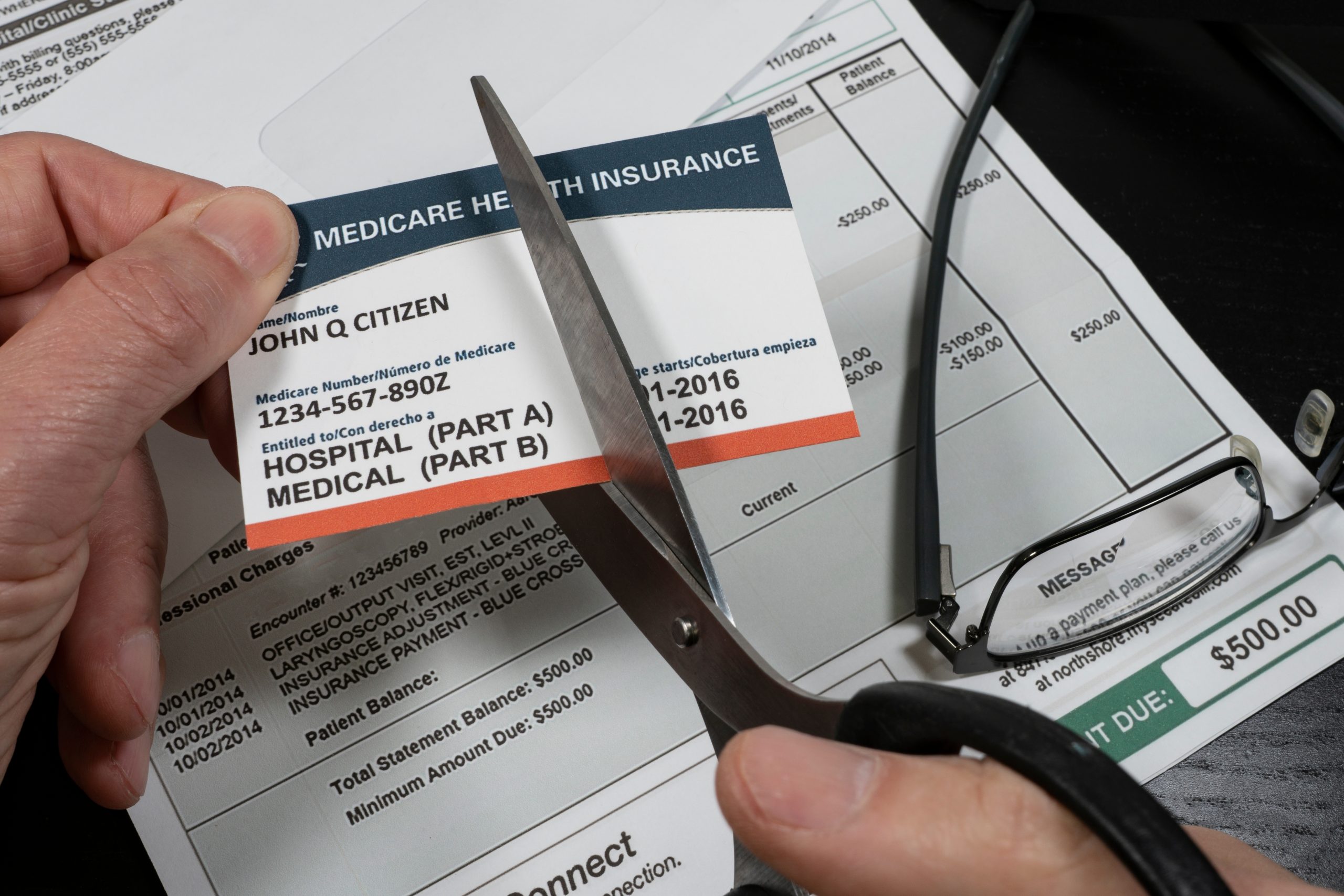

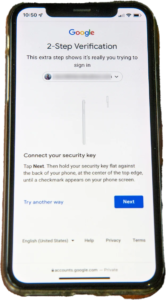

You know the routine. Everyone does. You log into your bank, airline account, or health insurance web portal, enter the correct password, and are directed to look on your smartphone  for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

United Health Grilled by Congress

In his testimony to the House Energy and Commerce Committee Wednesday, UnitedHealth Group CEO Andrew Witty blamed the absence of MFA as the weak link that allowed a ransomware attack to cripple subsidiary Change Healthcare in February. The breach had ripple effects throughout healthcare, given Change’s role as fiscal intermediary for thousands of providers. Healthcare systems on every level were unable to file claims and receive payments.

Asked by the committee why Change Healthcare, which United acquired in late 2022, did not have MFA in place, Witty testified, “Change Healthcare was a relatively older company with older technologies, which we had been working to upgrade since the acquisition. But for some reason, which we continue to investigate, this particular server did not have MFA on it.”

CBS News reported that Change Healthcare processes 15 billion transactions a year. “The scale of the attack,” their report stated, “meant that even patients who weren’t customers of UnitedHealth were potentially affected. Personal information that could cover a ‘substantial portion of people in America’ may have been taken in the attack.” The breach has already cost UnitedHealth Group nearly $900 million, plus the $22 million ransom Witty decided to pay to the hackers.

The Russia-based ransomware gang, ALPHV, or “BlackCat,” claimed responsibility for the attack, bragging that it stole more than six terabytes of data, including “sensitive” medical records. The attack triggered a disruption of payment and claims processing around the country.

We followed up our initial report on the attack with CMS guidance on March 20, 2024 and an update on April 11, 2024, with reports that Change Healthcare was being blackmailed again by another ransomware gang, RansomHub, who claimed to have 4TB of data from Change Healthcare and demanded another ransom payment.

Walmart & Optum, UnitedHealth Trouble Spots?

UnitedHealth Group is also in headline news this week for two other reasons. The company’s Optum division, which owns home care giant CenterWell, formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

A planned 10-year collaboration between UnitedHealth and Walmart to provide virtual healthcare services ended Tuesday after only one year. On April 30, the retail giant announced that it will close its 51 health centers across five states due to the “challenging reimbursement environment” and rising operating costs, which have resulted in a lack of profitability. Like Optum Virtual Care, the centers were providing virtual services via telehealth.

A sign of the post-pandemic times? Perhaps. We will keep watching.

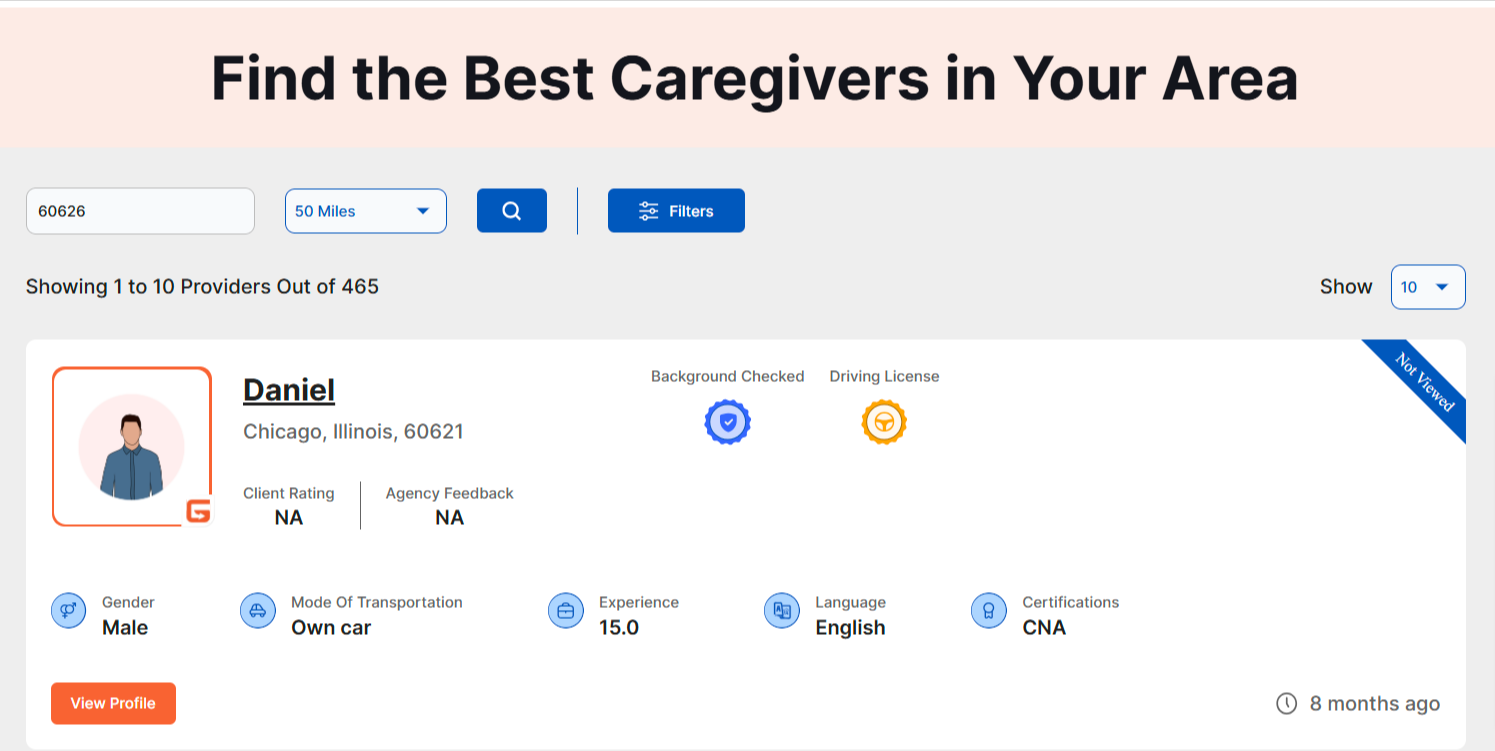

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim Rowan is a 30-year home care technology consultant who co-founded and served as Editor and principal writer of this publication for 25 years. He continues to occasionally contribute news and analysis articles under The Rowan Report’s new ownership. He also continues to work part-time as a Home Care recruiting and retention consultant. More information: RowanResources.com

Tim@RowanResources.com

©2024 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in Healthcare at Home: The Rowan Report.homecaretechreport.com One copy may be printed for personal use: further reproduction by permission only. editor@homecaretechreport.com

by Rowan Report | Mar 28, 2024 | Admin, Clinical, Partner News, Telehealth

CONTACT: Shannon Bishop-Green, SBishopGreen@MessagePartnersPR.com, (860) 305-3197

NEW REPORT FINDS THAT DIGITAL DIABETES MANAGEMENT TOOLS FAIL TO DELIVER MEANINGFUL HEALTH BENEFITS TO PATIENTS WHILE INCREASING SPENDING

Independent evaluation from Peterson Health Technology Institute recommends new directions for digital diabetes solutions

NEW YORK — Peterson Health Technology Institute (PHTI), an independent organization that evaluates healthcare technologies to improve health and lower costs, today released

a new evaluation of digital diabetes management tools. These solutions are used by millions of Americans and have been funded by $58 billion of investment and mergers and acquisitions, yet the evidence shows that the technologies do not deliver meaningful clinical benefits, and result in increased healthcare spending.

The analysis, conducted by a team of health technology assessment experts and informed by clinical advisors, evaluated eight widely used digital tools that people with Type 2 diabetes use to track and manage blood glucose using a noncontinuous glucometer.

The report found that people who use these tools achieve only small reductions in hemoglobin A1c (HbA1c) compared to those who do not, and these reductions are not sufficient or sustained enough to change the trajectory of their health, care, or long-term prognosis, including cardiovascular risks. The solutions also result in increased overall healthcare costs. One promising solution, Virta, supports nutritional ketosis to achieve diabetes remission in patients who follow the rigorous diet modifications.

“When these digital diabetes management tools launched more than a decade ago, they promised to improve health outcomes for people with diabetes and deliver savings to payers. Based on the scientific evidence, these solutions have fallen short, and it is time to move toward the next generation of innovation,” said Caroline Pearson, executive director of PHTI. “Patients with diabetes invest time, energy, and resources in these tools, and they deserve to experience meaningful, positive benefits for their health. The healthcare sector as a whole needs transparent, accurate information about the clinical and economic impact of these digital tools that are taking up precious healthcare dollars.”

PHTI’s rigorous analysis incorporated an evidence-based assessment framework and review of more than 1,100 articles, including 120 submitted to PHTI by companies evaluated in the report. PHTI’s ratings are at the category level, including remote patient monitoring solutions that support providers, and behavior and lifestyle modification solutions that engage users to improve their diet, exercise, and self-management.

HbA1c is the standard form of measurement of glycemic control in diabetics. The studies show that these digital tools deliver small reductions in HbA1c of 0.23 to 0.60 percentage points compared to usual care. These results are generally below industry standards for Minimal Clinically Important Difference (MCID) of 0.50 percentage points. Further, the evidence indicates that this small improvement is not durable because the reduction is not sustained over time.

Additionally, PHTI’s analysis did not find evidence to demonstrate that digital diabetes management tools improve other health factors, including weight loss, body mass index, blood pressure, cholesterol, or other common conditions impacting people with diabetes. The analysis also concluded that, despite the disproportionate impact of diabetes on low-income and racially and ethnically diverse communities, these tools are not currently being deployed in ways that improve health equity.

PHTI’s evaluation further determined that these tools increase net healthcare spending. This is due to the fact that price for the solutions exceeds the associated healthcare cost savings, because the minimal clinical benefit does not enable the patient to avoid other care or treatments. For patients using tools in the remote patient monitoring category, annual spending is projected to increase by $2,002 for commercial insurance patients, by $1,011 for Medicare patients, and by $723 for Medicaid patients, as a result of higher provider payments. For patients using tools in the behavior and lifestyle modification category, annual spending is estimated to increase by $484 for commercial insurance patients, by $513 for Medicare patients, and by $574 for Medicaid patients. For all payers, the increased spending associated with virtual diabetes solutions has a significant impact on total spending given how many people are eligible to use the solutions, including 4.3% of those with commercial insurance, 17.0% of those with Medicare, and 4.8% of those with Medicaid.

In addition to its scientific literature review, PHTI proactively engaged the companies included in the report and provided an opportunity for them to share data and product information. Companies in PHTI’s evaluation include DarioHealth, Glooko, Omada, Perry Health, Teladoc (Livongo), Verily (Onduo), Vida, and Virta. The evaluation considered evidence about which populations stand to benefit the most from using the technology, as well as the durability of clinical impacts given the importance of sustained glucose control to achieve health benefits. The economic analysis modeled expected healthcare savings resulting from improved glycemic control for patients using digital diabetes management solutions who are enrolled in Medicare, Medicaid, and commercial insurance.

PHTI identified two potential bright spots for digital diabetes management tools. Initial data showed that Virta users are much more likely to achieve clinically meaningful benefits in glycemic control, including diabetes remission and the ability to reduce or eliminate their diabetes medications, if they can maintain the rigorous dietary requirements of the intervention. The other area of greater potential is among patients with higher starting HbA1c levels who are newly starting insulin. By engaging these patients at an early critical transition point in their care, digital solutions could have more impact by helping establish good self-management habits among these higher-risk patients.

Category-level ratings are available

here.

In the United States, about one in seven adults—more than 38 million living in the U.S.—has Type 2 diabetes, which is the eighth leading cause of death. At over $400 billion of total healthcare spending annually, diabetes is the most expensive chronic condition to treat and manage. Given the critical role of patient self-management, investment in digital health tools has surged in recent years.

Throughout the assessment process, PHTI worked with a range of independent evaluation partners, clinical advisors, patients with Type 2 diabetes, and other stakeholders. Report contributors and reviewers included:

- Curta: assessed the clinical and economic impact of these technologies using the published ICER-PHTI Assessment Framework for Digital Health Technologies, including the systematic literature review and budget impact assessment

- Charm Economics: identified what technologies cost to deliver, how they work, and their impact on patients and purchasers

- Institute for Clinical and Economic Review (ICER): co-developed the ICER-PHTI Assessment Framework for Digital Health Technologies, and was consulted to review its implementation in this report

- Ami Bhatt, MD, chief innovation officer of the American College of Cardiology

- Richard Milani, MD, chief clinical innovation officer, Sutter Health; former innovation lead at Ochner Health System

- Karen Rheuban, MD, co-founder and director of the University of Virginia Center for Telehealth

“Managing diabetes is complex and essential to future cardiovascular health. Patients will gain agency and drive better clinical benefit if they direct their time and effort towards effective interventions rather than tools that provide marginal or no benefit,” said report contributor Ami Bhatt, MD, chief innovation officer of the American College of Cardiology.

“New diabetes technologies need to be easier to use, by the people who need them most, at lower cost than standard care, and provide real health benefits,” said report contributor Richard Milani, MD, chief clinical innovation officer at Sutter Health. “This evaluation suggests there is room for new innovations that deliver for patients and address worrying increases in healthcare spending.”

The PHTI report provides recommendations and best practices for innovators, providers, and payers. The next generation of diabetes management solutions should aim for clinically meaningful improvements in glycemic control, potentially integrating continuous glucose monitors and new GLP-1 obesity medications. Solutions should also generate sufficient evidence to support broader adoption, and they should prioritize access for populations who need them most. Providers of diabetes care should have clarity about the performance of these digital solutions when recommending them to their patients. Payers, including health plans and employers, should adapt their contracting approach to require transparency about the solution’s usage and benefits within their covered population and to include financial performance guarantees tied to clinical outcomes.

“PHTI is filling an important role in delivering actionable and market-facing information to digital health purchasers about what solutions will make a meaningful impact on health outcomes for members, making them worth investment,” said Peter Long, PhD, executive vice president, Strategy and Health Solutions at Blue Shield of California and a PHTI Advisory Board member. “Having an organization like PHTI cut through the noise of digital health options helps payers make faster and more effective decisions for members so that we can focus on the big work of transforming the healthcare system.”

PHTI has announced that future assessment areas include virtual physical therapy, blood pressure monitoring, and mental health tools.

# # #

About the Peterson Health Technology Institute

The Peterson Health Technology Institute (PHTI) provides independent evaluations of innovative healthcare technologies to improve health and lower costs. Through its rigorous, evidence-based research, PHTI analyzes the clinical benefits and economic impact of digital health solutions, as well as their effects on health equity, privacy, and security. These evaluations inform decisions for providers, patients, payers, and investors, accelerating the adoption of high-value technology in healthcare. PHTI was founded in 2023 by the Peterson Center on Healthcare. For more information, please visit PHTI.com.

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare.

for a code to enter to fully authorize your login. The name for this is Multi-Factor Authentication, or MFA. Lack of MFA procedures leaves your company at risk, which UnitedHealth discovered when it was grilled by Congress about the cyberattack on Change Healthcare. formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.

formerly Kindred at Home, and which is awaiting government approval for its bid to acquire Amedisys, has quietly been executing a reduction in force. Reports are that the bulk of the layoffs are hitting “Optum Virtual Care,” the name given to naviHealth following its $1 billion acquisition in 2020. Following a surge in demand during the pandemic, the company is apparently abandoning telehealth services.