Medicare Advantage Increase for Payers, not Providers

Artificial Intelligenceby Kristin Rowan, Editor

CMS Announces Medicare Advantage Pay Hike

On January 13, 2025, CMS announced its plans to increase payments to Medicare Advantage plans by 4.33%. Policy changes for Medicare Advantage and Part D include changes in how the agency calculates payments to health plans. A spokesperson from CMS said that the policy change provides access to affordable, high-quality care. The changes, however, don’t increase payments to the people actually providing the care, only to the payers.

Opposition

While major health plans across the U.S. were thrilled with the announcement and saw substantial stock price hikes immediately after, not everyone is on board. The American Medical Association (AMA) outlined how physicians who treat Medicare patients are getting pay cuts from CMS for the fifth year in a row. Meanwhile, HHS OIG released a report finding that MA insurers profited $7.5 billion from risk-adjusted payments in 2023.

“It’s unbelievable they’re giving insurance companies that had record profits an increase while at the same time cutting payment to physician practices that are struggling to survive. This contrast highlights the urgent need for Congress to prioritize linking payment to physician practices to the cost of providing care.”

Out-of-Pocket Cost Increase

In addition to the higher payments, the advance proposal includes an increase in the Part D deductible from $590 to $615. With this proposal, the out-of-pocket maximum will increase from $2,000 to $2,100 as well. Cost sharing after the deductible is reached but before the out-of-pocket max is reached will also increase. There is no increase for beneficiaries whose income is less than 100% of the Federal Poverty Level.

Coverage Increase

The CMS advance proposal calls for coverage and policy changes. Medicare and Medicaid programs will now cover anti-obesity medications. The plan imposes stricter rules on MA policies to prevent denial of reasonable and necessary services that would be covered under Medicare Part A and B. Finally, imposed guardrails on the use of AI. The guardrails will ensure AI systems are unbiased in patient care decisions. Additionally, the guardrails will ensure they do not perpetuate existing inequity in access to and receipt of medical services. The American Hospital Association appplauded this last change.

“The AHA commends CMS for taking important steps to increase oversight of 2026 Medicare Advantage plans to help ensure enrollees have equal access to medically necessary health care services. The AHA has previously raised concerns about the negative effects of certain Medicare Advantage practices and policies…that are more restrictive than Traditional Medicare and can compromise enrollee access to Medicare-covered services.”

Changes are not Definite

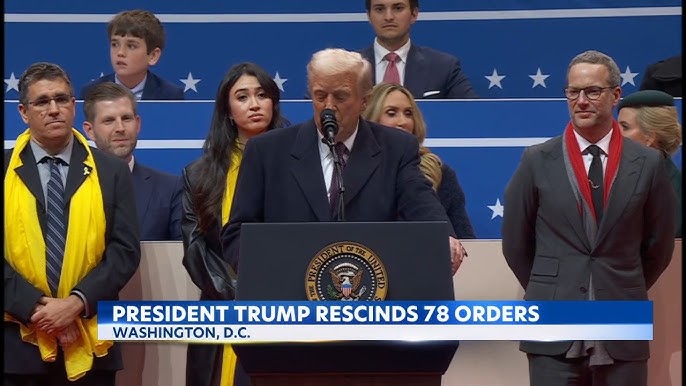

Even though CMS has announced these changes to start in January, 2026, they are not set in stone. As of January 20, 2025, we are operating under anew administration and the changes under Trump have already started. CMS intends to continue it’s three-year plan to update the MA risk adjustment model and the implementation of the Inflation Reduction Act. However, it seems likely that the Inflation Reduction Act will be replaced with a different plan for inflation.

Jeff Davis, director of health policy at McDermott+ believes it is likely that Trump’s team will throw out the updates to MA and Part D as well as Biden’s proposed staffing mandate for SNFs. In the first 24 hours of his Presidency, Trump revoked both Biden’s “Strengthening Medicaid and the Affordable Care Act” and “Continuing to Strengthen Americans’ Access to Affordable, Quality Health Coverage” executive orders. He also rescinded the Drug Pricing Model executive order that covered obesity drugs, lowered the price of some drugs, and accelerated FDA approval for drugs that address unmet medical needs.

As Yet Unknown

As was to be expected, many of Trump’s initial 78 executive orders are already facing lawsuits from various entities. There are as of yet no definitive answers to changes in Medicare, Medicare Advantage, or other policies that impact healthcare and care at home. The Rowan Report will continue to follow these stories as they unfold.

# # #

Kristin Rowan has been working at The Rowan Report since 2008. She is the owner and Editor-in-chief of The Rowan Report, the industry’s most trusted source for care at home news. She also has a master’s degree in business administration and marketing and runs Girard Marketing Group, a multi-faceted boutique marketing firm specializing in content creation, social media management, and event marketing. Connect with Kristin directly kristin@girardmarketinggroup.com or www.girardmarketinggroup.com

©2025 by The Rowan Report, Peoria, AZ. All rights reserved. This article originally appeared in The Rowan Report. One copy may be printed for personal use: further reproduction by permission only. editor@therowanreport.com

The financial and health implications of uninformed disenrollment from PACE to conventional MA plans are significant. The needs of PACE beneficiaries, most of whom have multiple complex medical conditions, cognitive or functional impairments – or all three – are not comprehensively addressed by MA plans. The loss of PACE services is harmful and, in some cases, can be life-threatening.

The financial and health implications of uninformed disenrollment from PACE to conventional MA plans are significant. The needs of PACE beneficiaries, most of whom have multiple complex medical conditions, cognitive or functional impairments – or all three – are not comprehensively addressed by MA plans. The loss of PACE services is harmful and, in some cases, can be life-threatening. We share CMS’ stated desire that people have access to accurate and complete information when they make health care choices. We have numerous examples of vulnerable seniors being induced to enroll in MA plans without being fully-informed of what they are giving up when they enroll.

We share CMS’ stated desire that people have access to accurate and complete information when they make health care choices. We have numerous examples of vulnerable seniors being induced to enroll in MA plans without being fully-informed of what they are giving up when they enroll.